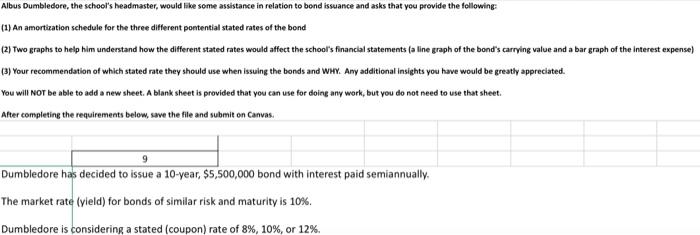

Albus Dumbledore, the school's headmaster, would like some assistance in relation to bond issuance and asks that you provide the following:

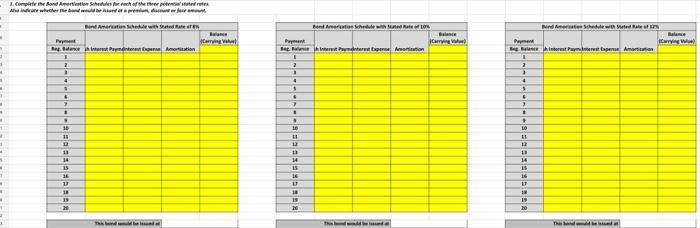

(1) An amortization schedule for the three different pontential stated rates of the bond

(2) Two graphs to help him understand how the different stated rates would affect the school's financial statements (a line graph of the bond's carrying value and a bar graph of the interest expense)

(3) Your recommendation of which stated rate they should use when issuing the bonds and WHY. Any additional insights you have would be greatly appreciated.

Dumbledore has decided to issue a 10-year, $5,500,000 bond with interest paid semiannually. The market rate (yield) for bonds of similar risk and maturity is 10%. Dumbledore is considering a stated (coupon) rate of 8%, 10%, or 12%.

Albus Dumbledore, the school's headmaster, would like some assistance in relation to bond issuance and asks that you provide the following (1) An amortization schedule for the three different pontential stated rates of the bond (2) Two graphs to help him understand how the different stated rates would affect the school's financial statements (a line graph of the band's carrying value and a bar graph of the Interest expense) (3) Your recommendation of which stated rate they should use when issuing the bonds and WHY. Any additional insights you have would be greatly appreciated. You will NOT be able to add a new sheet. A blank sheet is provided that you can use for doing any work, but you do not need to use that sheet. After completing the requirements below, save the file and submit on Canvas Dumbledore has decided to issue a 10-year, $5,500,000 bond with interest paid semiannually. The market rate (yield) for bonds of similar risk and maturity is 10%. Dumbledore is considering a stated (coupon) rate of 8%, 10%, or 12%. Complete the Bond American Studies for each of the reported And whether the workers are Bond Anar lewe Rarestes Carrying Begane Paint Amortion Bond Share Peyman CarW Mewted in Balan ang W Begin Pamer American 2 2 3 4 4 1 19 1 1 15 10 12 1 19 14 15 1 11 1 13 20 1 13 16 18 11 19 20 This ed 2. Place your two graphs comparing the different stated rates in the space below (line graph for the carrying value and bar graph for the interest expense): Your graphs should have clearly labeled axes, a legend, and a title. Place the graphs side by side horizonally in the space provided. 3. Give your recommendation of which stated rate Hogwarts should use for their bond issuance in the space below: Responses with no explanation of why you recommend a particular rate will receive NO credit. Excel Trick: Use Alt + Enter to go to a new line. Albus Dumbledore, the school's headmaster, would like some assistance in relation to bond issuance and asks that you provide the following (1) An amortization schedule for the three different pontential stated rates of the bond (2) Two graphs to help him understand how the different stated rates would affect the school's financial statements (a line graph of the band's carrying value and a bar graph of the Interest expense) (3) Your recommendation of which stated rate they should use when issuing the bonds and WHY. Any additional insights you have would be greatly appreciated. You will NOT be able to add a new sheet. A blank sheet is provided that you can use for doing any work, but you do not need to use that sheet. After completing the requirements below, save the file and submit on Canvas Dumbledore has decided to issue a 10-year, $5,500,000 bond with interest paid semiannually. The market rate (yield) for bonds of similar risk and maturity is 10%. Dumbledore is considering a stated (coupon) rate of 8%, 10%, or 12%. Complete the Bond American Studies for each of the reported And whether the workers are Bond Anar lewe Rarestes Carrying Begane Paint Amortion Bond Share Peyman CarW Mewted in Balan ang W Begin Pamer American 2 2 3 4 4 1 19 1 1 15 10 12 1 19 14 15 1 11 1 13 20 1 13 16 18 11 19 20 This ed 2. Place your two graphs comparing the different stated rates in the space below (line graph for the carrying value and bar graph for the interest expense): Your graphs should have clearly labeled axes, a legend, and a title. Place the graphs side by side horizonally in the space provided. 3. Give your recommendation of which stated rate Hogwarts should use for their bond issuance in the space below: Responses with no explanation of why you recommend a particular rate will receive NO credit. Excel Trick: Use Alt + Enter to go to a new line