Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Alex recently joined the auditing department of KPMG. One of the clients of KPMG is Kenny Sportswear Company (KSC). As one of his first assignments,

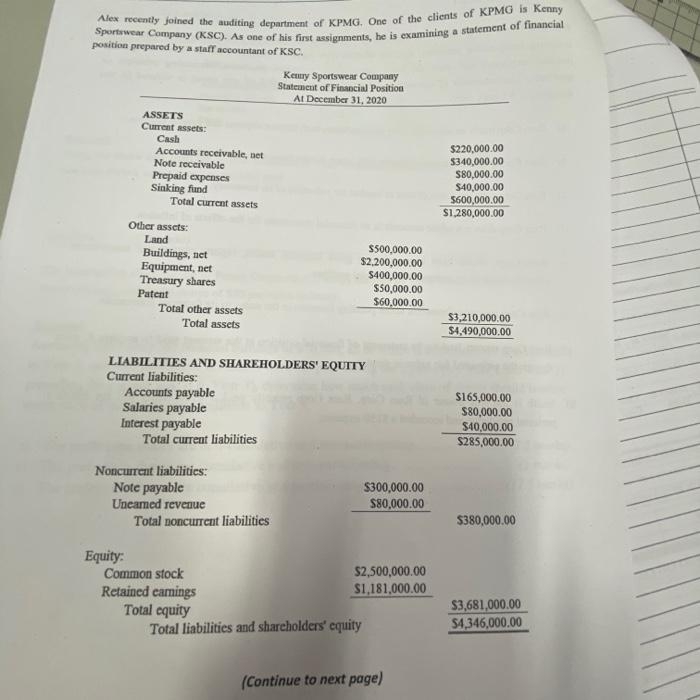

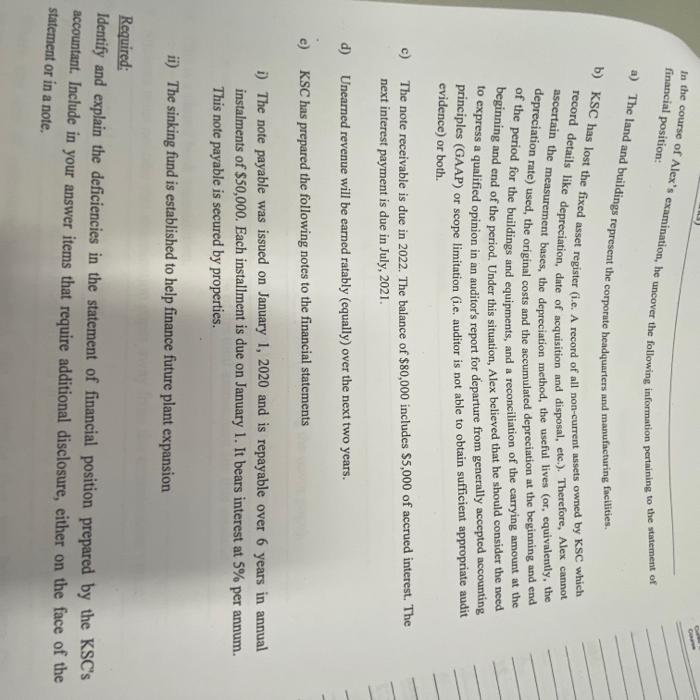

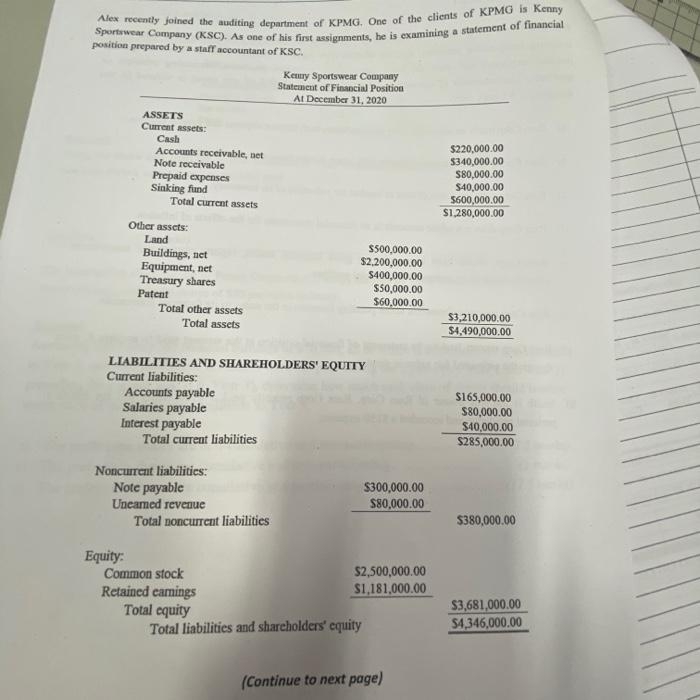

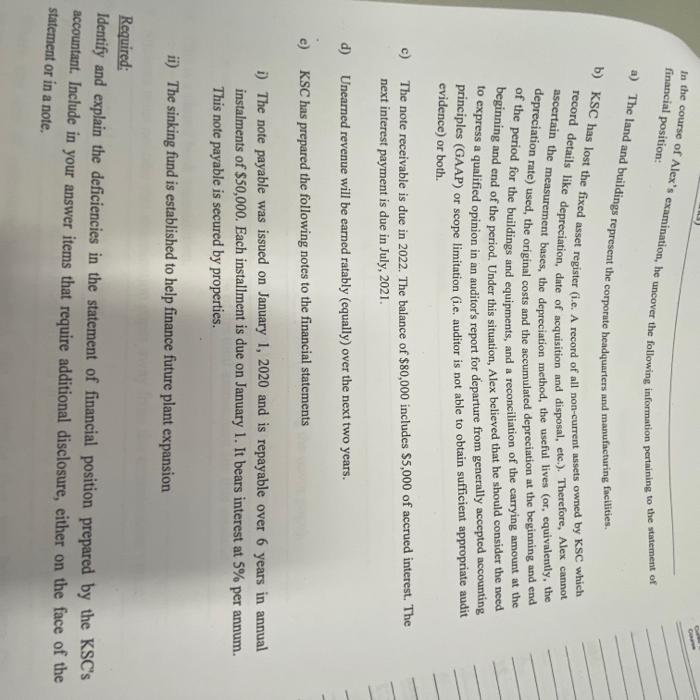

Alex recently joined the auditing department of KPMG. One of the clients of KPMG is Kenny Sportswear Company (KSC). As one of his first assignments, he is examining a statement of financial position prepared by a staff accountant of KSC. Kemury Sportswear Company Statement of Financial Position At December 31, 2020 ASSETS Current assets: Cash Accounts receivable, net Note receivable Prepaid expenses Sinking fund Total current assets $220,000.00 $340,000.00 S80,000.00 S40,000.00 5600,000.00 $1,280,000.00 Other assets: Land Buildings, net Equipment, net Treasury shares Patent Total other assets Total assets $500,000.00 $2.200,000.00 $400,000.00 $50,000.00 $60,000.00 $3,210,000.00 $4,490,000.00 LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities: Accounts payable Salaries payable Interest payable Total current liabilities Noncurrent liabilities: Note payable $300,000.00 Uneamed revenue $80,000.00 Total noncurrent liabilities $165,000.00 $80,000.00 $40,000.00 $285,000.00 $380,000.00 Equity: Common stock $2,500,000.00 Retained earnings S1,181,000.00 Total equity Total liabilities and shareholders' equity $3,681,000.00 $4,346,000.00 (Continue to next page) financial position: In the course of Alex's examination, he uncover the following information pertaining to the statement of a) The land and buildings represent the corporate headquarters and manufacturing facilities. b) KSC has lost the fixed asset register (i.e. A record of all non-current assets owned by KSC which record details like depreciation, date of acquisition and disposal, etc.). Therefore, Alex cannot ascertain the measurement bases, the depreciation method, the useful lives (or, equivalently, the depreciation rate) used, the