Answered step by step

Verified Expert Solution

Question

1 Approved Answer

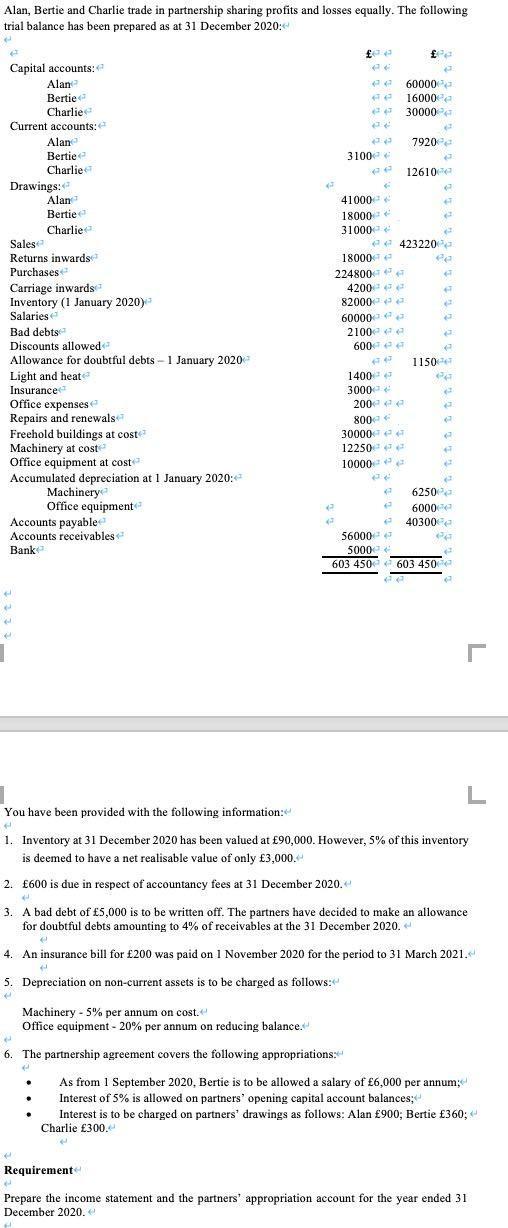

Alan, Bertie and Charlie trade in partnership sharing profits and losses equally. The following trial balance has been prepared as at 31 December 2020:

