Answered step by step

Verified Expert Solution

Question

1 Approved Answer

AJE B Palisade's federal income tax rate is 30% of pretax income [EBT]. Palisade does not owe state income tax. Palisade does not own

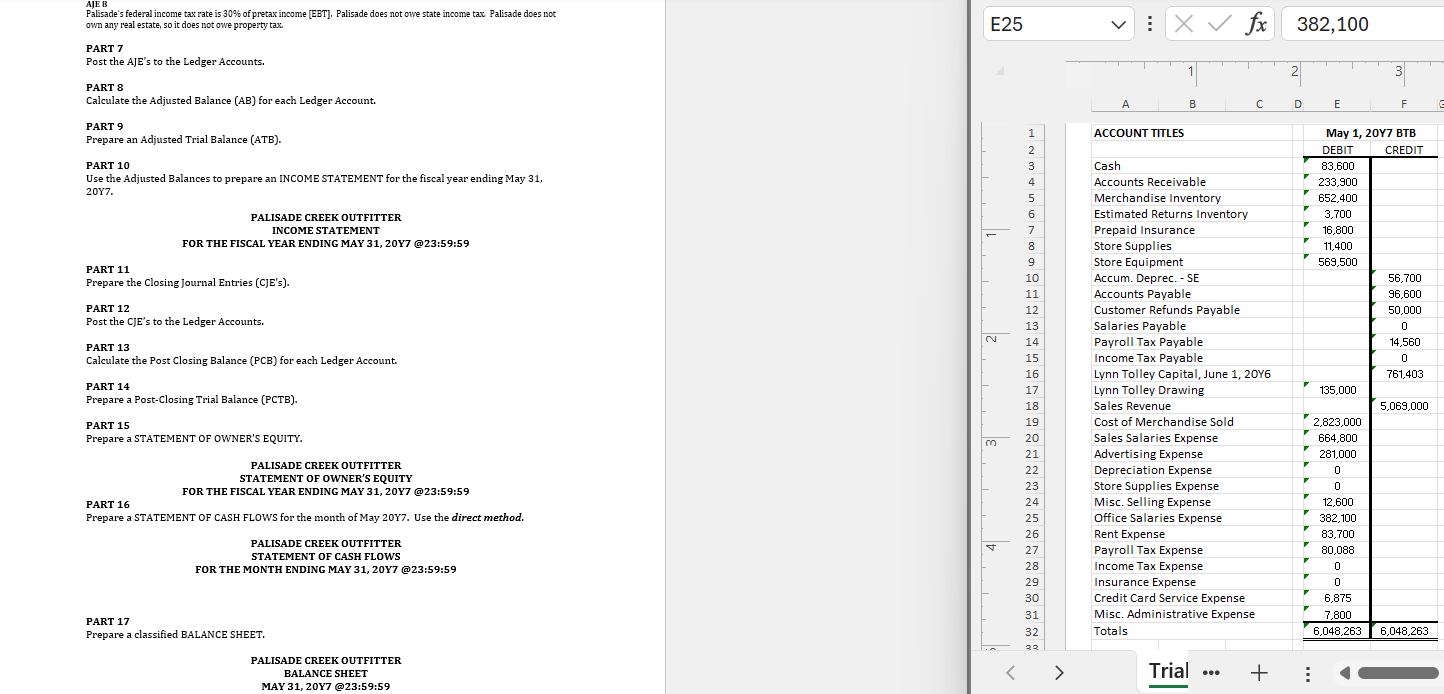

AJE B Palisade's federal income tax rate is 30% of pretax income [EBT]. Palisade does not owe state income tax. Palisade does not own any real estate, so it does not owe property tax. PART 7 Post the AJE's to the Ledger Accounts. PART 8 Calculate the Adjusted Balance (AB) for each Ledger Account. PART 9 Prepare an Adjusted Trial Balance (ATB). PART 10 Use the Adjusted Balances to prepare an INCOME STATEMENT for the fiscal year ending May 31, 20Y7. E25 3 PALISADE CREEK OUTFITTER INCOME STATEMENT FOR THE FISCAL YEAR ENDING MAY 31, 20Y7 @23:59:59 PART 11 Prepare the Closing Journal Entries (CJE's). PART 12 Post the CJE's to the Ledger Accounts. PART 13 Calculate the Post Closing Balance (PCB) for each Ledger Account. PART 14 Prepare a Post-Closing Trial Balance (PCTB). PART 15 Prepare a STATEMENT OF OWNER'S EQUITY. PART 16 PALISADE CREEK OUTFITTER STATEMENT OF OWNER'S EQUITY FOR THE FISCAL YEAR ENDING MAY 31, 2017 @23:59:59 Prepare a STATEMENT OF CASH FLOWS for the month of May 2017. Use the direct method. PALISADE CREEK OUTFITTER STATEMENT OF CASH FLOWs FOR THE MONTH ENDING MAY 31, 2017 @23:59:59 PART 17 Prepare a classified BALANCE SHEET. PALISADE CREEK OUTFITTER BALANCE SHEET MAY 31, 20Y7 @23:59:59 Xfx 382,100 A 1 ACCOUNT TITLES 2 1 2 B D E 3 F May 1, 2017 BTB DEBIT CREDIT Cash 83,600 4 Accounts Receivable 233,900 5 Merchandise Inventory 652,400 6 Estimated Returns Inventory 3,700 7 Prepaid Insurance 16,800 8 Store Supplies 11,400 9 Store Equipment 569,500 10 Accum. Deprec. - SE 56,700 11 Accounts Payable 96,600 12 Customer Refunds Payable 50,000 13 Salaries Payable 0 ~ 14 Payroll Tax Payable 15 Income Tax Payable 16 Lynn Tolley Capital, June 1, 20Y6 14,560 0 761,403 17 Lynn Tolley Drawing 135,000 18 Sales Revenue 5,069,000 19 Cost of Merchandise Sold 20 Sales Salaries Expense 2,823,000 664,800 m 21 Advertising Expense 281,000 22 Depreciation Expense 0 23 Store Supplies Expense 0 24 Misc. Selling Expense 12,600 25 Office Salaries Expense 382,100 26 Rent Expense 83,700 27 Payroll Tax Expense 80,088 28 Income Tax Expense 0 29 Insurance Expense 0 30 Credit Card Service Expense 6,875 31 Misc. Administrative Expense 7,800 32 Totals 6,048,263 6,048,263 33 < > Trial +

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started