original costs and the accumulated depreciation at the beginning and end beginning and end of the period. Under this situation, Alex believed that he should consider the need to express a qualified opinion in an auditor's report for departure from generally accepted accounting principles (GAAP) or scope limitation (i.c. auditor is not able to obtain sufficient appropriate audit evidence) or both. c) The note receivable is due in 2022. The balance of $80,000 includes $5,000 of accrued interest. The next interest payment is due in July, 2021. d) Unearned revenue will be earned ratably (equally) over the next two years. e) KSC has prepared the following notes to the financial statements 1) The note payable was issued on January 1, 2020 and is repayable over 6 years in annual instalments of $50,000. Each installment is due on January 1. It bears interest at 5% per annum. This note payable is secured by properties. ii) The sinking fund is established to help finance future plant expansion Required: Identify and explain the deficiencies in the statement of financial position prepared by the KSC's accountant. Include in your answer items that require additional disclosure, either on the face of the statement or in a note. Alex recently joined the auditing department of KPMG. One of the clients of KPMG is Kenny Sportswear Company (KSC). As one of his first assignments, he is examining a statement of financial position prepared by a staff accountant of KSC. Kemury Sportswear Company Statement of Financial Position At December 31, 2020 ASSETS Current assets: Cash Accounts receivable, net Note receivable Prepaid expenses Sinking fund Total current assets $220,000.00 $340,000.00 S80,000.00 S40,000.00 5600,000.00 $1,280,000.00 Other assets: Land Buildings, net Equipment, net Treasury shares Patent Total other assets Total assets $500,000.00 $2.200,000.00 $400,000.00 $50,000.00 $60,000.00 $3,210,000.00 $4,490,000.00 LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities: Accounts payable Salaries payable Interest payable Total current liabilities Noncurrent liabilities: