Question

Albert Co. is thinking about an IPO. Alberta Co. hired you as an analyst to evaluate the valuation its stock. In the table below

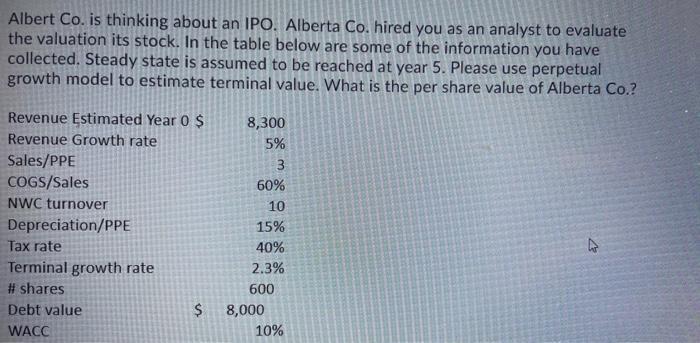

Albert Co. is thinking about an IPO. Alberta Co. hired you as an analyst to evaluate the valuation its stock. In the table below are some of the information you have collected. Steady state is assumed to be reached at year 5. Please use perpetual growth model to estimate terminal value. What is the per share value of Alberta Co.? Revenue Estimated Year 0 $ Revenue Growth rate Sales/PPE COGS/Sales NWC turnover Depreciation/PPE Tax rate Terminal growth rate # shares Debt value WACC $ 8,300 5% 3 60% 10 15% 40% 2.3% 600 8,000 10%

Step by Step Solution

3.36 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

To value Alberta Co we can use a combination of discounted cash flow DCF analysis for the forecast p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: James D. Stice, Earl K. Stice, Fred Skousen

17th Edition

032459237X, 978-0324592375

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App