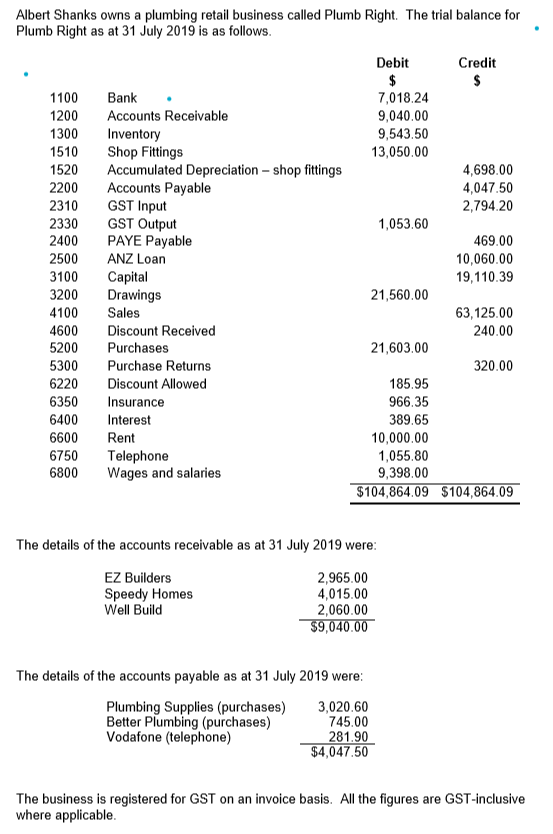

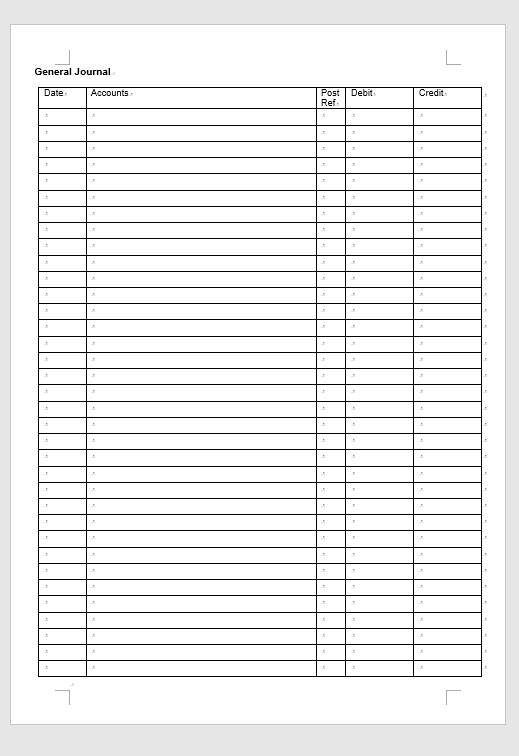

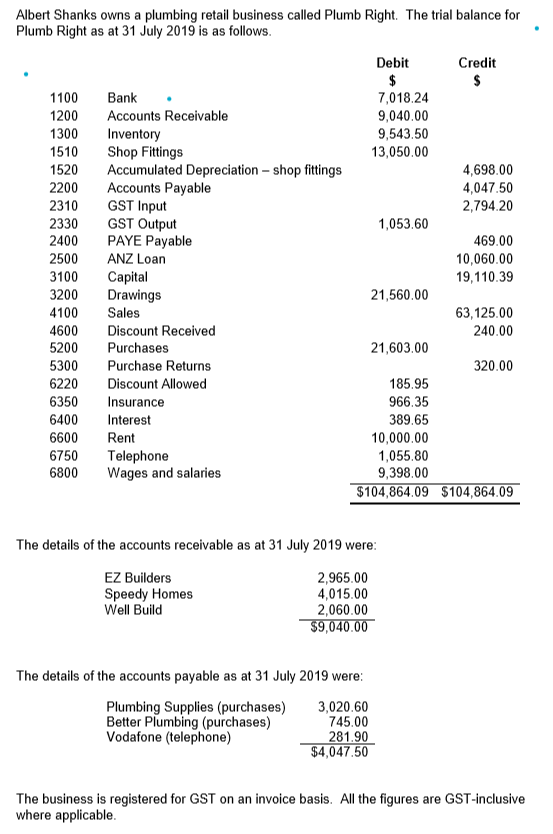

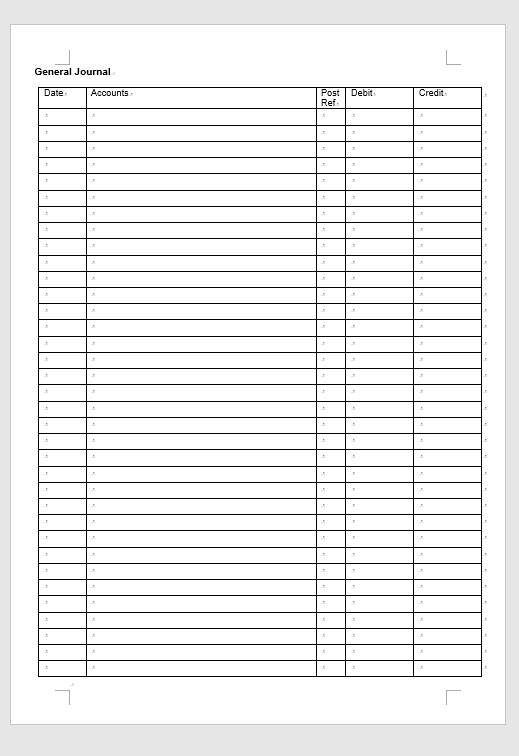

Albert Shanks owns a plumbing retail business called Plumb Right. The trial balance for Plumb Right as at 31 July 2019 is as follows. Debit Credit 1100 1200 1300 1510 1520 2200 2310 2330 2400 2500 3100 3200 4100 4600 5200 5300 6220 6350 6400 6600 6750 6800 Bank Accounts Receivable Inventory Shop Fittings Accumulated Depreciation - shop fittings Accounts Payable GST Input GST Output PAYE Payable ANZ Loan Capital Drawings Sales Discount Received Purchases Purchase Returns Discount Allowed Insurance Interest Rent Telephone Wages and salaries 7,018.24 9,040.00 9,543.50 13,050.00 4,698.00 4,047.50 2,794.20 1,053.60 469.00 10,060.00 19,110.39 21,560.00 63,125.00 240.00 21,603.00 320.00 185.95 966.35 389.65 10,000.00 1,055.80 9,398.00 $104,864.09 $104,864.09 The details of the accounts receivable as at 31 July 2019 were: EZ Builders Speedy Homes Well Build 2,965.00 4,015.00 2,060.00 $9,040.00 The details of the accounts payable as at 31 July 2019 were: Plumbing Supplies (purchases) Better Plumbing (purchases) Vodafone (telephone) 3,020.60 745.00 281.90 $4,047.50 The business is registered for GST on an invoice basis. All the figures are GST-inclusive where applicable. Details of transactions during August 2019 were as follows: Aug 1 Received $2,039.40 from Well Build in full settlement of account. 4 Albert took $5,000.00 as drawings. Received $980.00 from cash sales. 8 Paid Vodafone $281.90 in full settlement of account. Paid net wages of $867.00, from which PAYE of $210.00 had been deducted (i.e. gross wages were $1,077.00) 12 Albert took plumbing supplies which cost $550.00 for use in his own home. 15 Paid ANZ $500.00, $63.00 interest and $437.00.00 principal Speedy Homes paid $2,500.00 on account. 17 Received invoice and goods from Better Plumbing $3,500.00 19 Received $190.00 from cash sales. 20 Paid July PAYE. Paid Better Plumbing for July account, and received a 2% discount for prompt payment Paid Plumbing World $500.00 on account. 21 Received $2,965.00 from EZ Builders, 22 Paid net wages of $974.00, from which PAYE of $235.00 had been deducted (1.e. gross wages were $1,209.00) 26 Received an invoice and goods from Plumbing Supplies for $5,908.00. 