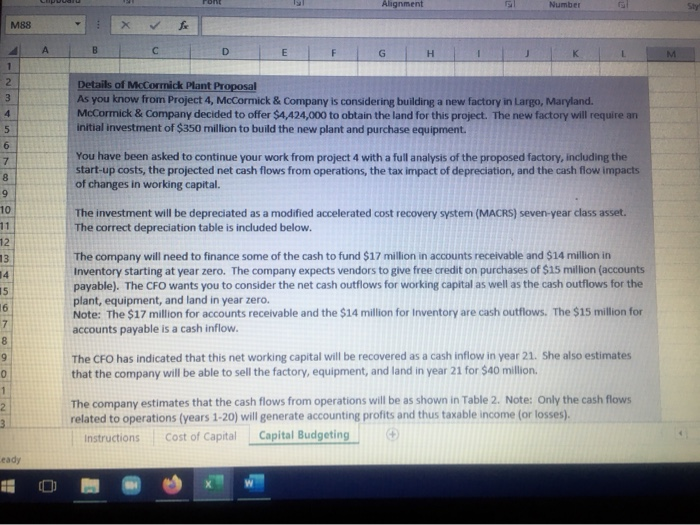

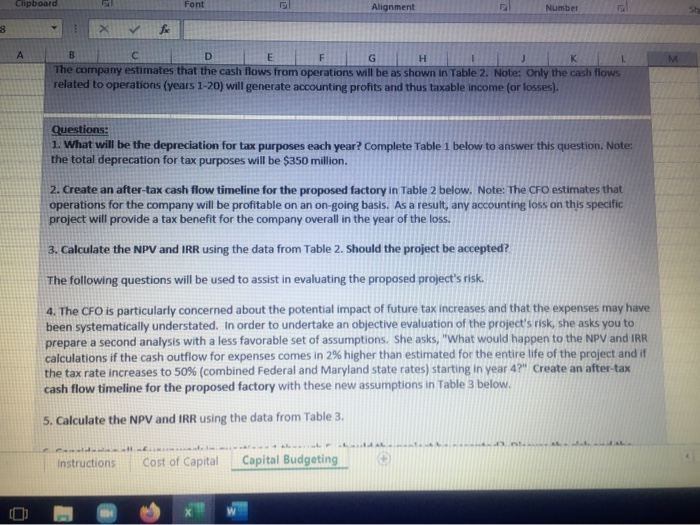

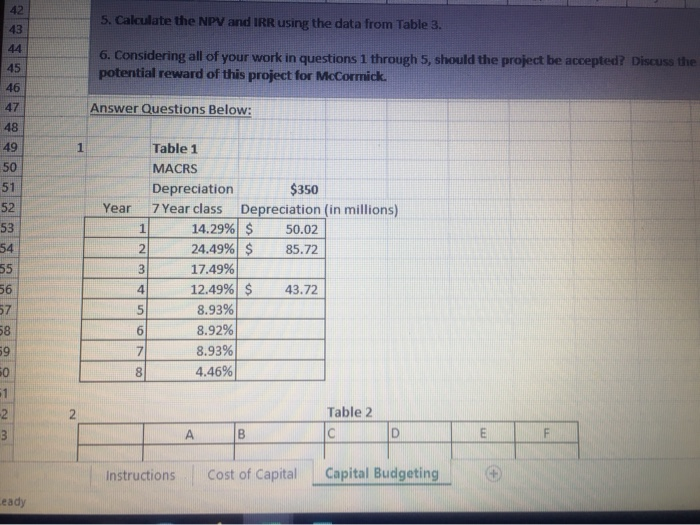

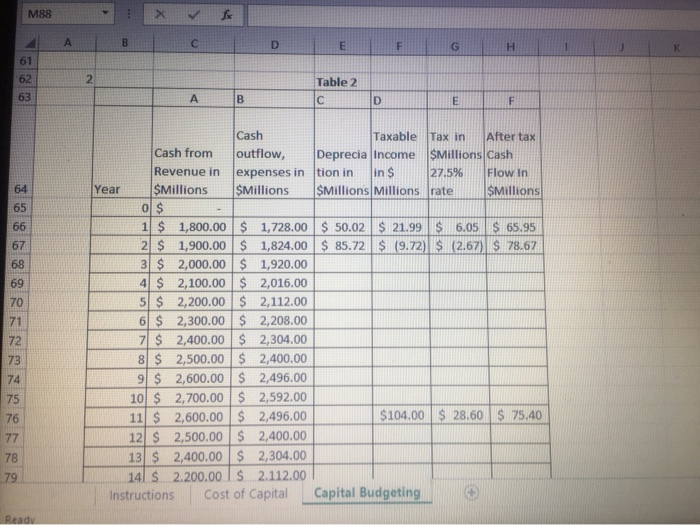

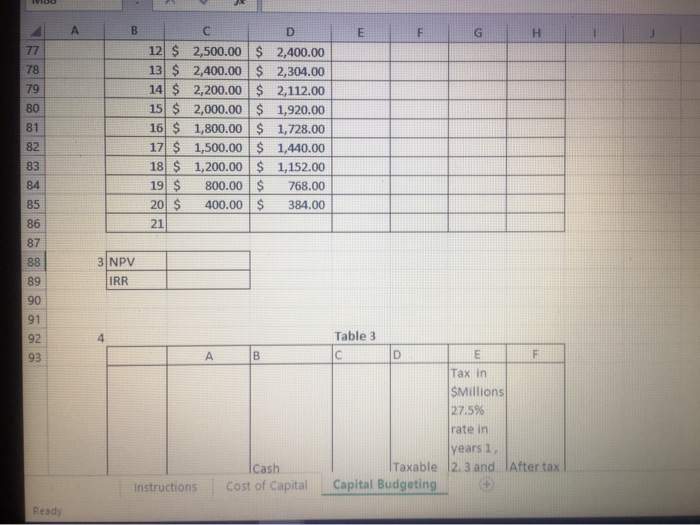

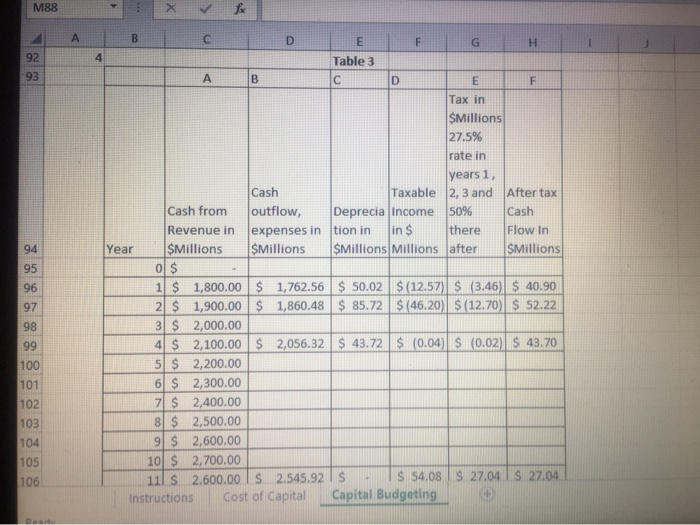

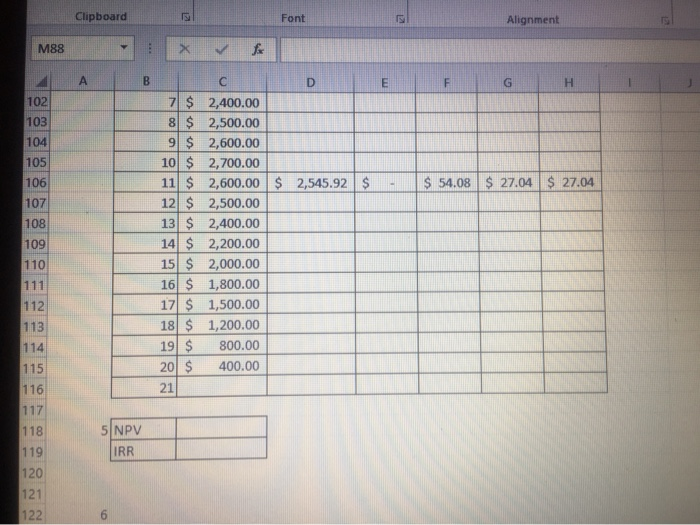

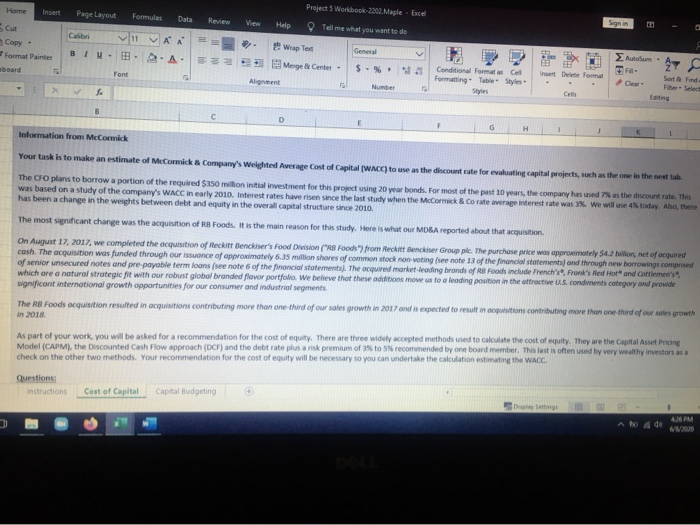

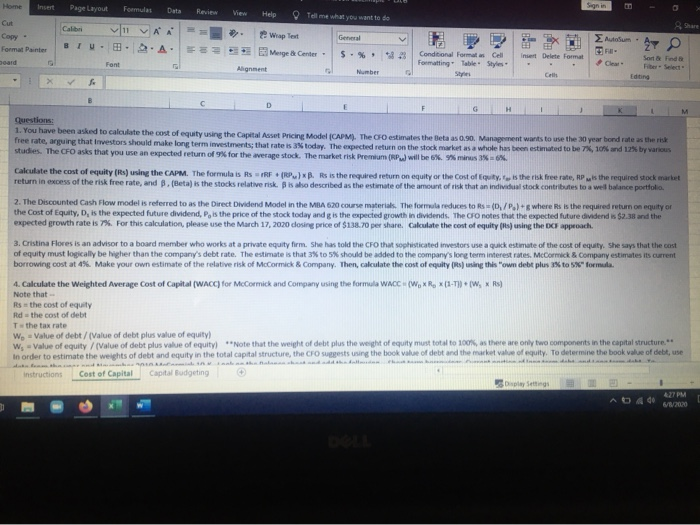

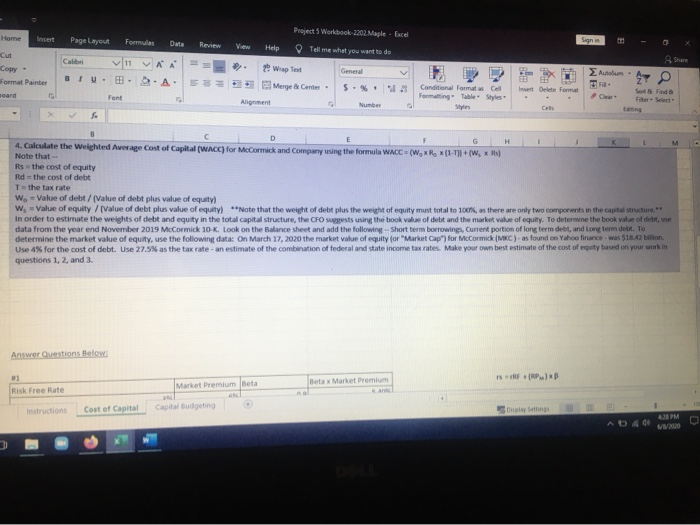

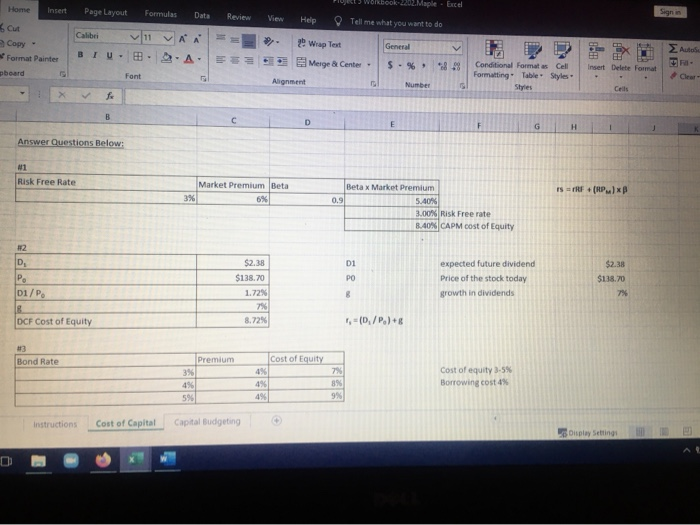

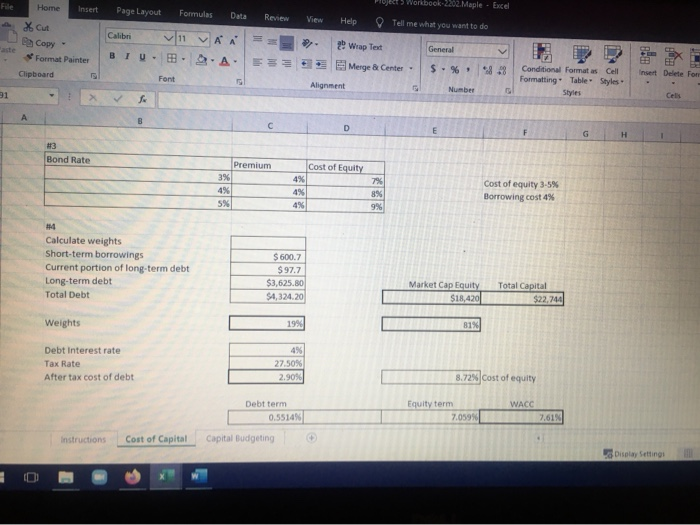

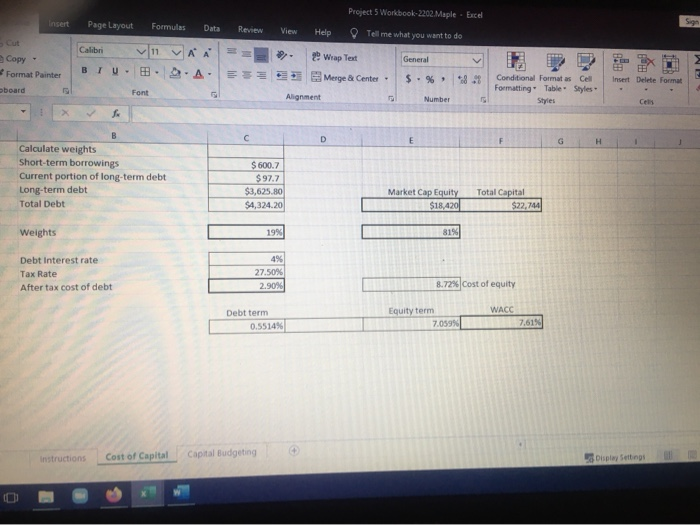

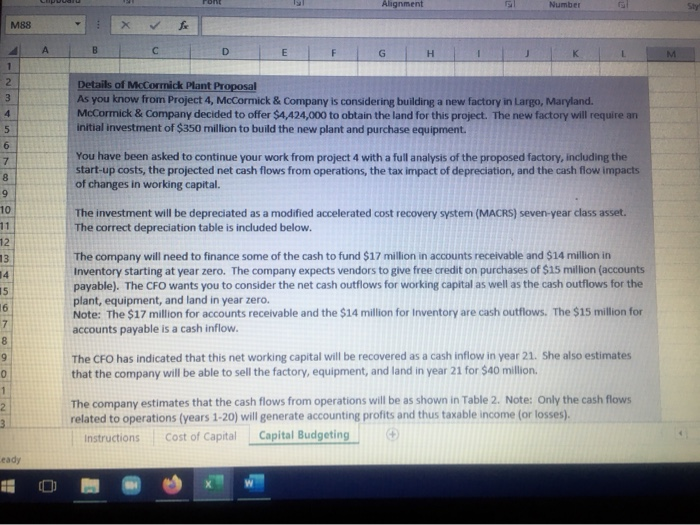

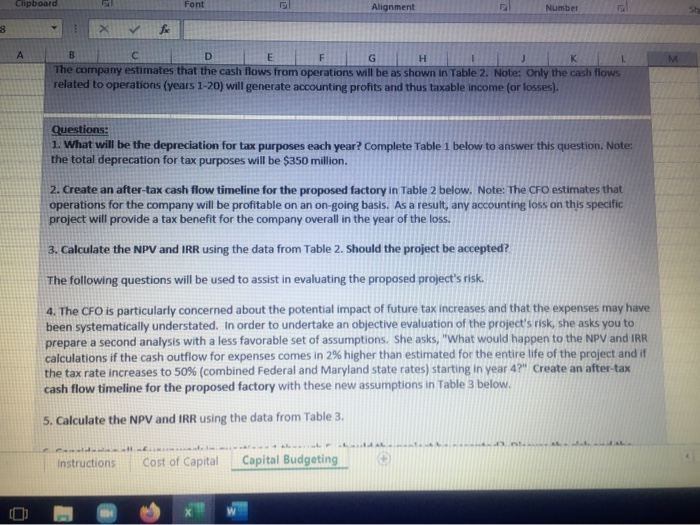

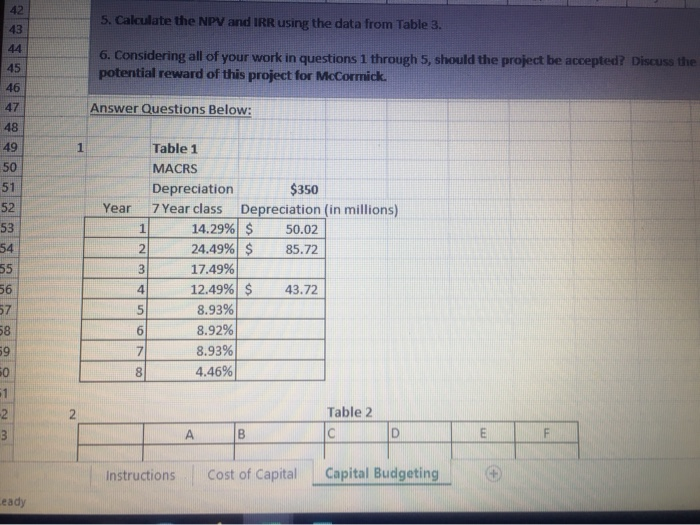

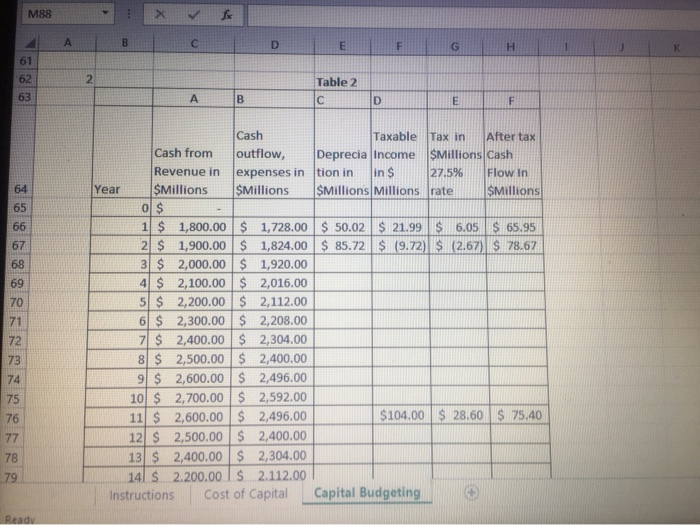

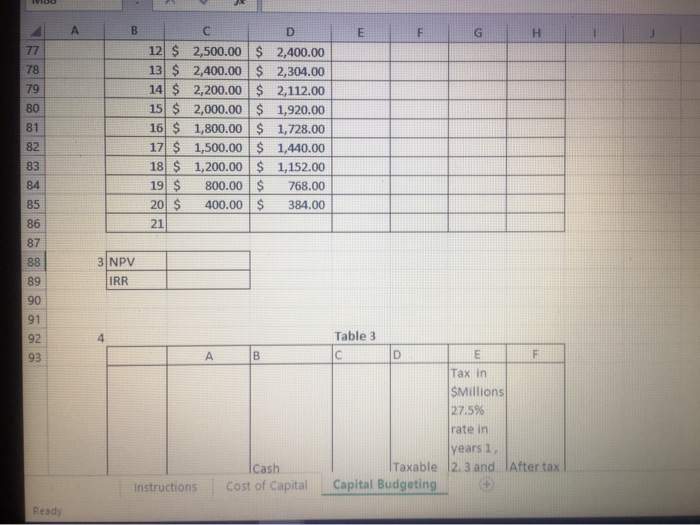

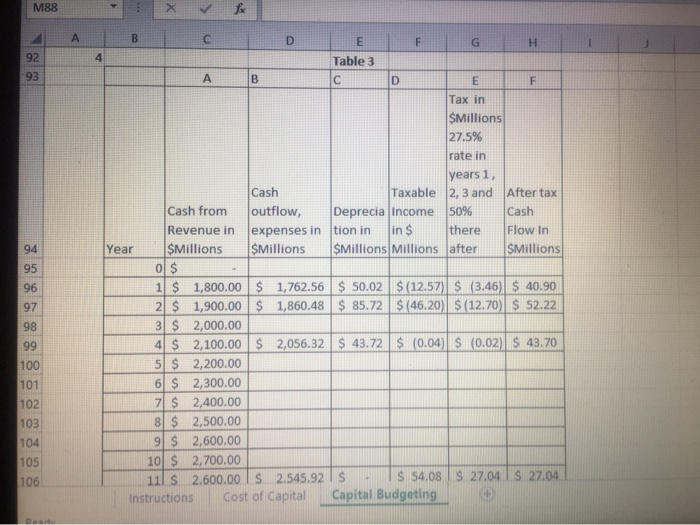

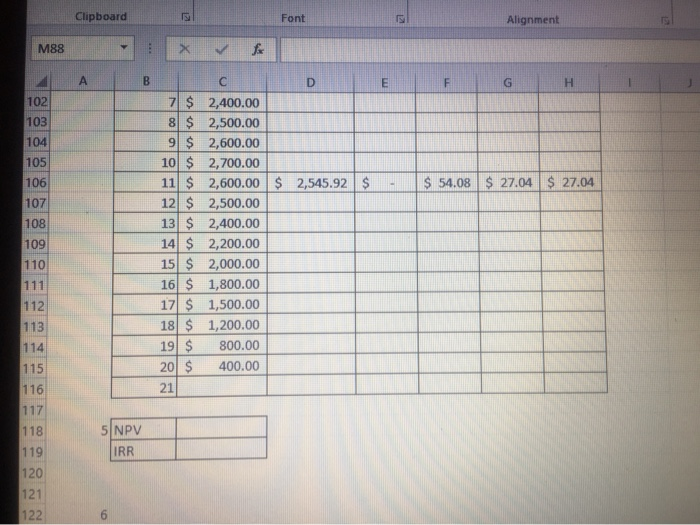

Alignment Number M88 B D G M 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 7 8 9 0 Details of McCormick Plant Proposal As you know from Project 4, McCormick & Company is considering building a new factory in Largo, Maryland. McCormick & Company decided to offer $4,424,000 to obtain the land for this project. The new factory will require an initial investment of $350 million to build the new plant and purchase equipment. You have been asked to continue your work from project 4 with a full analysis of the proposed factory, including the start-up costs, the projected net cash flows from operations, the tax impact of depreciation, and the cash flow impacts of changes in working capital. The investment will be depreciated as a modified accelerated cost recovery syster (MACRS) seven-year class asset. The correct depreciation table is included below. The company will need to finance some of the cash to fund $17 million in accounts receivable and $14 million in Inventory starting at year zero. The company expects vendors to give free credit on purchases of $15 million (accounts payable). The CFO wants you to consider the net cash outflows for working capital as well as the cash outflows for the plant, equipment, and land in year zero. Note: The $17 million for accounts receivable and the $14 million for Inventory are cash outflows. The $15 million for accounts payable is a cash inflow. The CFO has indicated that this net working capital will be recovered as a cash inflow in year 21. She also estimates that the company will be able to sell the factory, equipment, and land in year 21 for $40 million The company estimates that the cash flows from operations will be as shown in Table 2. Note: Only the cash flows related to operations (years 1-20) will generate accounting profits and thus taxable income (or losses). Instructions Cost of Capital Capital Budgeting 1 2 3 eady Clipboard Font Alignment Number 8 > F G H K M B D E The company estimates that the cash flows from operations will be as shown in Table 2. Note: Only the cash flows related to operations (years 1-20) will generate accounting profits and thus taxable income (or losses). Questions: 1. What will be the depreciation for tax purposes each year? Complete Table 1 below to answer this question. Note: the total deprecation for tax purposes will be $350 million. 