Question

Albuquerque, Incorporated, acquired 2 4 , 0 0 0 shares of Marmon Company several years ago for $ 6 5 0 , 0 0 0

Albuquerque, Incorporated, acquired shares of Marmon Company several years ago for $ At the acquisition date, Marmon reported a book value of $ and Albuquerque assessed the fair value of the noncontrolling interest at $ Any excess of acquisitiondate fair value over book value was assigned to broadcast licenses with indefinite lives. Since the acquisition date and until this point, Marmon has issued no additional shares. No impairment has been recognized for the broadcast licenses.

At the present time, Marmon reports $ as total stockholders equity, which is broken down as follows:

Common stock $ par value $

Additional paidin capital

Retained earnings

Total $

View the following as independent situations:

Required:

a & b Marmon sells and shares of previously unissued common stock to the public for $ and $ per share. Albuquerque purchased none of this stock. What journal entry should Albuquerque make to recognize the impact of this stock transaction?

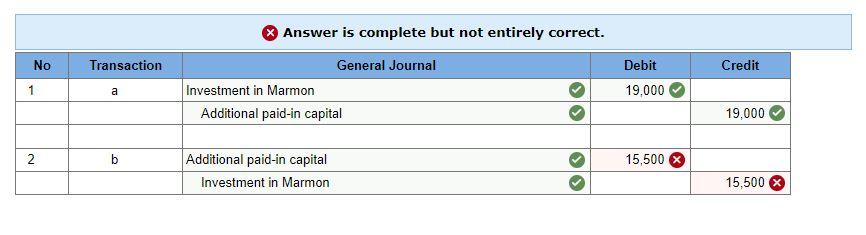

Note: If no entry is required for a transactionevent select No journal entry required" in the first account field. Do not round your intermediate calculations.Answer is complete but not entirely correct.

Answer is complete but not entirely correct. General Journal 1 No Transaction a Investment in Marmon Additional paid-in capital 2 b Additional paid-in capital Investment in Marmon Debit Credit 19,000 19,000 15,500 15,500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started