Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Al Ain company purchased a certain intangible asset (patent) to be used in its business operations. The intangible asset was purchased in January 2021

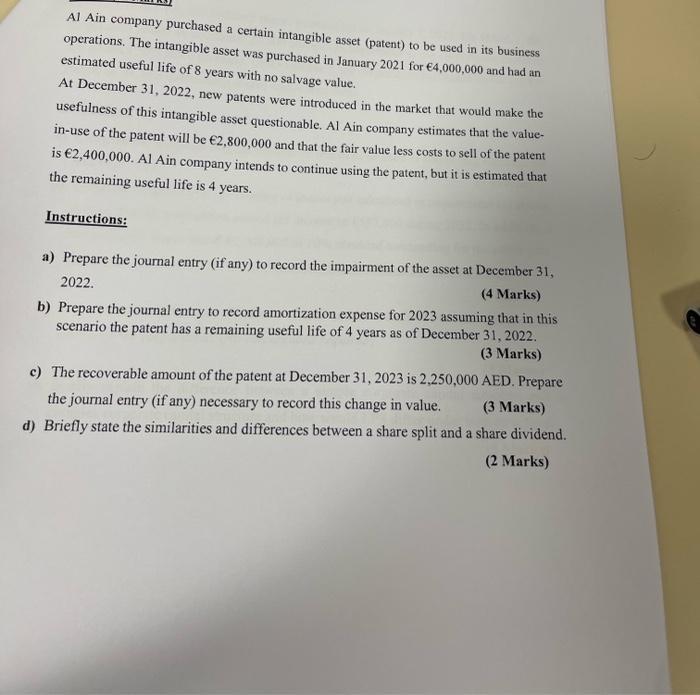

Al Ain company purchased a certain intangible asset (patent) to be used in its business operations. The intangible asset was purchased in January 2021 for 4,000,000 and had an estimated useful life of 8 years with no salvage value. At December 31, 2022, new patents were introduced in the market that would make the usefulness of this intangible asset questionable. Al Ain company estimates that the value- in-use of the patent will be 2,800,000 and that the fair value less costs to sell of the patent is 2,400,000. Al Ain company intends to continue using the patent, but it is estimated that the remaining useful life is 4 years. Instructions: a) Prepare the journal entry (if any) to record the impairment of the asset at December 31, 2022. (4 Marks) b) Prepare the journal entry to record amortization expense for 2023 assuming that in this scenario the patent has a remaining useful life of 4 years as of December 31, 2022. (3 Marks) c) The recoverable amount of the patent at December 31, 2023 is 2,250,000 AED. Prepare the journal entry (if any) necessary to record this change in value. (3 Marks) d) Briefly state the similarities and differences between a share split and a share dividend. (2 Marks)

Step by Step Solution

★★★★★

3.34 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

STEP ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started