27 Returned $150.00 of faulty goods to Plumbing Supplies 28 Invoiced EZ Builders $3,056.00 29 Received a $219.60 invoice from Vodafone. Required: a) Record all transactions in the appropriate journals. You are to use the following journals: Sales, Purchases, Purchase Returns, Cash Receipts, Cash Payment and General. [27 marks) b) Post the journals to the appropriate ledger: General Ledger Accounts Receivable Ledger Accounts Payable Ledger 135 marks] 8 marks] [10 marks] c) Prepare a Trial Balance as at 31 August 2019. [5 marks] General Journal Date Accounts Post Debit Ref. Credit III Sales Journal Date Customer : Invoice No. Post Ref. Invoice Amount Sales Amount GST Output Purchases Journal Date Supplier Invoice No. Post Ref. Invoice. Amount Purchases Amount. GSL Input Purchases Returns Journal Date Supplier Cr Note No.. Post Ref... Credit Purchases Note. Returns Amount. | Amount GSL Input Cash Receipts Journal Date Received From Post | Ref. Discount Banked. Allowed Cash Payments Journal Date Description Bank Post Discount Ref. Received DEBIT CREDIT Date Details Folio Date Details Folios Details Folio Debit Credit Balance Albert Shanks owns a plumbing retail business called Plumb Right. The trial balance for Plumb Right as at 31 July 2019 is as follows. Debit Credit 1100 1200 1300 1510 1520 2200 2310 2330 2400 2500 3100 3200 4100 4600 5200 5300 6220 6350 6400 6600 6750 6800 Bank Accounts Receivable Inventory Shop Fittings Accumulated Depreciation - shop fittings Accounts Payable GST Input GST Output PAYE Payable ANZ Loan Capital Drawings Sales Discount Received Purchases Purchase Returns Discount Allowed Insurance Interest Rent Telephone Wages and salaries 7,018.24 9,040.00 9,543.50 13,050.00 4,698.00 4,047.50 2,794.20 1,053.60 469.00 10,060.00 19,110.39 21,560.00 63,125.00 240.00 21,603.00 320.00 185.95 966.35 389.65 10,000.00 1,055.80 9,398.00 $104,864.09 $104,864.09 The details of the accounts receivable as at 31 July 2019 were: EZ Builders Speedy Homes Well Build 2,965.00 4,015.00 2,060.00 $9,040.00 The details of the accounts payable as at 31 July 2019 were: Plumbing Supplies (purchases) Better Plumbing (purchases) Vodafone (telephone) 3,020.60 745.00 281.90 $4,047.50 The business is registered for GST on an invoice basis. All the figures are GST-inclusive where applicable. Details of transactions during August 2019 were as follows: Aug 1 Received $2,039.40 from Well Build in full settlement of account. 