2. Create an after-tax cash flow timeline for the proposed factory in Table 2 below. Note: The CFO estimates that operations for the company will be profitable on an on-going basis. As a result, any accounting loss on this specific project will provide a tax benefit for the company overall in the year of the loss. 3. Calculate the NPV and IRR using the data from Table 2. Should the project be accepted? The following questions will be used to assist in evaluating the proposed project's risk. 4. The CFO is particularly concerned about the potential impact of future tax increases and that the expenses may have been systematically understated. In order to undertake an objective evaluation of the project's risk, she asks you to prepare a second analysis with a less favorable set of assumptions. She asks, "What would happen to the NPV and IRR calculations if the cash outflow for expenses comes in 2% higher than estimated for the entire life of the project and if the tax rate increases to 50% (combined Federal and Maryland state rates) starting in year 4?" Create an after-tax cash flow timeline for the proposed factory with these new assumptions in Table 3 below. 5. Calculate the NPV and IRR using the data from Table 3. Instructions Cost of Capital Capital Budgeting 5. Calculate the NPV and IRR using the data from Table 3. 42 43 44 45 6. Considering all of your work in questions 1 through 5, should the project be accepted? Discuss the potential reward of this project for McCormick. 46 47 Answer Questions Below: 48 49 1 50 51 52 Year 53 1 2 54 55 56 Table 1 MACRS Depreciation $350 7 Year class Depreciation (in millions) 14.29% $ 50.02 24.49% $ 85.72 17.49% 12.49% $ 43.72 8.93% 8.92% 8.93% 4.46% 3 4 57 58 59 7 50 51 Table 2 3 B D E F Instructions Cost of Capital Capital Budgeting Leady M88 fo B D E F G 61 62 63 2 Table 2 B D E F 64 65 66 67 68 69 70 71 72 73 74 Cash Taxable Tax in After tax Cash from outflow, Deprecia Income Millions Cash Revenue in expenses in tion in in $ 27.5% Flow in Year $Millions SMillions $Millions Millions rate SMillions o$ 1 $ 1,800.00 $ 1,728.00 $ 50.02 $ 21.99 $ 6.05 S 65.95 2 $ 1,900.00 $ 1,824.00 $ 85.72 $ (9.72) $ (2.67) $ 78.67 3 $ 2,000.00 $ 1,920.00 4 $ 2,100.00 $ 2,016.00 5 $ 2,200.00 $ 2,112.00 6 $ 2,300.00 $ 2,208.00 7 $ 2,400.00 $ 2,304.00 8 $ 2,500.00 $ 2,400.00 9 $ 2,600.00 $ 2,496.00 10 $ 2,700.00 $ 2,592.00 11 $2,600.00 $ 2,496.00 $104.00 $ 28.60 $ 75,40 12 $ 2,500.00 $ 2,400.00 13 $ 2,400.00 $ 2,304.00 141 $ 2.200.00 $ 2.112.00 Instructions Cost of Capital Capital