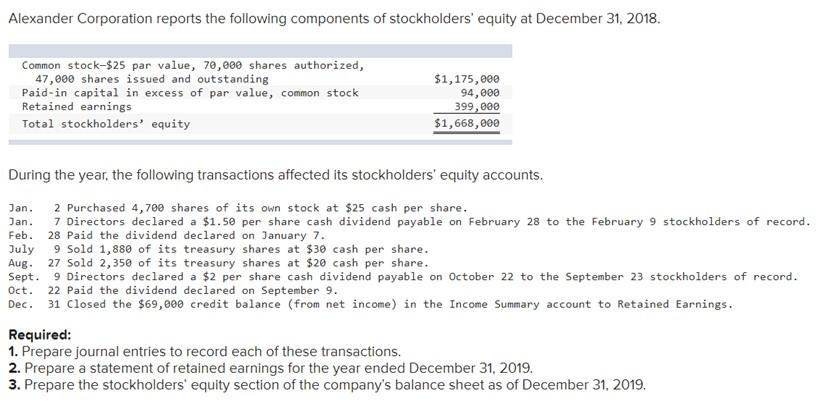

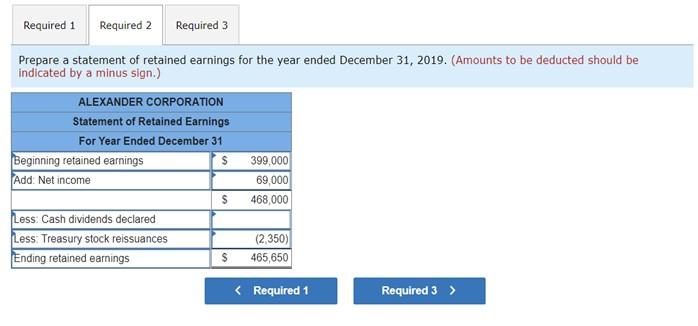

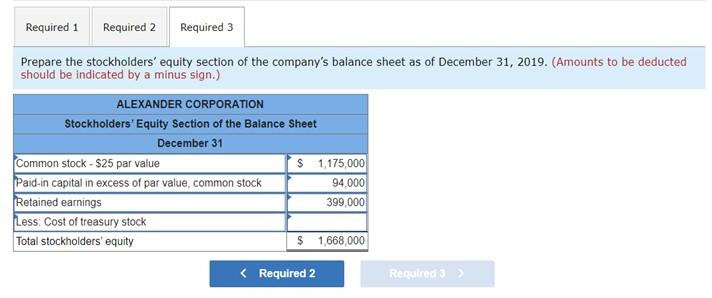

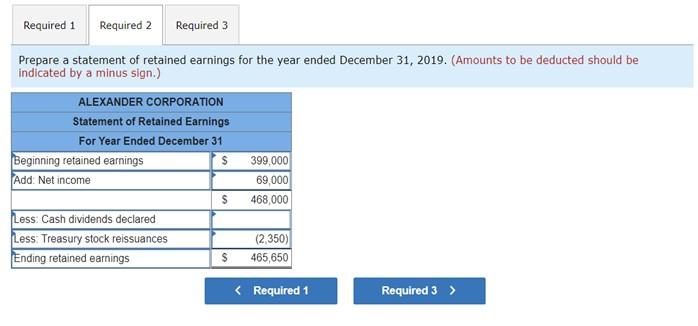

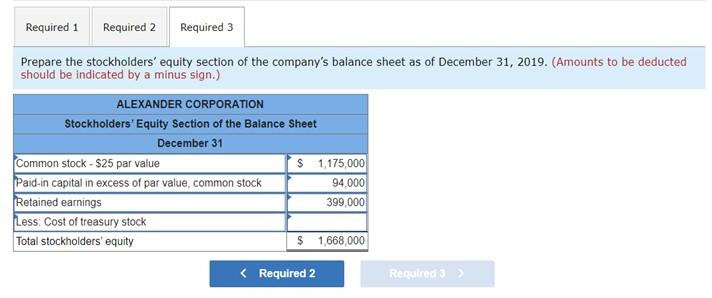

Alexander Corporation reports the following components of stockholders' equity at December 31, 2018. Common stock-$25 par value, 70,000 shares authorized, 47,000 shares issued and outstanding Paid-in capital in excess of par value, common stock Retained earnings Total stockholders' equity $1,175,000 94,000 399,000 $1,668 , During the year, the following transactions affected its stockholders' equity accounts. Jan. 2 Purchased 4,700 shares of its own stock at $25 cash per share. Jan. 7 Directors declared a $1.50 per share cash dividend payable on February 28 to the February 9 stockholders of record. Feb. 28 Paid the dividend declared on January 7. July 9 Sold 1,880 of its treasury shares at $30 cash per share. Aug 27 Sold 2,350 of its treasury shares at $20 cash per share. Sept. 9 Directors declared a $2 per share cash dividend payable on October 22 to the September 23 stockholders of record. Oct. 22 Paid the dividend declared on September 9. Dec. 31 closed the $69,000 credit balance (from net income) in the Income Summary account to Retained Earnings. Required: 1. Prepare journal entries to record each of these transactions. 2. Prepare a statement of retained earnings for the year ended December 31, 2019. 3. Prepare the stockholders' equity section of the company's balance sheet as of December 31, 2019. Required 1 Required 2 Required 3 Prepare a statement of retained earnings for the year ended December 31, 2019. (Amounts to be deducted should be indicated by a minus sign.) ALEXANDER CORPORATION Statement of Retained Earnings For Year Ended December 31 Beginning retained earnings $ AddNet income $ Less: Cash dividends declared Less: Treasury stock reissuances Ending retained earnings $ 399,000 69,000 468,000 (2,350) 465,650 Required 1 Required 2 Required 3 Prepare the stockholders' equity section of the company's balance sheet as of December 31, 2019. (Amounts to be deducted should be indicated by a minus sign.) ALEXANDER CORPORATION Stockholders' Equity Section of the Balance Sheet December 31 Common stock - $25 par value $ 1,175,000 Paid-in capital in excess of par value, common stock 94,000 Retained earnings 399,000 Less Cost of treasury stock Total stockholders' equity $ 1668,000 Required 2 Required 3