Question

Alice and Bruce are planning some significant changes for 2021. They have provided you with the following information and asked you to project their taxable

Alice and Bruce are planning some significant changes for 2021. They have provided you with the following information and asked you to project their taxable income and tax liability for 2021. Assume that the Byrds will itemize their deductions next year.

- The Byrds will invest the $1,600,000 of life insurance proceeds in short-term certificates of deposit (CDs) and use the interest for living expenses during 2021. They expect to earn interest of $32,000 on the CDs.

- Bruce has been promoted to regional manager, and his salary for 2021 will be $88,000. He estimates that state income tax withheld will increase by $4,000 and the Social Security tax withheld will be $5,456.

- Alice, who has been diagnosed with a serious illness, will take a leave of absence from work during 2021, so she will not receive a salary or incur any work-related expenses during the year. The estimated cost for her medical treatment is $15,400, of which $6,400 will be reimbursed by their insurance company. Their medical insurance premium will increase to $9,769.

- Property taxes on their residence are expected to increase to $5,100.

- The Byrds' home mortgage interest expense and charitable contributions are expected to be unchanged from the prior year.

- John will graduate from college in December 2020 and will take a job in New York City in January 2021. His starting salary will be $46,000.

In 2021, the medical expenses are reduced by 7.5% of AGI.

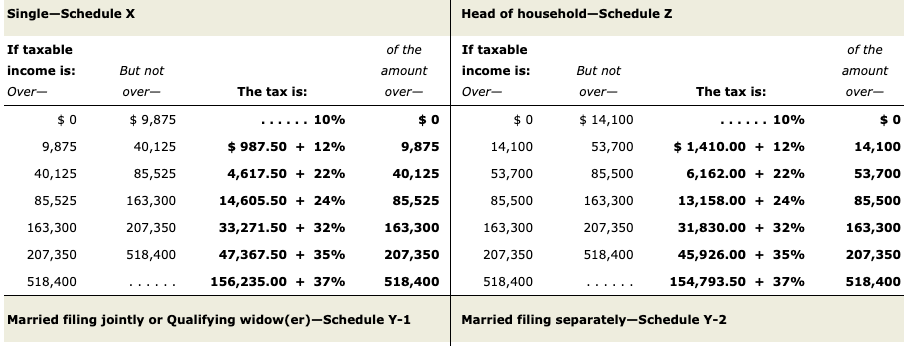

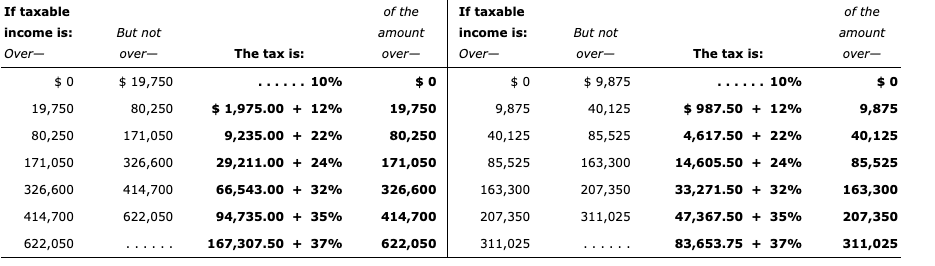

Assume that all of the information reported in 2020 will be the same in 2021 unless other information has been presented above. Use the 2020 Tax Rate Schedules.

Based on this information, the Bryd's projected itemized deductions for 2021 would be [$22,580 $30,794 $33,863] taxable income would be

[$82,890 $88,887 $91,956] and the related tax liability for 2021 would be [$10,989 $11,135 $12,109]

Please choose a choice within the [ ], USE 2020 TAX SCHED AS PICTURED and show work, thank you!

.

Single-Schedule X Head of household-Schedule z of the If taxable income is: Over- But not of the amount over- If taxable income is: Over- amount But not over- over- The tax is: The tax is: over- $ 0 $ 9,875 10% $ 14,100 10% $ 0 9,875 $ 987.50 + 12% 53,700 $ 1,410.00 + 12% 14,100 40,125 85,525 40,125 4,617.50 + 22% 85,500 6,162.00 + 22% 53,700 163,300 $ 0 9,875 40,125 85,525 163,300 207,350 518,400 85,525 163,300 13, 158.00 + 24% $ 0 14,100 53,700 85,500 163,300 207,350 518,400 85,500 14,605.50 + 24% 33,271.50 + 32% 47,367.50 + 35% 156,235.00 + 37% 207,350 163,300 207,350 518,400 31,830.00 + 32% 207,350 518,400 45,926.00 + 35% 163,300 207,350 518,400 518,400 154,793.50 + 37% Married filing jointly or Qualifying widow(er)-Schedule Y-1 Married filing separately-Schedule Y-2 of the If taxable income is: Over- of the amount But not If taxable income is: Over- amount But not over- The tax is: over- over- The tax is: over- $ 19,750 ...... 10% $ 9,875 ...... 10% $ 0 $ 0 19,750 $ 0 9,875 80,250 40,125 $ 987.50 + 12% 9,875 $ 1,975.00 + 12% 9,235.00 + 22% 80,250 171,050 40,125 4,617.50 + 22% 40,125 $ 0 19,750 80,250 171,050 326,600 414,700 85,525 163,300 171,050 326,600 29,211.00 + 24% 85,525 14,605.50 + 24% 85,525 326,600 414,700 66,543.00 + 32% 163,300 207,350 33,271.50 + 32% 163,300 414,700 622,050 94,735.00 + 35% 207,350 311,025 47,367.50 + 35% 207,350 622,050 167,307.50 + 37% 622,050 311,025 83,653.75 + 37% 311,025 Single-Schedule X Head of household-Schedule z of the If taxable income is: Over- But not of the amount over- If taxable income is: Over- amount But not over- over- The tax is: The tax is: over- $ 0 $ 9,875 10% $ 14,100 10% $ 0 9,875 $ 987.50 + 12% 53,700 $ 1,410.00 + 12% 14,100 40,125 85,525 40,125 4,617.50 + 22% 85,500 6,162.00 + 22% 53,700 163,300 $ 0 9,875 40,125 85,525 163,300 207,350 518,400 85,525 163,300 13, 158.00 + 24% $ 0 14,100 53,700 85,500 163,300 207,350 518,400 85,500 14,605.50 + 24% 33,271.50 + 32% 47,367.50 + 35% 156,235.00 + 37% 207,350 163,300 207,350 518,400 31,830.00 + 32% 207,350 518,400 45,926.00 + 35% 163,300 207,350 518,400 518,400 154,793.50 + 37% Married filing jointly or Qualifying widow(er)-Schedule Y-1 Married filing separately-Schedule Y-2 of the If taxable income is: Over- of the amount But not If taxable income is: Over- amount But not over- The tax is: over- over- The tax is: over- $ 19,750 ...... 10% $ 9,875 ...... 10% $ 0 $ 0 19,750 $ 0 9,875 80,250 40,125 $ 987.50 + 12% 9,875 $ 1,975.00 + 12% 9,235.00 + 22% 80,250 171,050 40,125 4,617.50 + 22% 40,125 $ 0 19,750 80,250 171,050 326,600 414,700 85,525 163,300 171,050 326,600 29,211.00 + 24% 85,525 14,605.50 + 24% 85,525 326,600 414,700 66,543.00 + 32% 163,300 207,350 33,271.50 + 32% 163,300 414,700 622,050 94,735.00 + 35% 207,350 311,025 47,367.50 + 35% 207,350 622,050 167,307.50 + 37% 622,050 311,025 83,653.75 + 37% 311,025Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started