Budgeting 75 76 77 78 79 Ready VFORD A B E F 77 78 79 80 81 C D 12 $ 2,500.00 $ 2,400.00 13 $ 2,400.00 $ 2,304.00 14 $ 2,200.00 $ 2,112.00 15 $ 2,000.00 $ 1,920.00 16 $ 1,800.00 $ 1,728.00 17 $ 1,500.00 $ 1,440.00 18 $ 1,200.00 $ 1,152.00 19 $ 800.00 $ 768.00 20 $ 400.00 $ 384.00 21 82 83 84 85 86 87 88 89 90 3 NPV IRR 91 92 93 A B Table 3 D E F Tax in SMillions 27.5% rate in years 1 Taxable 12.3 and After tax Capital Budgeting Cash Cost of Capital Instructions Ready M88 X fax C 92 4 93 94 95 E F G H Table 3 A B D E F Tax in $Millions 27.5% rate in years 1, Cash Taxable 2, 3 and After tax Cash from outflow, Deprecia Income 50% Cash Revenue in expenses in tion in in $ there Flow In Year SMillions SMillions $Millions Millions after SMillions 0 $ 1 $ 1,800.00 $ 1,762.56 $ 50.02 $ (12.57) S (3.46) S 40.90 2 $ 1,900.00 $ 1,860.48 $ 85.72 $ (46.20) $ (12.70) $ 52.22 3 $ 2,000.00 4 $ 2,100.00 $ 2,056.32 $ 43.72 $ (0.04) $ (0.02) $ 43.70 5 $ 2,200.00 6 $ 2,300.00 7 $ 2,400.00 8 $ 2,500.00 9 $ 2,600.00 10 $ 2,700.00 111 $ 2.600.00 LS 2.545.92 IS S 54.08 S 27.04S 27.04 Instructions Cost of Capital Capital Budgeting 96 97 98 99 100 101 102 103 104 105 106 De Clipboard 21 Font Alignment M88 X B E F G H 102 103 104 105 106 107 $ 54.08 $ 27.04 $ 27.04 108 D 7 $ 2,400.00 8 $ 2,500.00 9 $ 2,600.00 10 $ 2,700.00 11 $ 2,600.00 $ 2,545.92 $ 12 $ 2,500.00 13 $ 2,400.00 14 $ 2,200.00 15 $ 2,000.00 16 $ 1,800.00 17 $ 1,500.00 18 $ 1,200.00 19 $ 800.00 20 $ 400.00 21 109 110 111 112 113 114 115 116 117 118 SNPV IRR 119 120 121 122 Projects Workbook 2202. Maple Excel Page Layout Formulas Data Review View Help Sigri Tell me what you want to do Home Insert 5 cur Copy Format Painter board BIU. A. General Whapes Merge Center - F WE Auteum - $. Font Insert Delete Format Alignment Conditional Formatas Cel Formatting Table Styles Styles Sort Find F Number Cells Eating B G Information from McCormick Your task is to make an estimate of McCormick & Company's Weighted Average cost of capital (WACC) to use as the discount rate for evaluating capital projects, such as the one in the next tab. The CFO plans to borrow a portion of the required $350 million initial investment for this project using 20 year bonds. For most of the past 10 years, the company has used as the discount rate. This was based on a study of the company's WACC in early 2010. Interest rates have risen since the last study when the McCormick & Co rate average interest rate was 3%. We will use 4 today. Also, there has been a change in the weights between debt and equity in the overall capital structure since 2010 The most significant change was the acquisition of RB Foods. It is the main reason for this study. Here is what our MOBA reported about that acquisition On August 17, 2017, we completed the acquisition of Reckitt Benckiser's Food Division ("R8 Foods from Reckitt Benckiser Group