Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Alfred Hansen publishes an online travel blog. In need of cash, the business applies for a loan with National Bank. The bank requires borrowers

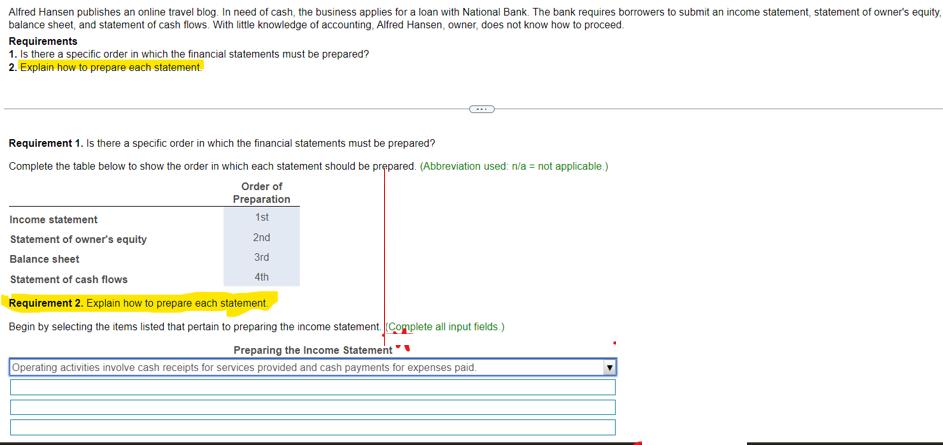

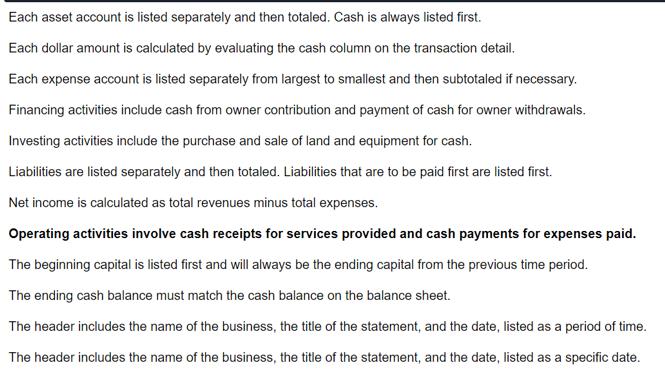

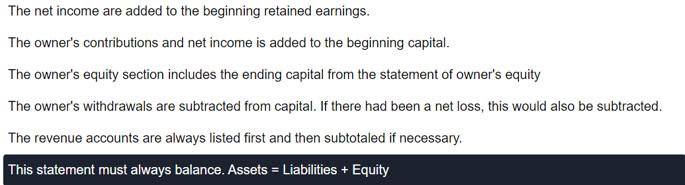

Alfred Hansen publishes an online travel blog. In need of cash, the business applies for a loan with National Bank. The bank requires borrowers to submit an income statement, statement of owner's equity. balance sheet, and statement of cash flows. With little knowledge of accounting, Alfred Hansen, owner, does not know how to proceed. Requirements 1. Is there a specific order in which the financial statements must be prepared? 2. Explain how to prepare each statement Requirement 1. Is there a specific order in which the financial statements must be prepared? Complete the table below to show the order in which each statement should be prepared. (Abbreviation used: n/a = not applicable.) Order of Preparation 1st 2nd 3rd 4th Income statement Statement of owner's equity Balance sheet Statement of cash flows Requirement 2. Explain how to prepare each statement Begin by selecting the items listed that pertain to preparing the income statement. (Complete all input fields.) Preparing the Income Statement Operating activities involve cash receipts for services provided and cash payments for expenses paid. Each asset account is listed separately and then totaled. Cash is always listed first. Each dollar amount is calculated by evaluating the cash column on the transaction detail. Each expense account is listed separately from largest to smallest and then subtotaled if necessary. Financing activities include cash from owner contribution and payment of cash for owner withdrawals. Investing activities include the purchase and sale of land and equipment for cash. Liabilities are listed separately and then totaled. Liabilities that are to be paid first are listed first. Net income is calculated as total revenues minus total expenses. Operating activities involve cash receipts for services provided and cash payments for expenses paid. The beginning capital is listed first and will always be the ending capital from the previous time period. The ending cash balance must match the cash balance on the balance sheet. The header includes the name of the business, the title of the statement, and the date, listed as a period of time. The header includes the name of the business, the title of the statement, and the date, listed as a specific date. The net income are added to the beginning retained earnings. The owner's contributions and net income is added to the beginning capital. The owner's equity section includes the ending capital from the statement of owner's equity The owner's withdrawals are subtracted from capital. If there had been a net loss, this would also be subtracted. The revenue accounts are always listed first and then subtotaled if necessary. This statement must always balance. Assets = Liabilities + Equity

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Based on the images youve provided it looks like you need help understanding the order in which financial statements should be prepared and how to prepare each of the statements mentioned To address t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started