Answered step by step

Verified Expert Solution

Question

1 Approved Answer

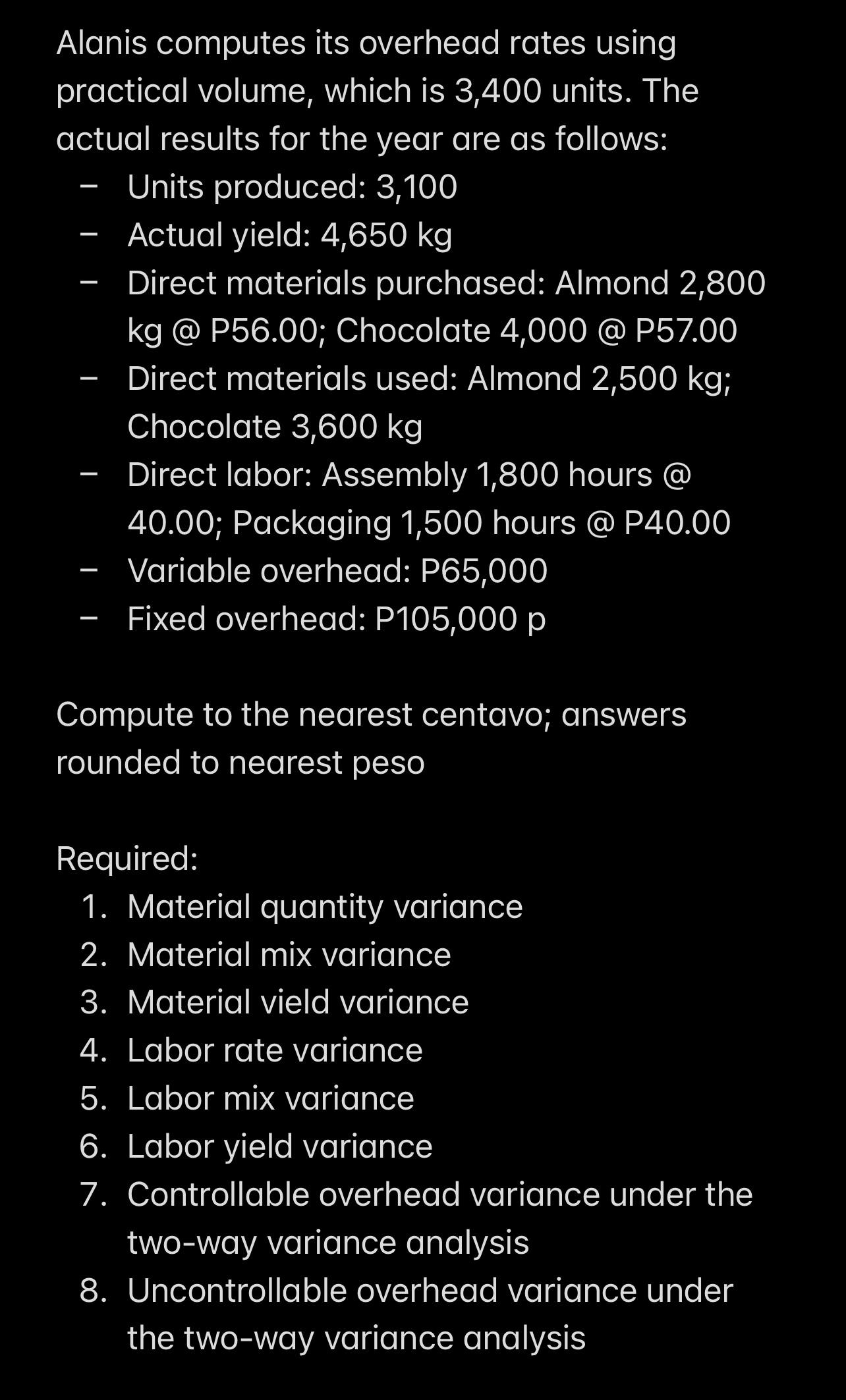

Alanis computes its overhead rates using practical volume, which is 3,400 units. The actual results for the year are as follows: Units produced: 3,100

Alanis computes its overhead rates using practical volume, which is 3,400 units. The actual results for the year are as follows: Units produced: 3,100 Actual yield: 4,650 kg - I Direct materials purchased: Almond 2,800 kg @ P56.00; Chocolate 4,000 @ P57.00 Direct materials used: Almond 2,500 kg; Chocolate 3,600 kg Direct labor: Assembly 1,800 hours @ 40.00; Packaging 1,500 hours @ P40.00 Variable overhead: P65,000 Fixed overhead: P105,000 p Compute to the nearest centavo; answers rounded to nearest peso Required: 1. Material quantity variance 2. Material mix variance 3. Material vield variance 4. Labor rate variance 5. Labor mix variance 6. Labor yield variance 7. Controllable overhead variance under the two-way variance analysis 8. Uncontrollable overhead variance under the two-way variance analysis

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the variances lets start with the given data Practical volume 3400 units Units produced 3100 units Actual yield 4650 kg Direct materials purchased Almond 2800 kg P5600 Chocolate 4000 kg P...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started