ple. The purchase price was approximately $4.2 bilion, net of acquired cash. The acquisition was funded through our issuance of approximately 6.35 million shares of common stock non voting see note 13 of the financial statements and through new borrowings compared of senior unsecured notes and pre-payable term loans (see note 6 of the financial statements. The acquired market leading brands of Foods include French's, Ron's Red Hot and Cottlemen's which are a natural strategic fit with our robust global branded flower portfolio We believe that these additions move us to a leading position in the offractive U.S. condiments category and prowide significant international growth opportunities for our consumer and industrial segments The RB Foods acquisition resulted in acquisitions contributing more than one-third of our sales growth in 2017 and is expected to result in acquisitions contributing more than one-third of our sales growth in 2018 As part of your work, you will be asked for a recommendation for the cost of equity. There are three widely accepted methods used to calculate the cost of equity. They are the Capital Asset Pricing Model (CAPM), the Discounted Cash Flow approach (DCF) and the debt rate plus a risk premium of to recommended by one board member. This last is often used by very wealthy investors as check on the other two methods. Your recommendation for the cost of equity will be necessary so you can undertake the calculation estimating the WACC Questions instructions Cost of Capital Capital Budgeting Deng A 4 Insert E Page Layout Formula Data Review View Help Tell me what you want to do Calibri 2 Wrap Text Gel Cut Copy - Format Painter Doard $.% Conditional Formats Cell Formatting Table Styles Insert Delete Format Sort & Find Font Alignment Number > H M B G Questions: 1. You have been asked to calculate the cost of equity using the Capital Asset Pricing Model (CAPM). The estimates the Beta as 0.90. Management wants to use the 30 year bond rate as the risk free rate, arguing that investors should make long term investments that rate is today. The expected return on the stock market as a whole has been estimated to be 7%, 10% and 125 by various studies. The CFO asks that you use an expected return of 9% for the average stock. The market risk Premium (RP) will be minus 30% Calculate the cost of equity (Rs) using the CAPM. The formula is Rs TRF RP.) D. Rs is the required return on equity or the cost of Equity, is the risk free rute, Pis the required stock market return in excess of the risk free rate, and (Beta) is the stocks relative risk. is also described as the estimate of the amount of risk that an individual stock contributes to a well balance portfolio 2. The Discounted Cash Flow model is referred to as the Direct Dividend Model in the MBA 620 course materials. The formula reduces to Rs = (0,/P.) where Rs