Question

Ali Inc. expects to generate free-cash of $350000250000per year forever. If the firm's cost of capital is 0.09 percent, the firm cost of equity

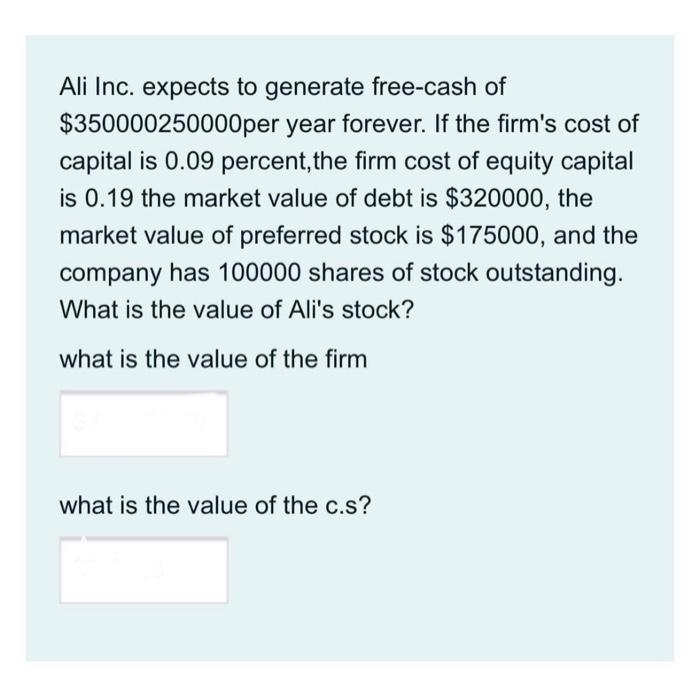

Ali Inc. expects to generate free-cash of $350000250000per year forever. If the firm's cost of capital is 0.09 percent, the firm cost of equity capital is 0.19 the market value of debt is $320000, the market value of preferred stock is $175000, and the company has 100000 shares of stock outstanding. What is the value of Ali's stock? what is the value of the firm what is the value of the c.s?

Step by Step Solution

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Answer The value of firm will be free cash flowcost of capital Market Value of common stock ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Valuation The Art and Science of Corporate Investment Decisions

Authors: Sheridan Titman, John D. Martin

3rd edition

133479528, 978-0133479522

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App