Question

Ali lives in accommodation owned by his employer and has a salary of 21,000 a year. The accommodation has an annual value of 11,200

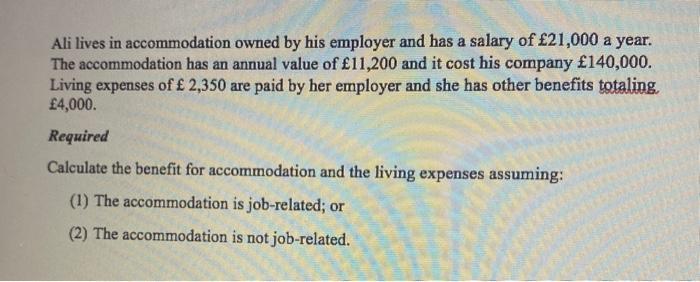

Ali lives in accommodation owned by his employer and has a salary of 21,000 a year. The accommodation has an annual value of 11,200 and it cost his company 140,000. Living expenses of 2,350 are paid by her employer and she has other benefits totaling. 4,000. Required Calculate the benefit for accommodation and the living expenses assuming: (1) The accommodation is job-related; or (2) The accommodation is not job-related.

Step by Step Solution

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

1 If the accommodation is jobrelated Accommodation benefit Annual value of accommodation 10 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Federal Taxation 2017 Individuals

Authors: Thomas R. Pope, Timothy J. Rupert, Kenneth E. Anderson

30th Edition

134420861, 978-0134743110, 134743113, 978-0134420868

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App