is the required return on equity or the Cost of Equity, D, is the expected future dividend, P, is the price of the stock today and g is the expected growth in dividends. The CFO notes that the expected future dividend is $2.38 and the expected growth rate is 7%. For this calculation, please use the March 17, 2020 dosing price of $138.70 per share. Calculate the cost of equity (is) using the DF approach 3. Cristina Flores is an advisor to a board member who works at a private equity firm. She has told the CFO that sophisticated investors use a quick estimate of the cost of equity. She says that the cost of equity must logically be higher than the company's debt rate. The estimate is that 3% to 5% should be added to the company's long term interest rates. McCormick & Company estimates its current borrowing cost at 4%. Make your own estimate of the relative risk of McCormick & Company. Then, calculate the cost of equity (Rs) using this own debt plus 3% to 5% formula 4. Calculate the weighted Average cost of Capital (WACC) for McCormick and Company using the formula WACC (W XR, *(1-T)*(W, * Rs) Note that Rss the cost of equity Rd the cost of debt Tthe tax rate W Value of debt / (Value of debt plus value of equity) W, -Value of equity / (Value of debt plus value of equity) Note that the weight of debt plus the weight of equity must total to 100%, as there are only two components in the capital structure. ** In order to estimate the weights of debt and equity in the total capital structure, the CFO suggests using the book value of debt and the market value of equity. To determine the book value of debt, use Instructions Cost of Capital Capital Budgeting Dal Settings 427 PM F Home Insert Page Layout Formulas Projects Workbook 2202 Maple - Excel Tell me what you want to do Data Sign in View Help Calibri Share . General Cut Copy Format Painter card . Auti. BIU. 2 Wrap Test Merge Center O A $. Conditional Formatos C Formatting Table Styles Invert De Format Fort Gear Agent Number Find a Flere teng D E G H 1 M F 4. Calculate the Weighted Average cost of Capital (WACC) for McCormick and Company using the formula WACC = (W x H (1-1)) + (W x ) Note that Rs the cost of equity Rd the cost of debt To the tax rate W. - Value of debt / (Value of debt plus value of equity W. Value of equity / Value of debt plus value of equity) **Note that the weight of debt plus the weight of equity must total to 100%, as there are only two components in the capital structure." In order to estimate the weights of debt and equity in the total capital structure, the CFO suggests using the book value of debt and the market value of equity. To determine the book value of debt, use data from the year end November 2019 McCormick 10K. Look on the Balance sheet and add the following - Short term borrowings, Current portion of long term debt, and long term debt. To