Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. Using a discount rate of 6%, calculate the present value of Alcoa's take-or-pay contracts. Assume payments are made at the beginning of each

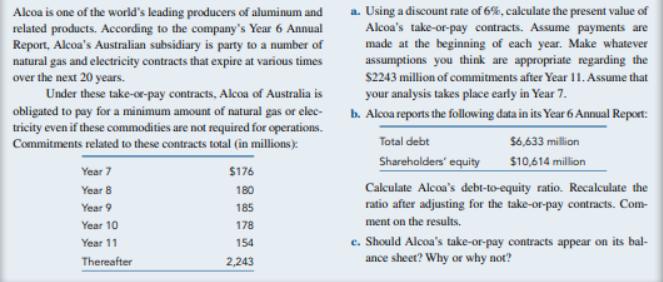

a. Using a discount rate of 6%, calculate the present value of Alcoa's take-or-pay contracts. Assume payments are made at the beginning of each year. Make whatever assumptions you think are appropriate regarding the Alcoa is one of the world's leading producers of aluminum and related products. According to the company's Year 6 Annual Report, Alcoa's Australian subsidiary is party to a number of natural gas and electricity contracts that expire at various times over the next 20 years. Under these take-or-pay contracts, Alcoa of Australia is obligated to pay for a minimum amount of natural gas or elec- b. Alcoa reports the following data in its Year 6 Annual Report: tricity even if these commodities are not required for operations. $2243 million of commitments after Year 11. Assume that your analysis takes place early in Year 7. Commitments related to these contracts total (in millions) Total debt $6,633 million Shareholders' equity $10,614 million Year 7 $176 Cakculate Alcoa's debt-to-equity ratio. Recalculate the ratio after adjusting for the take-or-pay contracts. Com- Year 8 180 Year 9 185 Year 10 178 ment on the results. e. Should Alcoa's take-or-pay contracts appear on its bal- ance sheet? Why or why not? Year 11 154 Thereafter 2,243

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Solution a Contracts Discounting Values Discounted cotract val...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started