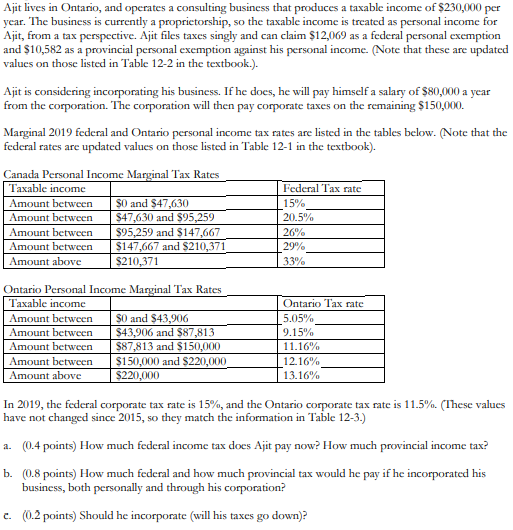

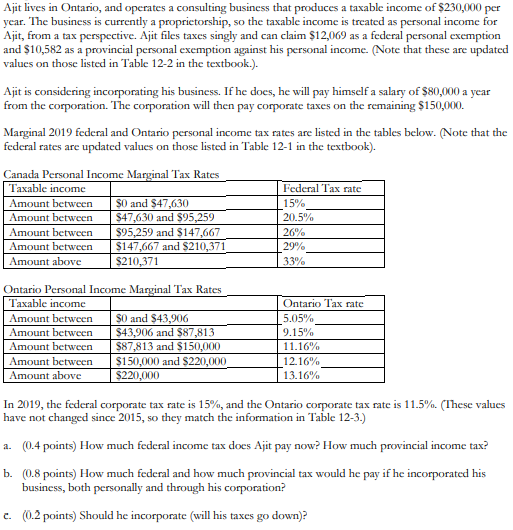

Ajit lives in Ontario, and operates a consulting business that produces a taxable income of $230,000 per year. The business is currently a proprietorship, so the taxable income is treated as personal income for Ajit, from a tax perspective. Ajit files taxes singly and can claim $12,069 as a federal personal exemption and $10,582 as a provincial personal exemption against his personal income. (Note that these are updated values on those listed in Table 12-2 in the textbook.). Ajit is considering incorporating his business. If he does, he will pay himself a salary of $80,000 a year from the corporation. The corporation will then pay corporate taxes on the remaining $150,000. Marginal 2019 federal and Ontario personal income tax rates are listed in the tables below. (Note that the federal rates are updated values on those listed in Table 12-1 in the textbook). Canada Personal Income Marginal Tax Rates Taxable income Federal Tax rate Amount between $0 and $47,630 15% Amount between $47,630 and $95,259 Amount between $95,259 and $147,667 Amount between $147,667 and $210,371 29% $210,371 33% 20.5% 26% Amount above Ontario Personal Income Marginal Tax Rates Taxable income Amount between $0 and $43,906 Amount between $43,906 and $87,813 Amount between $87,813 and $150,000 Amount between $150,000 and $220,000 Amount above $220,000 Ontario Tax rate 5.05% 9.15% 11.16% 12.16% 13.16% In 2019, the federal corporate tax rate is 15%, and the Ontario corporate tax rate is 11.5%. (These values have not changed since 2015, so they match the information in Table 12-3.) a. (0.4 points) How much federal income tax does Ajit pay now? How much provincial income tax? b. (0.8 points) How much federal and how much provincial tax would he pay if he incorporated his business, both personally and through his corporation? c. (0.2 points) Should he incorporate will his taxes go down)? Ajit lives in Ontario, and operates a consulting business that produces a taxable income of $230,000 per year. The business is currently a proprietorship, so the taxable income is treated as personal income for Ajit, from a tax perspective. Ajit files taxes singly and can claim $12,069 as a federal personal exemption and $10,582 as a provincial personal exemption against his personal income. (Note that these are updated values on those listed in Table 12-2 in the textbook.). Ajit is considering incorporating his business. If he does, he will pay himself a salary of $80,000 a year from the corporation. The corporation will then pay corporate taxes on the remaining $150,000. Marginal 2019 federal and Ontario personal income tax rates are listed in the tables below. (Note that the federal rates are updated values on those listed in Table 12-1 in the textbook). Canada Personal Income Marginal Tax Rates Taxable income Federal Tax rate Amount between $0 and $47,630 15% Amount between $47,630 and $95,259 Amount between $95,259 and $147,667 Amount between $147,667 and $210,371 29% $210,371 33% 20.5% 26% Amount above Ontario Personal Income Marginal Tax Rates Taxable income Amount between $0 and $43,906 Amount between $43,906 and $87,813 Amount between $87,813 and $150,000 Amount between $150,000 and $220,000 Amount above $220,000 Ontario Tax rate 5.05% 9.15% 11.16% 12.16% 13.16% In 2019, the federal corporate tax rate is 15%, and the Ontario corporate tax rate is 11.5%. (These values have not changed since 2015, so they match the information in Table 12-3.) a. (0.4 points) How much federal income tax does Ajit pay now? How much provincial income tax? b. (0.8 points) How much federal and how much provincial tax would he pay if he incorporated his business, both personally and through his corporation? c. (0.2 points) Should he incorporate will his taxes go down)