determine the market value of equity, use the following data: On March 17, 2020 the market value of equity (or "Market Cap for McCormick ( MC)-as found on Yahoo finance - was $18.42 billion. Use 4% for the cost of debt. Use 27.5% as the tax rate - an estimate of the combination of federal and state income tax rates. Make your own best estimate of the cost of equity based on your work in questions 1, 2, and 3. Answer Questions Below 1. RPP Risk Free Rate Market Premium Beta Beta Market Premium Instructions Cost of Capital Capital Budgeting Settings AD 4 4:25 PM WO Home book 22. Maple - Excel Insert Page Layout Formulas Data Review Sign in View Help Tell me what you want to do Calibri cut Copy - Format Painter AN 26 Wrap Test General Autose BIU.B Meige & Center $ - % *888 Insert Delete Format pboard Font Conditional Formats Cell Formatting Table Styles Styles Alignment Number f B D G 1 Answer Questions Below: 1 Risk Free Rate Market Premium Beta 6% IS F (RP) xp 3% Betax Market Premium 0.9 5.40% 3.006 Risk Free rate 8.40% CAPM cost of Equity D1 12 D. Po 01/P $2.38 $138.70 PO $2.38 $138.70 1.72% 7% expected future dividend Price of the stock today growth in dividends 8 7% DCF Cost of Equity 8.725 1, (0./P.)+8 3 Bond Rate Premium Cost of Equity 4% 3% 4% 59 7% 8% 9% Cost of equity 3-5% Borrowing cost 4% 496 Instructions Cost of Capital Capital Budgeting Display Settings File Home Bets Workbook 22.Maple - Excel Insert Page Layout Formulas Review View Help Tell me what you want to do Calibri Xcut Pa Copy Format Painter VAN 2 Wrap Text General III V BIU- S. A. Merge & Center - $. %. 8.98 EET Insert Delete For Clipboard Font Alignment Conditional Formatas Cell Formatting Table Styles Styles Number 31 B D E F G Bond Rate Premium Cost of Equity 3% 4% 5% 4% 4% 7% 8% 9% Cost of equity 3-5% Borrowing cost 4% Calculate weights Short-term borrowings Current portion of long-term debt Long-term debt Total Debt $ 600.7 $ 97.7 $3,625.80 $4,324.20 Market Cap Equity $18,420 Total Capital $22,744 Weights 19% 81% Debt Interest rate Tax Rate After tax cost of debt 4% 27.50% 2.90% 8.72% cost of equity WACC Debt term 0.5514% Equity term 7.059% 7,61% instructions Cost of Capital Capital Budgeting Display Settings Project 5 Workbook 2202. Maple - Excel Insert Page Layout Formulas Data Review View Help Tell me what you want to do Calibri General M Copy Format Painter BIU- B-A- 9. 2 Wrap Text Merge & Center Alignment $ . % *822 Insert Delete Format board Font Conditional Format as Cell Formatting Table Styles Styles Number C D E H B Calculate weights Short-term borrowings Current portion of long-term debt Long-term debt Total Debt $ 600.7 $ 97.7 $3,625.80 $4,324.20 Market Cap Equity $18,420 Total Capital $22,7441 Weights 19% 81% Debt Interest rate Tax Rate After tax cost of debt 4% 27.50% 2.90% 8.72% Cost of equity WACC Debt term 0.5514% Equity term 