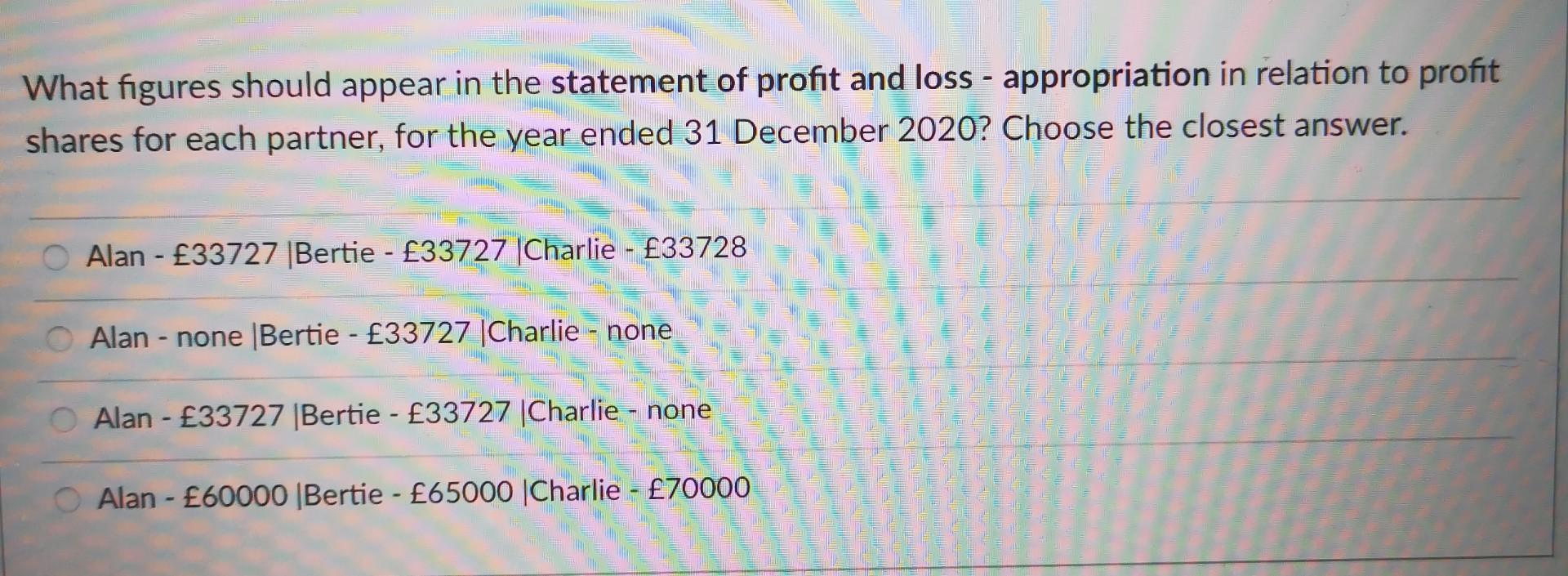

Alan, Bertie and Charlie trade in partnership sharing profits and losses equally. The following trial balance has been prepared as at 31 December 2020: N e Capital accounts: Alan Bertie Charlie Current accounts: Drawings: Sales Returns inwards Purchases Carriage inwards Inventory (1 January 2020) Salaries Bad debts Discounts allowed Allowance for doubtful debts - 1 January 2020 Light and heat Insurance Office expenses Repairs and renewals Freehold buildings at cost Machinery at cost Office equipment at cost. Accumulated depreciation at 1 January 2020: 4 2 Alane Bertie Charlie Accounts payable Accounts receivables Bank 2 M Alan Bertie Charlie Machinery Office equipment P e Machinery - 5% per annum on cost. Office equipment - 20% per annum on reducing balance. e 00 ee ee 43 Requirement 3100 A 6. The partnership agreement covers the following appropriations: P 41000 18000 e 31000 224800 Pe 18000 4200 e AP 82000 60000 e 2100 e 600 e 1400 30000 200 e 800 30000 12250 10000 e de 56000 2 ep P 60000 16000 30000 e 423220 7920 12610 1150 23 e AT 6000 40300 2 Pa A 22 P P e Pa 2 e A e e 6250 a You have been provided with the following information: 4 1. Inventory at 31 December 2020 has been valued at 90,000. However, 5% of this inventory is deemed to have a net realisable value of only 3,000. Pa 5000 603 450 603 4500 ee 47 2. 600 is due in respect of accountancy fees at 31 December 2020. # 3. A bad debt of 5,000 is to be written off. The partners have decided to make an allowance for doubtful debts amounting to 4% of receivables at the 31 December 2020. e 4 An insurance bill for 200 was paid on 1 November 2020 for the period to 31 March 2021. e 5. Depreciation on non-current assets is to be charged as follows: M r L As from 1 September 2020, Bertie is to be allowed a salary of 6,000 per annum; Interest of 5% is allowed on partners' opening capital account balances; Interest is to be charged on partners' drawings as follows: Alan 900; Bertie 360; Charlie 300.4 e Prepare the income statement and the partners' appropriation account for the year ended 31 December 2020. What figures should appear in the statement of profit and loss - appropriation in relation to profit shares for each partner, for the year ended 31 December 2020? Choose the closest answer. Alan - 33727 |Bertie - 33727 Charlie - 33728 Alan - none |Bertie - 33727 |Charlie - none Alan - 33727 |Bertie - 33727 |Charlie - none Alan - 60000 |Bertie - 65000 |Charlie - 70000

Step by Step Solution

★★★★★

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

a PARTNERSHIP INCOME STATEMENT FOR THE YEAR ENDED 31 DECEMBER 2020 POUND Sales ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started