Question

Alice and Stella have decided to start a touring company, conducting tours through Kakadu National Park in the Northern Territory. They decided to incorporate a

Alice and Stella have decided to start a touring company, conducting tours through Kakadu National Park in the Northern Territory. They decided to incorporate a company to provide limited liability, as well as a low tax rate.

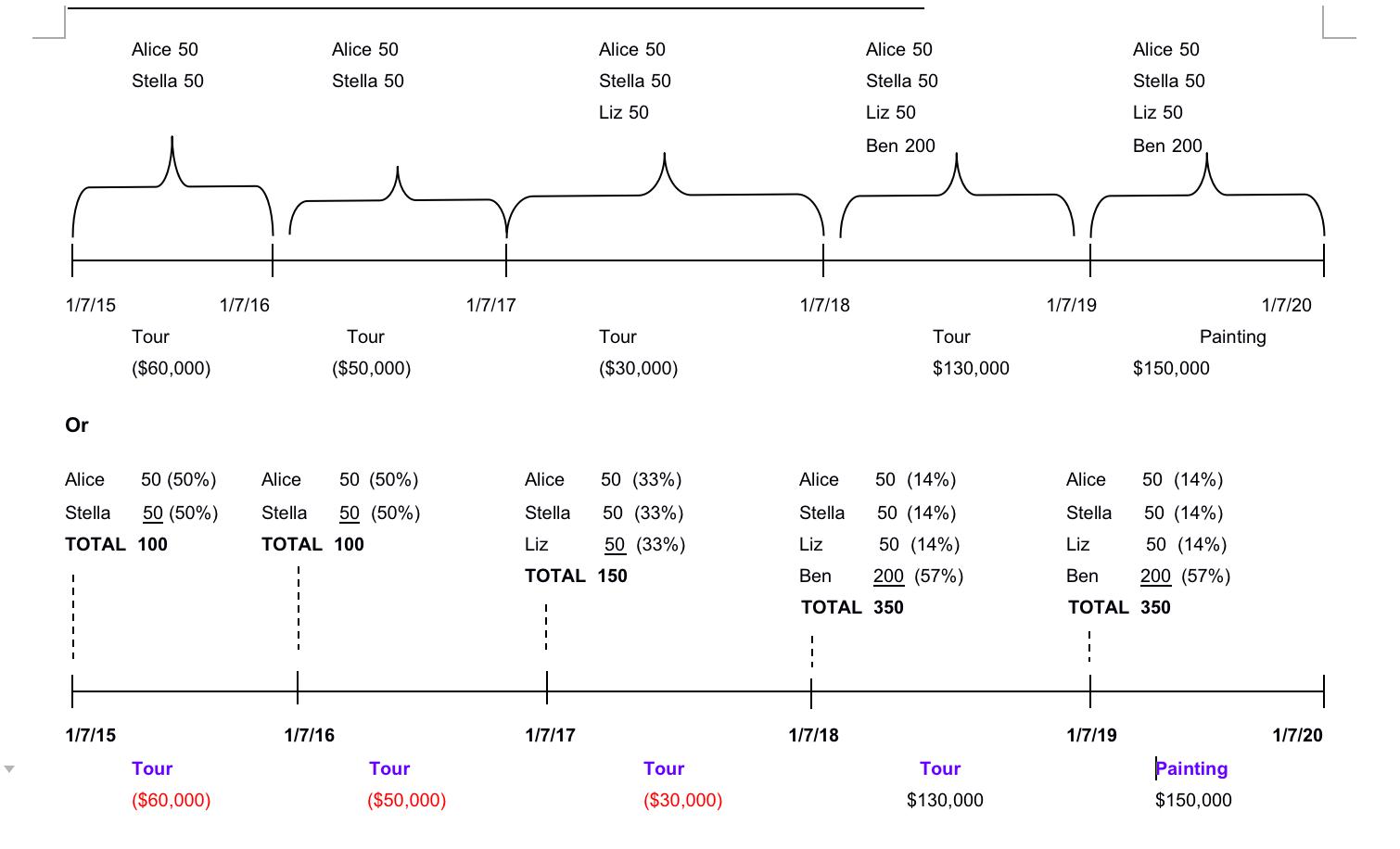

The company, Smiling Croc Pty Ltd, was incorporated on 1 July 2015 will 100 issued shares. Alice and Stella own 50% each of the issued shares on 1 July 2015.

Unfortunately, in the company’s first year of operation, after an unfortunate accident between a client and one of the jumping crocodiles, the company generated a loss of $60,000 for the 30 June 2016 year.

The company’s fortune was not much better for 30 June 2017 year, as the company generated a loss of $50,000.

To obtain further money for the company’s operations, the company issued 50 shares to Liz on 1 July 2017. Though the company still foundered, and for the 30 June 2018, made a loss of $30,000.

To raise more money, the company issued 200 shares to Ben on 1 July 2018. For the 30 June 2019 year, the company generated its first profit (before considering losses) of $130,000. The company saw a golden business opportunity, so it ceased its touring operations and instead started selling aboriginal paintings on 1 July 2019. This decision appears to be a good one; as for the 30 June 2020 year the company generated profits (before considering losses) of $150,000.

The company has failed to lodge tax returns since it commenced operations, and now seeks your advice from your firm. In particular: your Boss wants to know if the carried forward losses available to reduce the company’s profits made:

- Advise and calculate whether the carried forward losses can be offset against its taxable income for the 30 June 2019 year.

- Discuss whether the company can utilise the carried forward losses to offset its taxable income for the 30 June 2020 year.

Note!! You have to look at each year separately and start with the year that had the oldest losses first (s 36-17(7) ITAA97)

Alice 50 Alice 50 Alice 50 Alice 50 Alice 50 Stella 50 Stella 50 Stella 50 Stella 50 Stella 50 Liz 50 Liz 50 Liz 50 Ben 200 Ben 200 1/7/15 1/7/16 1/7/17 1/7/18 1/7/19 1/7/20 Tour Tour Tour Tour Painting ($60,000) ($50,000) ($30,000) $130,000 $150,000 Or Alice 50 (50%) Alice 50 (50%) Alice 50 (33%) Alice 50 (14%) Alice 50 (14%) Stella 50 (50%) Stella 50 (50%) Stella 50 (33%) Stella 50 (14%) Stella 50 (14%) TOTAL 100 TOTAL 100 Liz 50 (33%) Liz 50 (14%) Liz 50 (14%) TOTAL 150 Ben 200 (57%) Ben 200 (57%) TOTAL 350 TOTAL 350 1/7/15 1/7/16 1/7/17 1/7/18 1/7/19 1/7/20 Tour Tour Tour Tour ainting ($60,000) ($50,000) ($30,000) $130,000 $150,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started