7.059% 7.61% instructions Cost of Capital Capital Budgeting Display Settings O Alignment Number M88 B D G M 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 7 8 9 0 Details of McCormick Plant Proposal As you know from Project 4, McCormick & Company is considering building a new factory in Largo, Maryland. McCormick & Company decided to offer $4,424,000 to obtain the land for this project. The new factory will require an initial investment of $350 million to build the new plant and purchase equipment. You have been asked to continue your work from project 4 with a full analysis of the proposed factory, including the start-up costs, the projected net cash flows from operations, the tax impact of depreciation, and the cash flow impacts of changes in working capital. The investment will be depreciated as a modified accelerated cost recovery syster (MACRS) seven-year class asset. The correct depreciation table is included below. The company will need to finance some of the cash to fund $17 million in accounts receivable and $14 million in Inventory starting at year zero. The company expects vendors to give free credit on purchases of $15 million (accounts payable). The CFO wants you to consider the net cash outflows for working capital as well as the cash outflows for the plant, equipment, and land in year zero. Note: The $17 million for accounts receivable and the $14 million for Inventory are cash outflows. The $15 million for accounts payable is a cash inflow. The CFO has indicated that this net working capital will be recovered as a cash inflow in year 21. She also estimates that the company will be able to sell the factory, equipment, and land in year 21 for $40 million The company estimates that the cash flows from operations will be as shown in Table 2. Note: Only the cash flows related to operations (years 1-20) will generate accounting profits and thus taxable income (or losses). Instructions Cost of Capital Capital Budgeting 1 2 3 eady Clipboard Font Alignment Number 8 > F G H K M B D E The company estimates that the cash flows from operations will be as shown in Table 2. Note: Only the cash flows related to operations (years 1-20) will generate accounting profits and thus taxable income (or losses). Questions: 1. What will be the depreciation for tax purposes each year? Complete Table 1 below to answer this question. Note: the total deprecation for tax purposes will be $350 million. 2. Create an after-tax cash flow timeline for the proposed factory in Table 2 below. Note: The CFO estimates that operations for the company will be profitable on an on-going basis. As a result, any accounting loss on this specific project will provide a tax benefit for the company overall in the year of the loss. 3. Calculate the NPV and IRR using the data from Table 2. Should the project be accepted? The following questions will