Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Alexandra purchased a $56,900 automobile during 2020 The business use was 60 percent What is the allowable depreciation for the current year (Ignore any possible

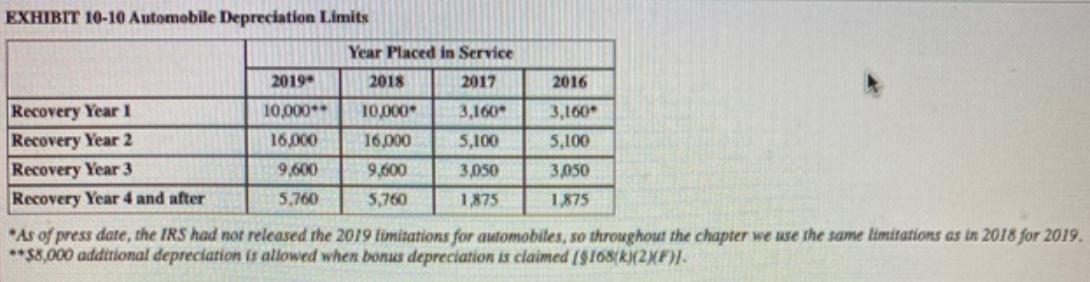

Alexandra purchased a $56,900 automobile during 2020 The business use was 60 percent What is the allowable depreciation for the current year (Ignore any possible bonus depreciation) (Use Exhibit 10-10)

EXHIBIT 10-10 Automobile Depreciation Limits Year Placed in Service 2019 2018 2017 2016 Recovery Year 1 Recovery Year 2 Recovery Year 3 Recovery Year 4 and after 10,000** 10,000 3,160 3,160 16,000 16,000 5,100 5,100 9,600 9,600 3,050 3,050 5,760 5,760 1,875 1,875 *As of press date, the IRS had not released the 2019 limitations for automobiles, so throughout the chapter we use the same limitations as in 2018 for 2019. *$8,000 additional depreciation is allowed when bonus depreciation is claimed ($168(k(2XF).

Step by Step Solution

★★★★★

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Automobile depreciation ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started