Note payable $300,000.00 Uneamed revenue $80,000.00 Total noncurrent liabilities $165,000.00 $80,000.00 $40,000.00 $285,000.00 $380,000.00 Equity: Common stock $2,500,000.00 Retained earnings S1,181,000.00 Total equity Total liabilities and shareholders' equity $3,681,000.00 $4,346,000.00 (Continue to next page) financial position: In the course of Alex's examination, he uncover the following information pertaining to the statement of a) The land and buildings represent the corporate headquarters and manufacturing facilities. b) KSC has lost the fixed asset register (i.e. A record of all non-current assets owned by KSC which record details like depreciation, date of acquisition and disposal, etc.). Therefore, Alex cannot ascertain the measurement bases, the depreciation method, the useful lives (or, equivalently, the depreciation rate) used, the original costs and the accumulated depreciation at the beginning and end beginning and end of the period. Under this situation, Alex believed that he should consider the need to express a qualified opinion in an auditor's report for departure from generally accepted accounting principles (GAAP) or scope limitation (i.c. auditor is not able to obtain sufficient appropriate audit evidence) or both. c) The note receivable is due in 2022. The balance of $80,000 includes $5,000 of accrued interest. The next interest payment is due in July, 2021. d) Unearned revenue will be earned ratably (equally) over the next two years. e) KSC has prepared the following notes to the financial statements 1) The note payable was issued on January 1, 2020 and is repayable over 6 years in annual instalments of $50,000. Each installment is due on January 1. It bears interest at 5% per annum. This note payable is secured by properties. ii) The sinking fund is established to help finance future plant expansion Required: Identify and explain the deficiencies in the statement of financial position prepared by the KSC's accountant. Include in your answer items that require additional disclosure, either on the face of the statement or in a

