Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Alex and Hagi decided to open a home cleaning service company, H@L .,. The following information is a partial list of transactions from H@L Inc.

Alex and Hagi decided to open a home cleaning service company, H@L .,. The following information is a partial list of transactions from H@L Inc.

January 1- Alex and Hagi each donated $ 25.000 in exchange for common stock to start the business. March 3- H@L Inc., paid $ 3.000 cash for a two-year insurance policy that was effective immediately. March 15-The Company purchased $8.000 of supplies on account.

April 5- The Company purchased some cleaning equipment for $10.000 cash. The equipment should last for five years with no residual value. H@L company will take a full year of depreciation in 2020.

May 1-H@L Inc., purchased a years worth of advertising in a local newspaper for $ 1.200 cash. September 1- The Company obtained a nine-month loan for $ 15.000 at 5% from Do Not Trust Bank, with interest and principal payable on June 2021.

December 31- The Company paid $ 5.000 of accounts payable owed from transaction 3.

December 31- The Company earned service revenues of $ 26.225, of which $23.225 were on account.

Note

The company had $2.000 of the supplies still on hand at the end of the year.

Requirements:

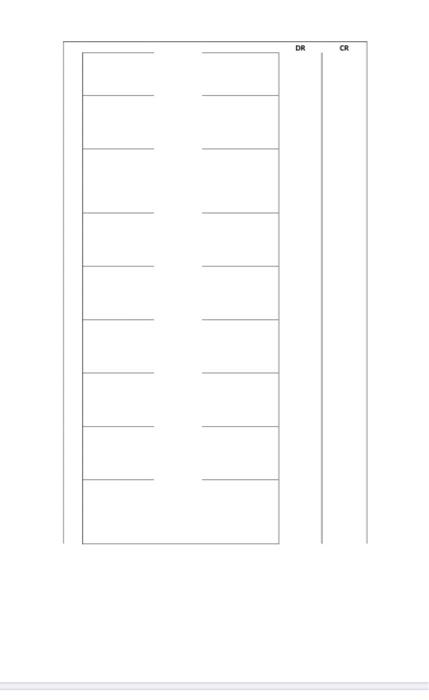

1- Give the journal entries for the transactions: include any adjusting entries.

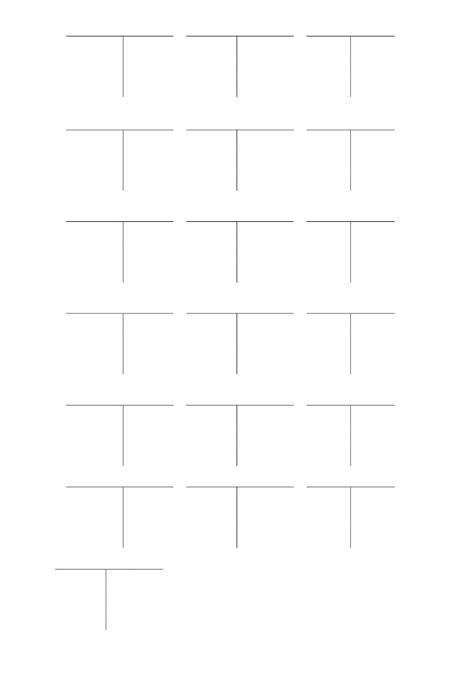

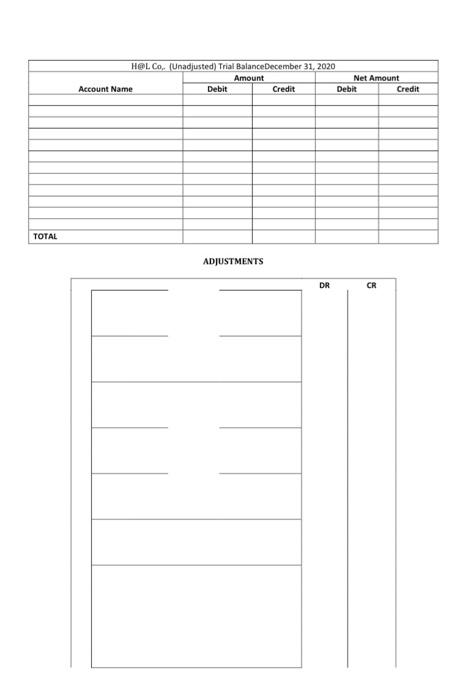

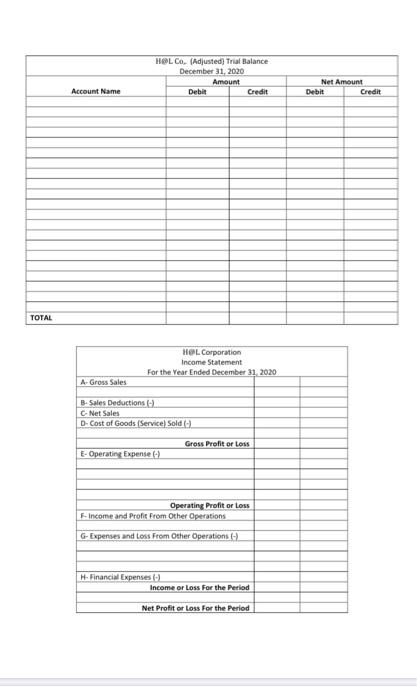

2- Post the journal entries to T accounts, prepare an adjusted trial balance at December 31, 2020.

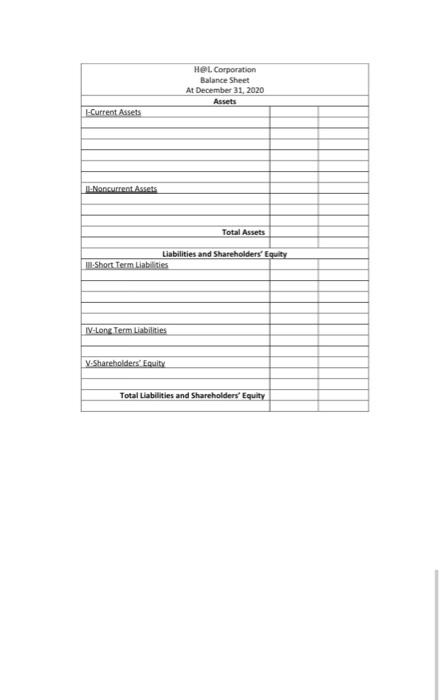

3- Prepare the income statement, and the balance sheet at December 31, 2020. Then, prepare the closing entries.

GOOD LUCK

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started