Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Alex Limited (a GST registered firm) is planning to have a Christmas party for staff. This party is going to be on the last

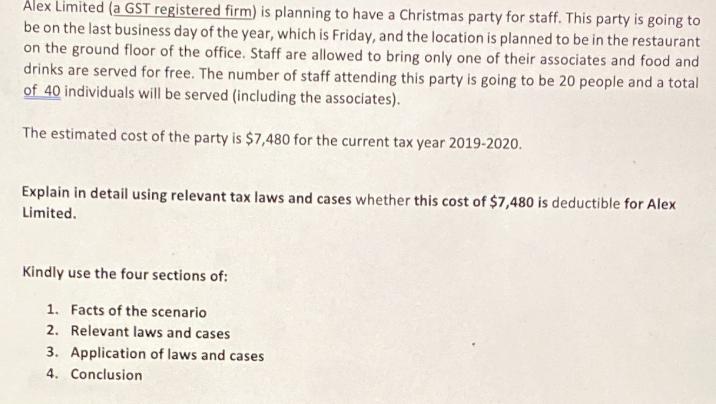

Alex Limited (a GST registered firm) is planning to have a Christmas party for staff. This party is going to be on the last business day of the year, which is Friday, and the location is planned to be in the restaurant on the ground floor of the office. Staff are allowed to bring only one of their associates and food and drinks are served for free. The number of staff attending this party is going to be 20 people and a total of 40 individuals will be served (including the associates). The estimated cost of the party is $7,480 for the current tax year 2019-2020. Explain in detail using relevant tax laws and cases whether this cost of $7,480 is deductible for Alex Limited. Kindly use the four sections of: 1. Facts of the scenario 2. Relevant laws and cases 3. Application of laws and cases 4. Conclusion

Step by Step Solution

★★★★★

3.54 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Facts of the scenario Alex Limited is a GST registered firm that is planning to have a Christmas party for staff The party is going to be on the last ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started