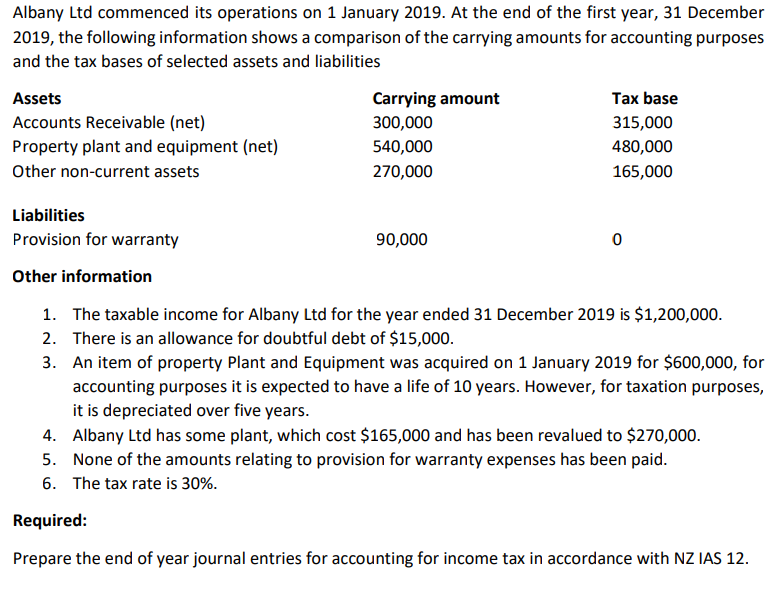

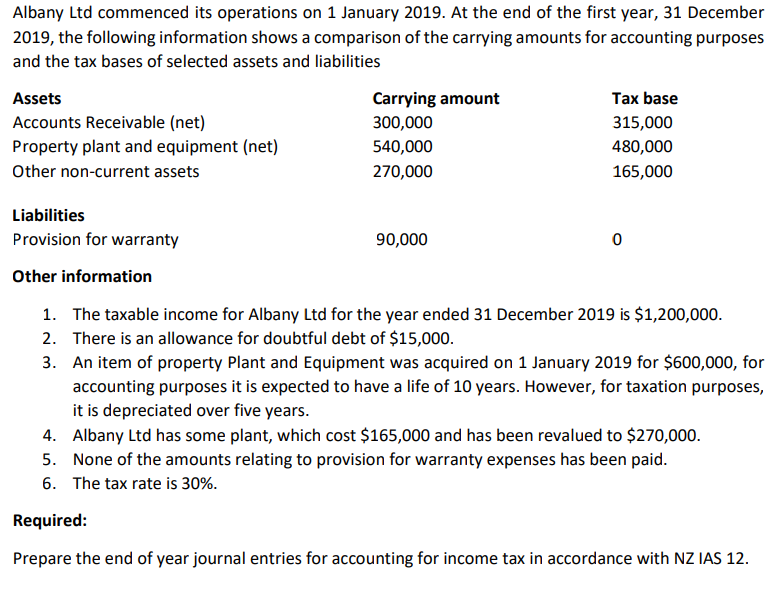

Albany Ltd commenced its operations on 1 January 2019. At the end of the first year, 31 December 2019, the following information shows a comparison of the carrying amounts for accounting purposes and the tax bases of selected assets and liabilities Assets Carrying amount Tax base Accounts Receivable (net) 300,000 315,000 Property plant and equipment (net) 540,000 480,000 Other non-current assets 270,000 165,000 Liabilities Provision for warranty 90,000 0 Other information 1. The taxable income for Albany Ltd for the year ended 31 December 2019 is $1,200,000. 2. There is an allowance for doubtful debt of $15,000. 3. An item of property Plant and Equipment was acquired on 1 January 2019 for $600,000, for accounting purposes it is expected to have a life of 10 years. However, for taxation purposes, it is depreciated over five years. 4. Albany Ltd has some plant, which cost $165,000 and has been revalued to $270,000. 5. None of the amounts relating to provision for warranty expenses has been paid. 6. The tax rate is 30%. Required: Prepare the end of year journal entries for accounting for income tax in accordance with NZ IAS 12. Albany Ltd commenced its operations on 1 January 2019. At the end of the first year, 31 December 2019, the following information shows a comparison of the carrying amounts for accounting purposes and the tax bases of selected assets and liabilities Assets Carrying amount Tax base Accounts Receivable (net) 300,000 315,000 Property plant and equipment (net) 540,000 480,000 Other non-current assets 270,000 165,000 Liabilities Provision for warranty 90,000 0 Other information 1. The taxable income for Albany Ltd for the year ended 31 December 2019 is $1,200,000. 2. There is an allowance for doubtful debt of $15,000. 3. An item of property Plant and Equipment was acquired on 1 January 2019 for $600,000, for accounting purposes it is expected to have a life of 10 years. However, for taxation purposes, it is depreciated over five years. 4. Albany Ltd has some plant, which cost $165,000 and has been revalued to $270,000. 5. None of the amounts relating to provision for warranty expenses has been paid. 6. The tax rate is 30%. Required: Prepare the end of year journal entries for accounting for income tax in accordance with NZ IAS 12