Answered step by step

Verified Expert Solution

Question

1 Approved Answer

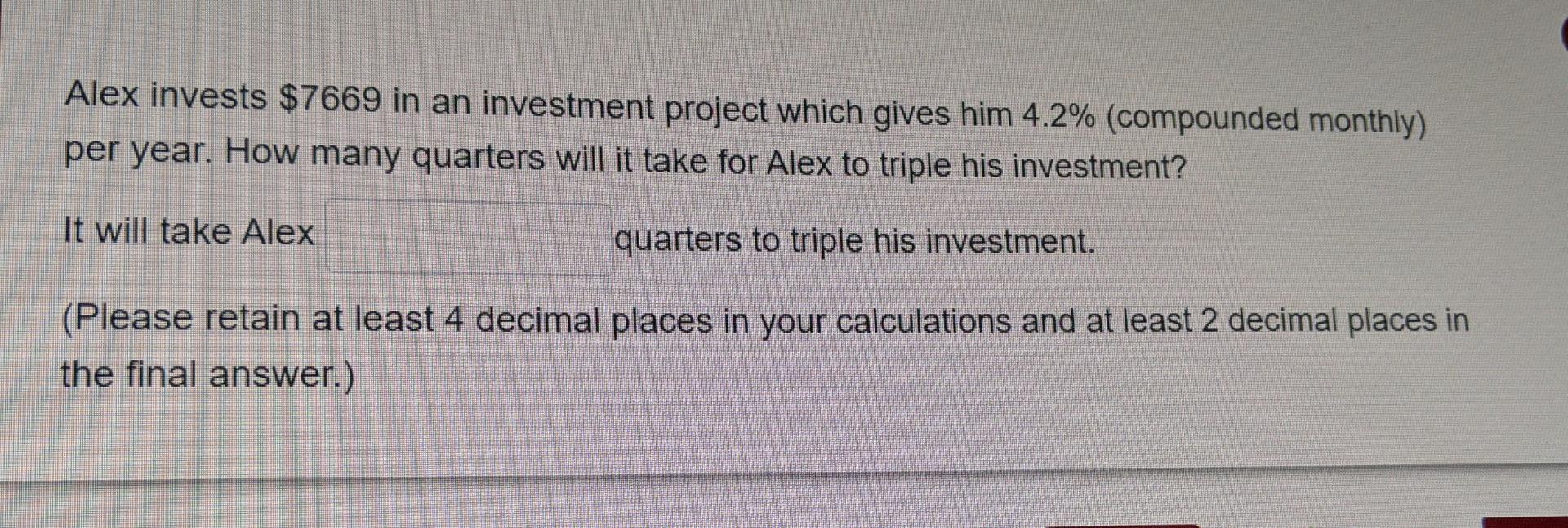

Alex invests $7669 in an investment project which gives him 4.2% (compounded monthly) per year. How many quarters will it take for Alex to triple

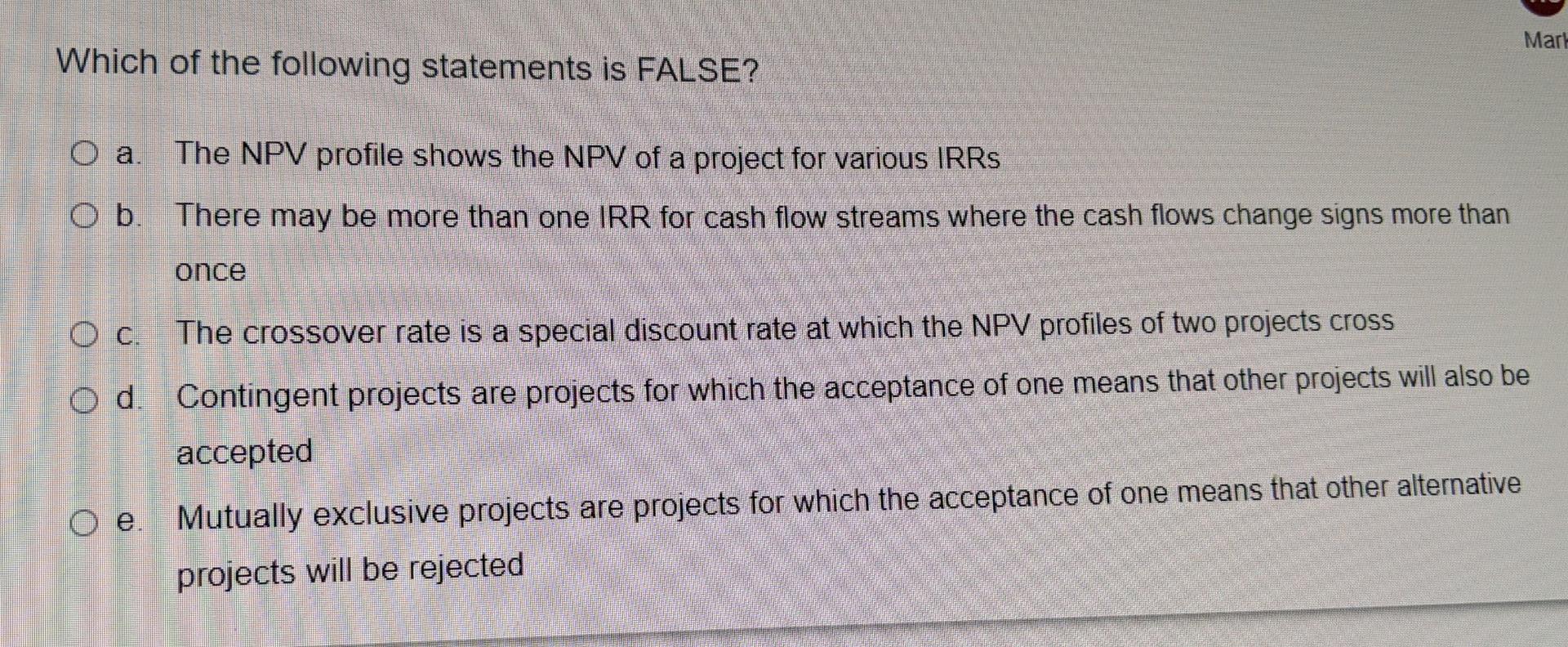

Alex invests $7669 in an investment project which gives him 4.2% (compounded monthly) per year. How many quarters will it take for Alex to triple his investment? It will take Alex quarters to triple his investment. (Please retain at least 4 decimal places in your calculations and at least 2 decimal places in the final answer.) Mark Which of the following statements is FALSE? O a. The NPV profile shows the NPV of a project for various IRRS Ob. There may be more than one IRR for cash flow streams where the cash flows change signs more than once OC. The crossover rate is a special discount rate at which the NPV profiles of two projects cross Od. Contingent projects are projects for which the acceptance of one means that other projects will also be accepted Oe. Mutually exclusive projects are projects for which the acceptance of one means that other alternative projects will be rejected

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started