Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Alex and Betty have agreed to form a cash-basis general partnership As of January 1, 20X4, Alex contributed $175,000 cash and an apartment complex

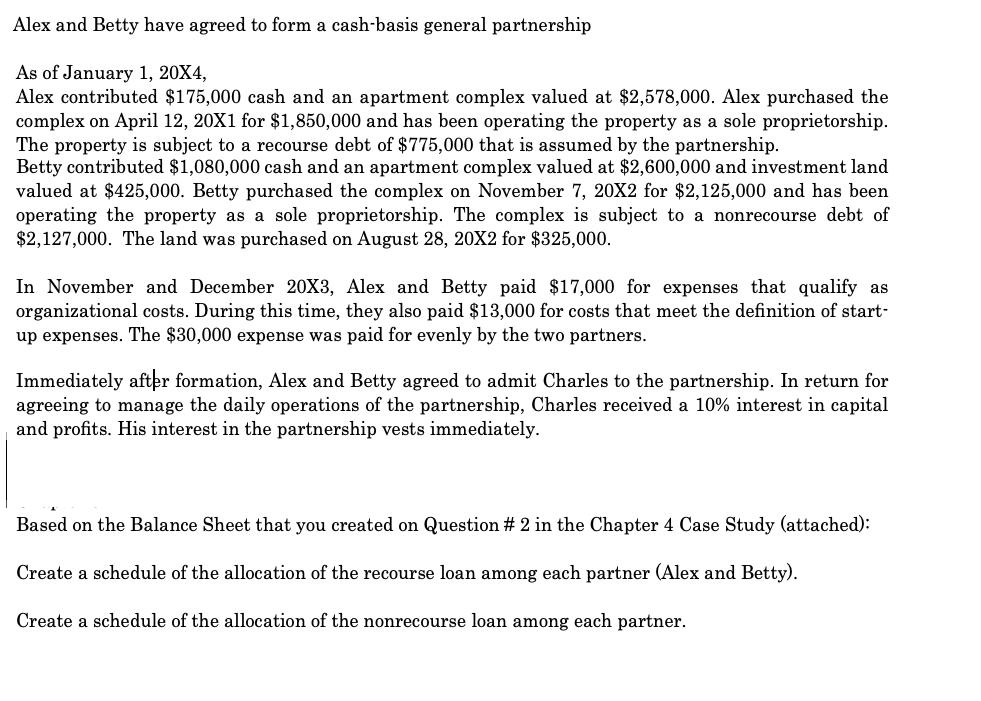

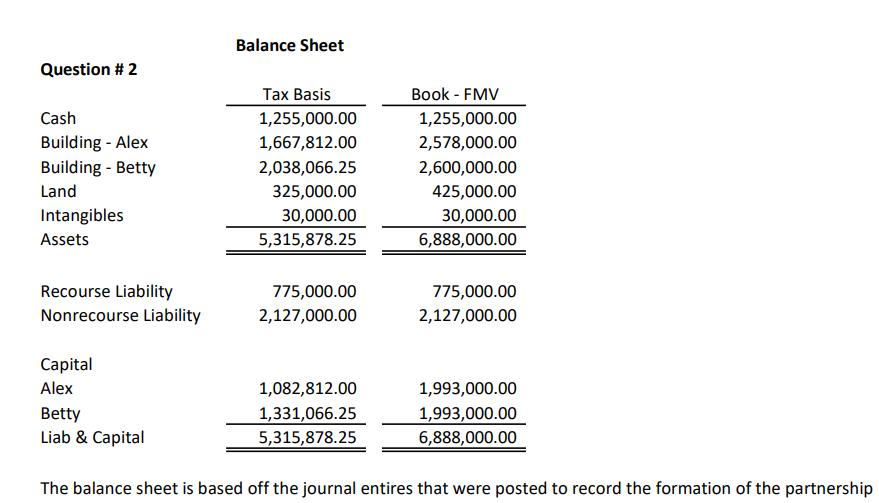

Alex and Betty have agreed to form a cash-basis general partnership As of January 1, 20X4, Alex contributed $175,000 cash and an apartment complex valued at $2,578,000. Alex purchased the complex on April 12, 20X1 for $1,850,000 and has been operating the property as a sole proprietorship. The property is subject to a recourse debt of $775,000 that is assumed by the partnership. Betty contributed $1,080,000 cash and an apartment complex valued at $2,600,000 and investment land valued at $425,000. Betty purchased the complex on November 7, 20X2 for $2,125,000 and has been operating the property as a sole proprietorship. The complex is subject to a nonrecourse debt of $2,127,000. The land was purchased on August 28, 20X2 for $325,000. In November and December 20X3, Alex and Betty paid $17,000 for expenses that qualify as organizational costs. During this time, they also paid $13,000 for costs that meet the definition of start- up expenses. The $30,000 expense was paid for evenly by the two partners. Immediately after formation, Alex and Betty agreed to admit Charles to the partnership. In return for agreeing to manage the daily operations of the partnership, Charles received a 10% interest in capital and profits. His interest in the partnership vests immediately. Based on the Balance Sheet that you created on Question # 2 in the Chapter 4 Case Study (attached): Create a schedule of the allocation of the recourse loan among each partner (Alex and Betty). Create a schedule of the allocation of the nonrecourse loan among each partner. Question # 2 Cash Building - Alex Building - Betty Land Intangibles Assets Recourse Liability Nonrecourse Liability Capital Alex Betty Liab & Capital Balance Sheet Tax Basis 1,255,000.00 1,667,812.00 2,038,066.25 325,000.00 30,000.00 5,315,878.25 775,000.00 2,127,000.00 1,082,812.00 1,331,066.25 5,315,878.25 Book - FMV 1,255,000.00 2,578,000.00 2,600,000.00 425,000.00 30,000.00 6,888,000.00 775,000.00 2,127,000.00 1,993,000.00 1,993,000.00 6,888,000.00 The balance sheet is based off the journal entires that were posted to record the formation of the partnership

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Calculation Inside Basis of Apartment Buildings contributed assume no depreciation deducted Cost of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started