Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Alade, Baba and Chinedu started a partnership on 1 January, 2020 sharing profits and losses in the ratio of 3:2:1. According to the partnership agreement,

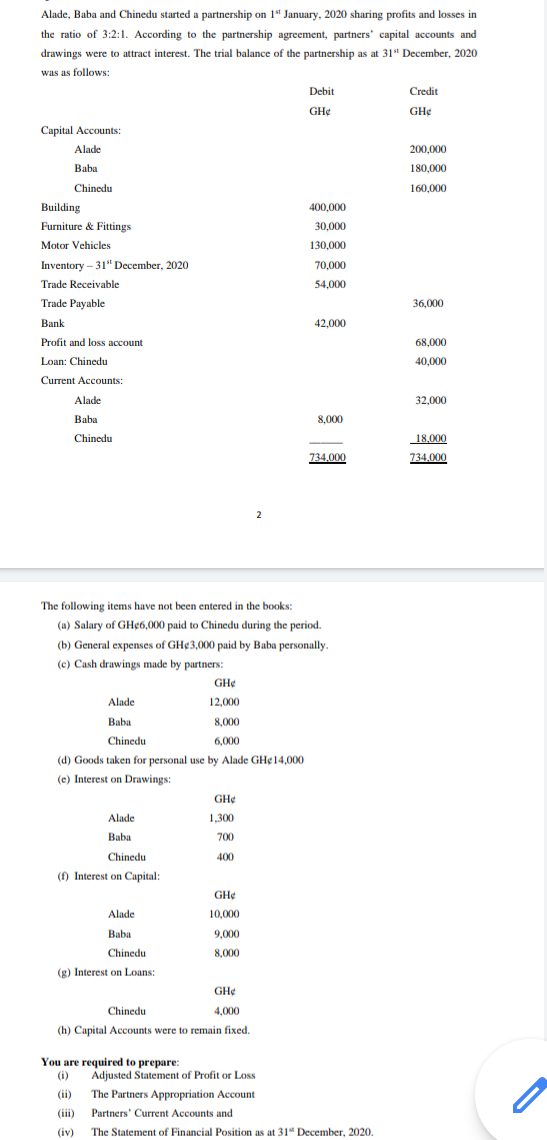

Alade, Baba and Chinedu started a partnership on 1" January, 2020 sharing profits and losses in the ratio of 3:2:1. According to the partnership agreement, partners' capital accounts and drawings were to attract interest. The trial balance of the partnership as at 31" December, 2020 was as follows: Debit Credit GH GH Capital Accounts: Alade 200,000 Baba 180,000 Chinedu 160,000 Building 400,000 Furniture & Fittings 30,000 Motor Vehicles 130,000 Inventory - 31" December, 2020 70.000 Trade Receivable 54,000 Trade Payable 36,000 Bank 42,000 Profit and loss account 68,000 Loan: Chinedu 40,000 Current Accounts: Alade 32.000 Baba 8.000 Chinedu 18.000 734.000 734.000 2 The following items have not been entered in the books: (a) Salary of GH6,000 paid to Chinedu during the period. (b) General expenses of GH 3,000 paid by Baba personally. (c) Cash drawings made by partners: GH Alade 12,000 Baba 8,000 Chinedu 6,000 (d) Goods taken for personal use by Alade GH14,000 (e) Interest on Drawings: GH Alade 1,300 Baba 700 Chinedu 400 () (1) Interest on Capital: GH Alade 10,000 Baba 9,000 Chinedu 8,000 (g) Interest on Loans: GH Chinedu 4,000 (h) Capital Accounts were to remain fixed. You are required to prepare: (1) Adjusted Statement of Profit or Loss (11) ( The Partners Appropriation Account (iii) Partners Current Accounts and (iv) The Statement of Financial Position as at 31 December, 2020

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started