Answered step by step

Verified Expert Solution

Question

1 Approved Answer

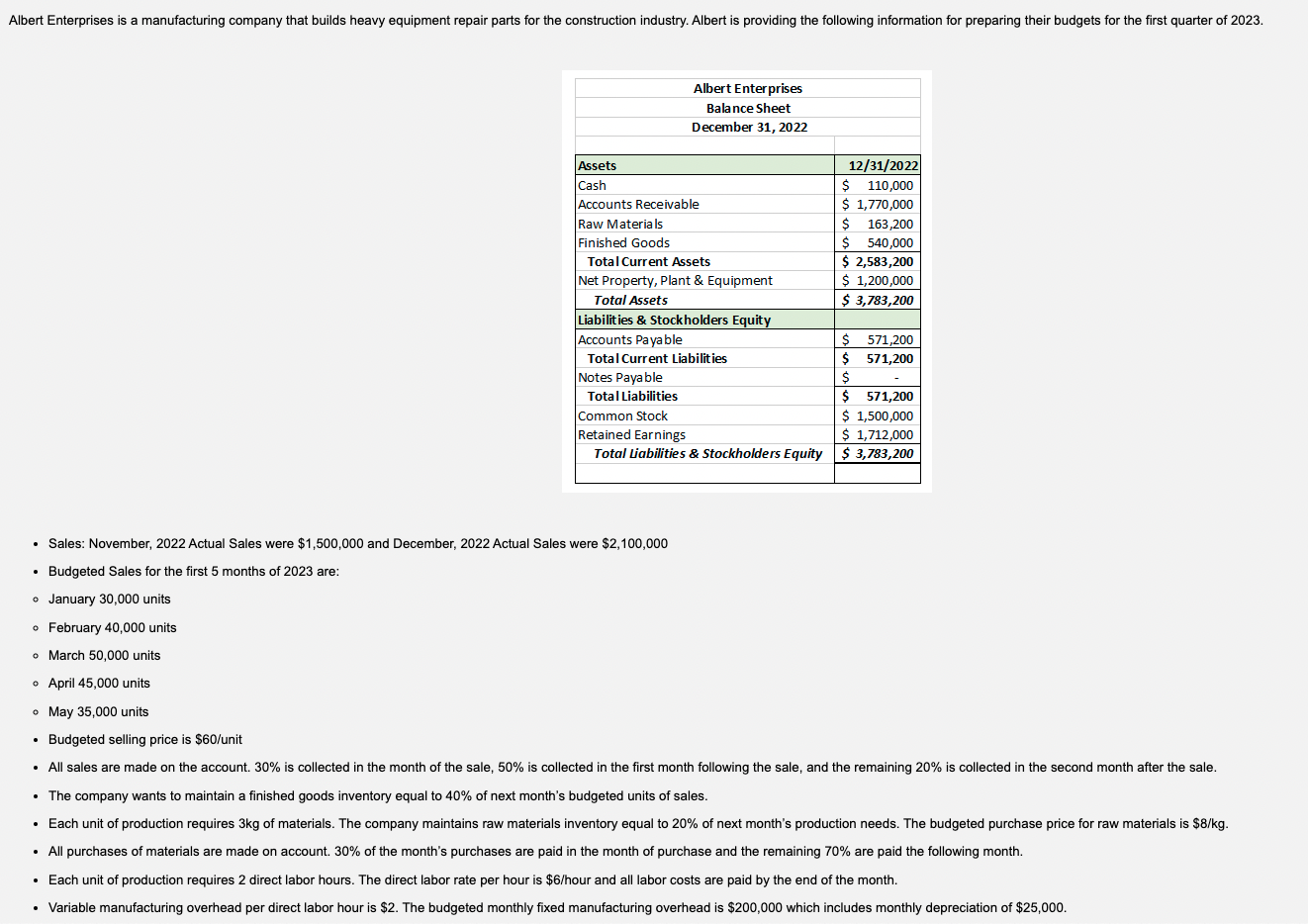

Albert Enterprises is a manufacturing company that builds heavy equipment repair parts for the construction industry. Albert is providing the following information for preparing their

Albert Enterprises is a manufacturing company that builds heavy equipment repair parts for the construction industry. Albert is providing the following information for preparing their budgets for the first quarter of

Sales: November, Actual Sales were $ and December, Actual Sales were $

Budgeted Sales for the first months of are:

January units

February units

March units

April units

May units

Budgeted selling price is $unit

All sales are made on the account. is collected in the month of the sale, is collected in the first month following the sale, and the remaining is collected in the second month after the sale.

The company wants to maintain a finished goods inventory equal to of next months budgeted units of sales.

Each unit of production requires kg of materials. The company maintains raw materials inventory equal to of next months production needs. The budgeted purchase price for raw materials is $kg

All purchases of materials are made on account. of the months purchases are paid in the month of purchase and the remaining are paid the following month.

Each unit of production requires direct labor hours. The direct labor rate per hour is $hour and all labor costs are paid by the end of the month.

Variable manufacturing overhead per direct labor hour is $ The budgeted monthly fixed manufacturing overhead is $ which includes monthly depreciation of $

Variable selling expenses per unit sold are $unit The budgeted monthly fixed selling and administrative expenses are $ which includes monthly depreciation of $

The company will be acquiring some additional equipment in the first quarter of the year. They will purchase equipment for $ in cash in January.

Dividends of $ will be paid out in March.

The company has a policy that it needs to maintain a cash balance of $ at all times. They do have a line of credit with their bank. It has an annual interest rate of Borrowing, if needed, will occur at the beginning of the month and repayment of the principal and interest will occur at the end of the month. Borrowings and repayments are done in increments of $

REQUIRED:

Prepare the sales budget for each month of the first quarter. points

Prepare the schedule of expected cash collections for each month of the first quarter. points

Prepare the production budget for each month of the first quarter. points

Prepare the direct materials budget for each month of the first quarter. points

Prepare the schedule of cash payments to suppliers for each month of the first quarter. points

Prepare the direct labor budget for each month of the first quarter. points

Prepare the manufacturing overhead budget for each month of the first quarter. points

Prepare the selling and administrative expense budget for each month of the first quarter. points

Prepare the cash budget for each month of the first quarter. points

Prepare the budgeted income statement for the full quarter. points

Prepare the budgeted balance sheet as of March pointsSales: November, Actual Sales were $ and December, Actual Sales were $

Budgeted Sales for the first months of are:

January units

February units

March units

April units

May units

Budgeted selling price is $ unit

The company wants to maintain a finished goods inventory equal to of next month's budgeted units of sales.

All purchases of materials are made on account. of the month's purchases are paid in the month of purchase and the remaining are paid the following month.

Each unit of production requires direct labor hours. The direct labor rate per hour is $ hour and all labor costs are paid by the end the month.

Variable manufacturing overhead per direct labor hour is $ The budgeted monthly fixed manufacturing overhead is $ which includes monthly depreciation of $

Need: answers in figures please

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started