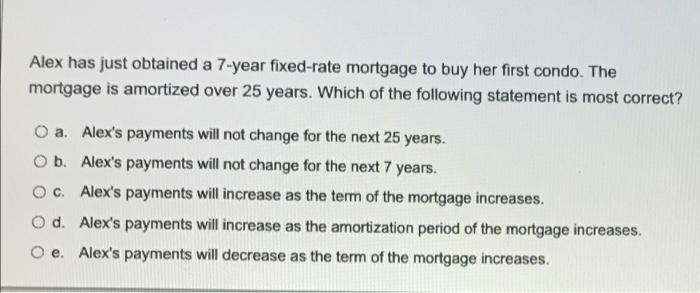

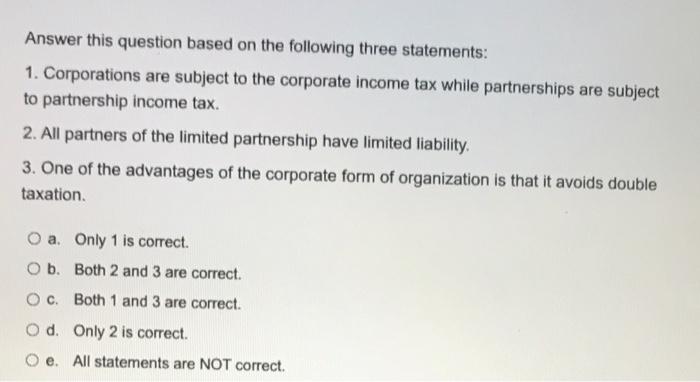

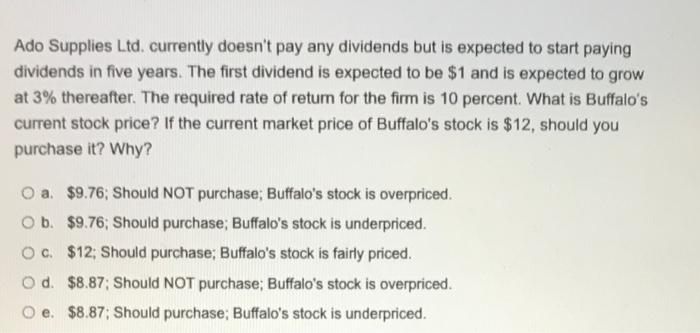

Alex has just obtained a 7-year fixed-rate mortgage to buy her first condo. The mortgage is amortized over 25 years. Which of the following statement is most correct? O a. Alex's payments will not change for the next 25 years. O b. Alex's payments will not change for the next 7 years. Oc. Alex's payments will increase as the term of the mortgage increases. O d. Alex's payments will increase as the amortization period of the mortgage increases. O e. Alex's payments will decrease as the term of the mortgage increases. Answer this question based on the following three statements: 1. Corporations are subject to the corporate income tax while partnerships are subject to partnership income tax. 2. All partners of the limited partnership have limited liability 3. One of the advantages of the corporate form of organization is that it avoids double taxation. O a. Only 1 is correct. O b. Both 2 and 3 are correct. Oc. Both 1 and 3 are correct. O d. Only 2 is correct. O e. All statements are NOT correct. Ado Supplies Ltd. currently doesn't pay any dividends but is expected to start paying dividends in five years. The first dividend is expected to be $1 and is expected to grow at 3% thereafter. The required rate of return for the firm is 10 percent. What is Buffalo's current stock price? If the current market price of Buffalo's stock is $12, should you purchase it? Why? O a $9.76; Should NOT purchase; Buffalo's stock is overpriced. O b. $9.76; Should purchase; Buffalo's stock is underpriced. O c. $12: Should purchase; Buffalo's stock is fairly priced. O d. $8.87; Should NOT purchase; Buffalo's stock is overpriced. Oe. $8.87; Should purchase, Buffalo's stock is underpriced. Alex has just obtained a 7-year fixed-rate mortgage to buy her first condo. The mortgage is amortized over 25 years. Which of the following statement is most correct? O a. Alex's payments will not change for the next 25 years. O b. Alex's payments will not change for the next 7 years. Oc. Alex's payments will increase as the term of the mortgage increases. O d. Alex's payments will increase as the amortization period of the mortgage increases. O e. Alex's payments will decrease as the term of the mortgage increases. Answer this question based on the following three statements: 1. Corporations are subject to the corporate income tax while partnerships are subject to partnership income tax. 2. All partners of the limited partnership have limited liability 3. One of the advantages of the corporate form of organization is that it avoids double taxation. O a. Only 1 is correct. O b. Both 2 and 3 are correct. Oc. Both 1 and 3 are correct. O d. Only 2 is correct. O e. All statements are NOT correct. Ado Supplies Ltd. currently doesn't pay any dividends but is expected to start paying dividends in five years. The first dividend is expected to be $1 and is expected to grow at 3% thereafter. The required rate of return for the firm is 10 percent. What is Buffalo's current stock price? If the current market price of Buffalo's stock is $12, should you purchase it? Why? O a $9.76; Should NOT purchase; Buffalo's stock is overpriced. O b. $9.76; Should purchase; Buffalo's stock is underpriced. O c. $12: Should purchase; Buffalo's stock is fairly priced. O d. $8.87; Should NOT purchase; Buffalo's stock is overpriced. Oe. $8.87; Should purchase, Buffalo's stock is underpriced