Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Alan, Bob and Colin have been successfully trading as ABC partnership for several years. Due to ill health Alan has decided to retire from

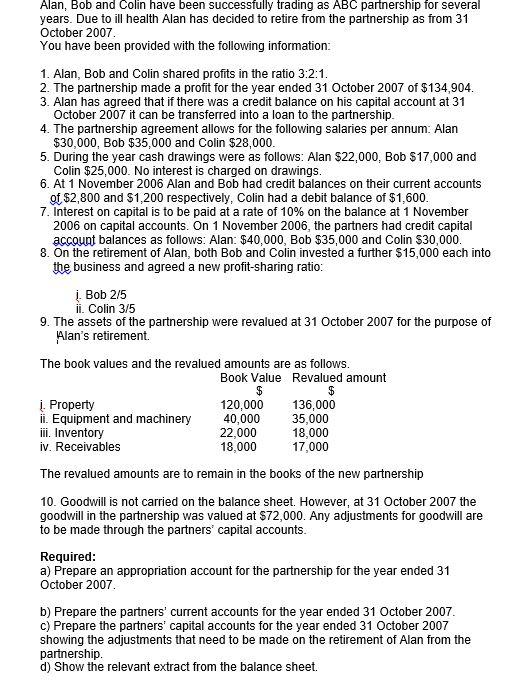

Alan, Bob and Colin have been successfully trading as ABC partnership for several years. Due to ill health Alan has decided to retire from the partnership as from 31 October 2007. You have been provided with the following information: 1. Alan, Bob and Colin shared profits in the ratio 3:2:1. 2. The partnership made a profit for the year ended 31 October 2007 of $134,904. 3. Alan has agreed that if there was a credit balance on his capital account at 31 October 2007 it can be transferred into a loan to the partnership. 4. The partnership agreement allows for the following salaries per annum: Alan $30,000, Bob $35,000 and Colin $28,000. 5. During the year cash drawings were as follows: Alan $22,000, Bob $17,000 and Colin $25,000. No interest is charged on drawings. 6. At 1 November 2006 Alan and Bob had credit balances on their current accounts of $2,800 and $1,200 respectively, Colin had a debit balance of $1,600. 7. Interest on capital is to be paid at a rate of 10% on the balance at 1 November 2006 on capital accounts. On 1 November 2006, the partners had credit capital account balances as follows: Alan: $40,000, Bob $35,000 and Colin $30,000. 8. On the retirement of Alan, both Bob and Colin invested a further $15,000 each into the business and agreed a new profit-sharing ratio: . Bob 2/5 ii. Colin 3/5 9. The assets of the partnership were revalued at 31 October 2007 for the purpose of Alan's retirement. The book values and the revalued amounts are as follows. Book Value Revalued amount $ $ . Property 120,000 136,000 ii. Equipment and machinery 40,000 35,000 iii. Inventory 22,000 18,000 iv. Receivables 18,000 17,000 The revalued amounts are to remain in the books of the new partnership 10. Goodwill is not carried on the balance sheet. However, at 31 October 2007 the goodwill in the partnership was valued at $72,000. Any adjustments for goodwill are to be made through the partners' capital accounts. Required: a) Prepare an appropriation account for the partnership for the year ended 31 October 2007. b) Prepare the partners' current accounts for the year ended 31 October 2007. c) Prepare the partners' capital accounts for the year ended 31 October 2007 showing the adjustments that need to be made on the retirement of Alan from the partnership. d) Show the relevant extract from the balance sheet.

Step by Step Solution

★★★★★

3.33 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

a Appropriation Account for the year ended 31 October 2007 Appropriation Account For the year ended 31 October 2007 Profit for the year 134904 Salarie...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started