Alex recently joined the auditing department of KPMG. One of the clients of KPMG is Kenny Sportswear Company (KSC). As one of his first assignments, he is examining a statement of financial position prepared by a staff accountant of KSC. Kemury Sportswear Company Statement of Financial Position At December 31, 2020 ASSETS Current assets: Cash Accounts receivable, net Note receivable Prepaid expenses Sinking fund Total current assets $220,000.00 $340,000.00 S80,000.00 S40,000.00 5600,000.00 $1,280,000.00 Other assets: Land Buildings, net Equipment, net Treasury shares Patent Total other assets Total assets $500,000.00 $2.200,000.00 $400,000.00 $50,000.00 $60,000.00 $3,210,000.00 $4,490,000.00 LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities: Accounts payable Salaries payable Interest payable Total current liabilities Noncurrent liabilities: Note payable $300,000.00 Uneamed revenue $80,000.00 Total noncurrent liabilities $165,000.00 $80,000.00 $40,000.00 $285,000.00 $380,000.00 Equity: Common stock $2,500,000.00 Retained earnings S1,181,000.00 Total equity Total liabilities and shareholders' equity $3,681,000.00 $4,346,000.00 (Continue to next page) financial position: In the course of Alex's examination, he uncover the following information pertaining to the statement of a) The land and buildings represent the corporate headquarters and manufacturing facilities. b) KSC has lost the fixed asset register (i.e. A record of all non-current assets owned by KSC which record details like depreciation, date of acquisition and disposal, etc.). Therefore, Alex cannot ascertain the measurement bases, the depreciation method, the useful lives (or, equivalently, the depreciation rate) used, the original costs and the accumulated depreciation at the beginning and end beginning and end of the period. Under this situation, Alex believed that he should consider the need to express a qualified opinion in an auditor's report for departure from generally accepted accounting principles (GAAP) or scope limitation (i.c. auditor is not able to obtain sufficient appropriate audit evidence) or both. c) The note receivable is due in 2022. The balance of $80,000 includes $5,000 of accrued interest. The next interest payment is due in July, 2021. d) Unearned revenue will be earned ratably (equally) over the next two years. e) KSC has prepared the following notes to the financial statements 1) The note payable was issued on January 1, 2020 and is repayable over 6 years in annual instalments of $50,000. Each installment is due on January 1. It bears interest at 5% per annum. This note payable is secured by properties. ii) The sinking fund is established to help finance future plant expansion Required: Identify and explain the deficiencies in the statement of financial position prepared by the KSC's accountant. Include in your answer items that require additional disclosure, either on the face of the statement or in a note. Alex recently joined the auditing department of KPMG. One of the clients of KPMG is Kenny Sportswear Company (KSC). As one of his first assignments, he is examining a statement of financial position prepared by a staff accountant of KSC. Kemury Sportswear Company Statement of Financial Position At December 31, 2020 ASSETS Current assets: Cash Accounts receivable, net Note receivable Prepaid expenses Sinking fund Total current assets $220,000.00 $340,000.00 S80,000.00 S40,000.00 5600,000.00 $1,280,000.00 Other assets: Land Buildings, net Equipment, net Treasury shares Patent Total other assets Total assets $500,000.00 $2.200,000.00 $400,000.00 $50,000.00 $60,000.00 $3,210,000.00 $4,490,000.00 LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities: Accounts payable Salaries payable Interest payable Total current liabilities Noncurrent liabilities: Note payable $300,000.00 Uneamed revenue $80,000.00 Total noncurrent liabilities $165,000.00 $80,000.00 $40,000.00 $285,000.00 $380,000.00 Equity: Common stock $2,500,000.00 Retained earnings S1,181,000.00 Total equity Total liabilities and shareholders' equity $3,681,000.00 $4,346,000.00 (Continue to next page) financial position: In the course of Alex's examination, he uncover the following information pertaining to the statement of a) The land and buildings represent the corporate headquarters and manufacturing facilities. b) KSC has lost the fixed asset register (i.e. A record of all non-current assets owned by KSC which record details like depreciation, date of acquisition and disposal, etc.). Therefore, Alex cannot ascertain the measurement bases, the depreciation method, the useful lives (or, equivalently, the depreciation rate) used, the original costs and the accumulated depreciation at the beginning and end beginning and end of the period. Under this situation, Alex believed that he should consider the need to express a qualified opinion in an auditor's report for departure from generally accepted accounting principles (GAAP) or scope limitation (i.c. auditor is not able to obtain sufficient appropriate audit evidence) or both. c) The note receivable is due in 2022. The balance of $80,000 includes $5,000 of accrued interest. The next interest payment is due in July, 2021. d) Unearned revenue will be earned ratably (equally) over the next two years. e) KSC has prepared the following notes to the financial statements 1) The note payable was issued on January 1, 2020 and is repayable over 6 years in annual instalments of $50,000. Each installment is due on January 1. It bears interest at 5% per annum. This note payable is secured by properties. ii) The sinking fund is established to help finance future plant expansion Required: Identify and explain the deficiencies in the statement of financial position prepared by the KSC's accountant. Include in your answer items that require additional disclosure, either on the face of the statement or in a

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started