Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Alain Manufacturing Co. estimates its predetermined overhead rate annually on the basis of direct labor hours. At the beginning of the year 2019, The

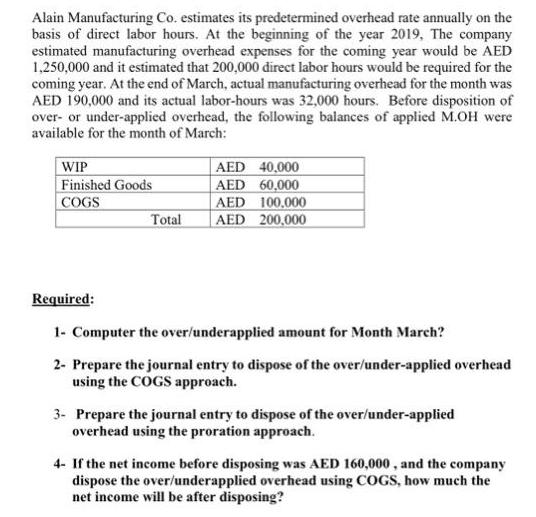

Alain Manufacturing Co. estimates its predetermined overhead rate annually on the basis of direct labor hours. At the beginning of the year 2019, The company estimated manufacturing overhead expenses for the coming year would be AED 1,250,000 and it estimated that 200,000 direct labor hours would be required for the coming year. At the end of March, actual manufacturing overhead for the month was AED 190,000 and its actual labor-hours was 32,000 hours. Before disposition of over- or under-applied overhead, the following balances of applied M.OH were available for the month of March: WIP Finished Goods COGS Total AED 40,000 AED 60,000 AED 100,000 AED 200,000 Required: 1- Computer the over/underapplied amount for Month March? 2- Prepare the journal entry to dispose of the over/under-applied overhead using the COGS approach. 3- Prepare the journal entry to dispose of the over/under-applied overhead using the proration approach. 4- If the net income before disposing was AED 160,000, and the company dispose the over/underapplied overhead using COGS, how much the net income will be after disposing?

Step by Step Solution

★★★★★

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

1 To compute the overunderapplied amount for the month of March we need to compare the actual manufa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started