4 Albert took $5,000.00 as drawings. Received $980.00 from cash sales. 8 Paid Vodafone $281.90 in full settlement of account. Paid net wages of $867.00, from which PAYE of $210.00 had been deducted (i.e. gross wages were $1,077.00) 12 Albert took plumbing supplies which cost $550.00 for use in his own home. 15 Paid ANZ $500.00, $63.00 interest and $437.00.00 principal Speedy Homes paid $2,500.00 on account. 17 Received invoice and goods from Better Plumbing $3,500.00 19 Received $190.00 from cash sales. 20 Paid July PAYE. Paid Better Plumbing for July account, and received a 2% discount for prompt payment Paid Plumbing World $500.00 on account. 21 Received $2,965.00 from EZ Builders, 22 Paid net wages of $974.00, from which PAYE of $235.00 had been deducted (1.e. gross wages were $1,209.00) 26 Received an invoice and goods from Plumbing Supplies for $5,908.00. 27 Returned $150.00 of faulty goods to Plumbing Supplies 28 Invoiced EZ Builders $3,056.00 29 Received a $219.60 invoice from Vodafone. Required: a) Record all transactions in the appropriate journals. You are to use the following journals: Sales, Purchases, Purchase Returns, Cash Receipts, Cash Payment and General. [27 marks) b) Post the journals to the appropriate ledger: General Ledger Accounts Receivable Ledger Accounts Payable Ledger 135 marks] 8 marks] [10 marks] c) Prepare a Trial Balance as at 31 August 2019. [5 marks] General Journal Date Accounts Post Debit Ref. Credit III Sales Journal Date Customer : Invoice No. Post Ref. Invoice Amount Sales Amount GST Output Purchases Journal Date Supplier Invoice No. Post Ref. Invoice. Amount Purchases Amount. GSL Input Purchases Returns Journal Date Supplier Cr Note No.. Post Ref... Credit Purchases Note. Returns Amount. | Amount GSL Input Cash Receipts Journal Date Received From Post | Ref. Discount Banked. Allowed Cash Payments Journal Date Description Bank Post Discount Ref. Received DEBIT CREDIT Date Details Folio Date Details Folios Details Folio Debit Credit Balance