Answered step by step

Verified Expert Solution

Question

1 Approved Answer

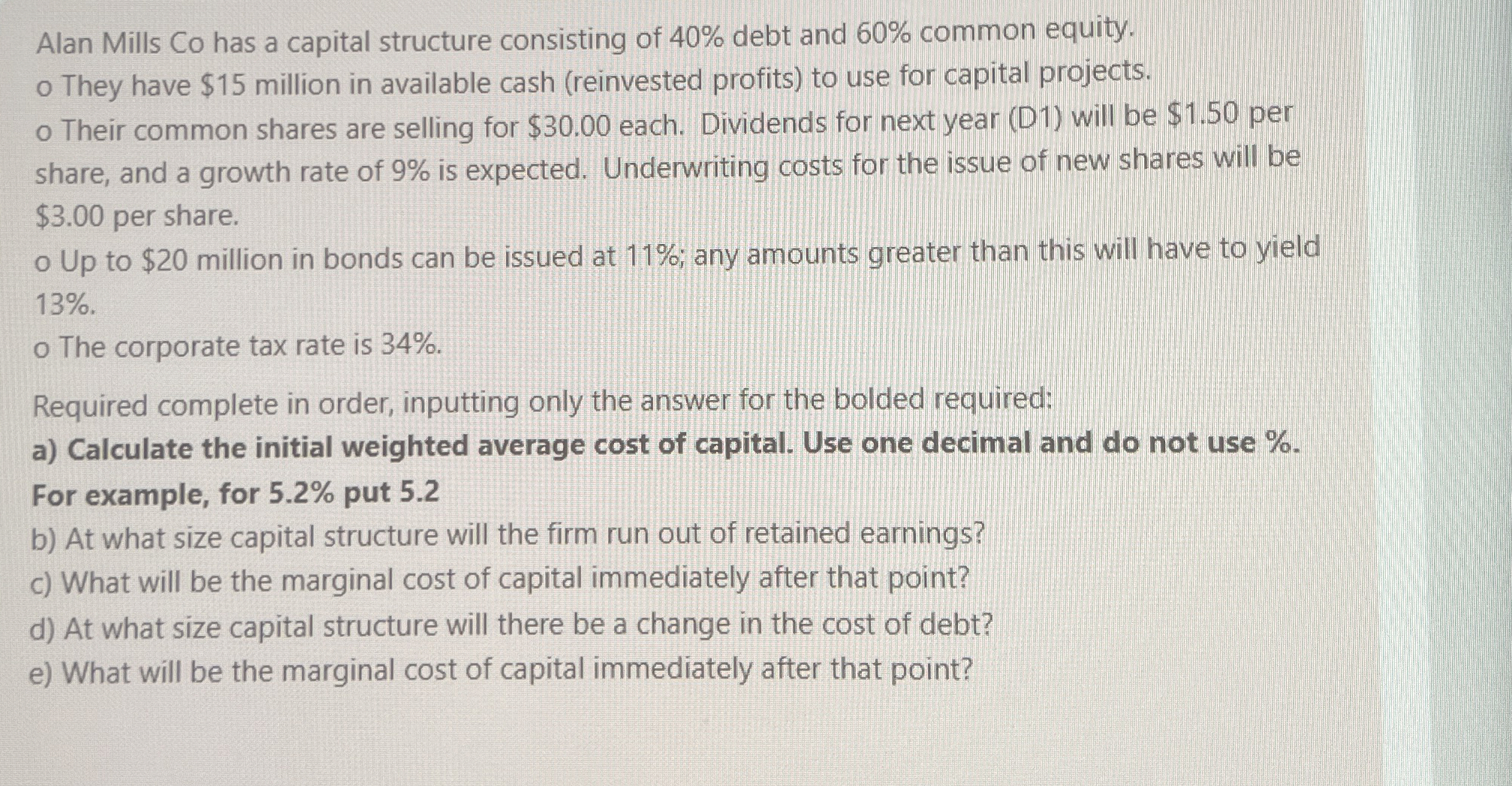

Alan Mills Co has a capital structure consisting of 4 0 % debt and 6 0 % common equity. They have $ 1 5 million

Alan Mills Co has a capital structure consisting of debt and common equity.

They have $ million in available cash reinvested profits to use for capital projects.

Their common shares are selling for $ each. Dividends for next year D will be $ per

share, and a growth rate of is expected. Underwriting costs for the issue of new shares will be

$ per share.

Up to $ million in bonds can be issued at ; any amounts greater than this will have to yield

The corporate tax rate is

Required complete in order, inputting only the answer for the bolded required:

a Calculate the initial weighted average cost of capital. Use one decimal and do not use

For example, for put

b At what size capital structure will the firm run out of retained earnings?

c What will be the marginal cost of capital immediately after that point?

d At what size capital structure will there be a change in the cost of debt?

e What will be the marginal cost of capital immediately after that point?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started