Answered step by step

Verified Expert Solution

Question

1 Approved Answer

AKG Corporation has an ownership stake in four other companies. which of the following deduction amounts is correct? AKG Corporation has an ownership stake in

AKG Corporation has an ownership stake in four other companies. which of the following deduction amounts is correct?

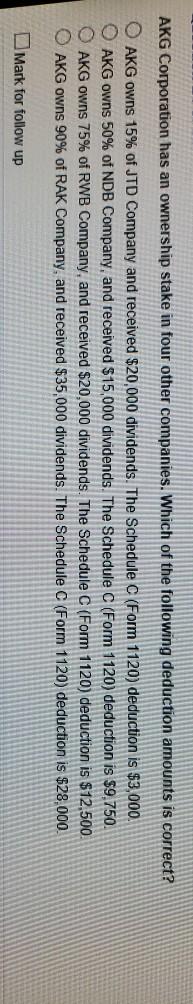

AKG Corporation has an ownership stake in four other companies. Which of the following deduction amounts is correct? AKG owns 15% of JTD Company and received $20,000 dividends. The Schedule C (Form 1120) deduction is $3,000. O AKG owns 50% of NDB Company, and received $15,000 dividends. The Schedule C (Form 1120) deduction is $9,750. AKG owns 75% of RWB Company, and received $20,000 dividends. The Schedule C (Form 1120) deduction is $12,500. AKG owns 90% of RAK Company, and received $35,000 dividends. The Schedule C (Form 1120) deduction is $28,000. Mark for follow up

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started