be used to assist in evaluating the proposed project's risk. 4. The CFO is particularly concerned about the potential impact of future tax increases and that the expenses may have been systematically understated. In order to undertake an objective evaluation of the project's risk, she asks you to prepare a second analysis with a less favorable set of assumptions. She asks, "What would happen to the NPV and IRR calculations if the cash outflow for expenses comes in 2% higher than estimated for the entire life of the project and if the tax rate increases to 50% (combined Federal and Maryland state rates) starting in year 4?" Create an after-tax cash flow timeline for the proposed factory with these new assumptions in Table 3 below. 5. Calculate the NPV and IRR using the data from Table 3. Instructions Cost of Capital Capital Budgeting 5. Calculate the NPV and IRR using the data from Table 3. 42 43 44 45 6. Considering all of your work in questions 1 through 5, should the project be accepted? Discuss the potential reward of this project for McCormick. 46 47 Answer Questions Below: 48 49 1 50 51 52 Year 53 1 2 54 55 56 Table 1 MACRS Depreciation $350 7 Year class Depreciation (in millions) 14.29% $ 50.02 24.49% $ 85.72 17.49% 12.49% $ 43.72 8.93% 8.92% 8.93% 4.46% 3 4 57 58 59 7 50 51 Table 2 3 B D E F Instructions Cost of Capital Capital Budgeting Leady M88 fo B D E F G 61 62 63 2 Table 2 B D E F 64 65 66 67 68 69 70 71 72 73 74 Cash Taxable Tax in After tax Cash from outflow, Deprecia Income Millions Cash Revenue in expenses in tion in in $ 27.5% Flow in Year $Millions SMillions $Millions Millions rate SMillions o$ 1 $ 1,800.00 $ 1,728.00 $ 50.02 $ 21.99 $ 6.05 S 65.95 2 $ 1,900.00 $ 1,824.00 $ 85.72 $ (9.72) $ (2.67) $ 78.67 3 $ 2,000.00 $ 1,920.00 4 $ 2,100.00 $ 2,016.00 5 $ 2,200.00 $ 2,112.00 6 $ 2,300.00 $ 2,208.00 7 $ 2,400.00 $ 2,304.00 8 $ 2,500.00 $ 2,400.00 9 $ 2,600.00 $ 2,496.00 10 $ 2,700.00 $ 2,592.00 11 $2,600.00 $ 2,496.00 $104.00 $ 28.60 $ 75,40 12 $ 2,500.00 $ 2,400.00 13 $ 2,400.00 $ 2,304.00 141 $ 2.200.00 $ 2.112.00 Instructions Cost of Capital Capital Budgeting 75 76 77 78 79 Ready VFORD A B E F 77 78 79 80 81 C D 12 $ 2,500.00 $ 2,400.00 13 $ 2,400.00 $ 2,304.00 14 $ 2,200.00 $ 2,112.00 15 $ 2,000.00 $ 1,920.00 16 $ 1,800.00 $ 1,728.00 17 $ 1,500.00 $ 1,440.00 18 $ 1,200.00 $ 1,152.00 19 $ 800.00 $ 768.00 20 $ 400.00 $ 384.00 21 82 83 84 85 86 87 88 89 90 3 NPV IRR 91 92 93 A B Table 3 D E F Tax in SMillions 27.5% rate in years 1 Taxable 12.3 and After tax Capital Budgeting Cash Cost of Capital Instructions Ready M88 X fax C 92 4 93 94 95 E F G H Table 3 A B D E F Tax in $Millions 27.5% rate in years 1, Cash Taxable 2, 3 and After tax Cash from outflow, Deprecia Income 50% Cash Revenue in expenses in tion in in $ there Flow In Year SMillions SMillions $Millions Millions after SMillions 0 $ 1 $ 1,800.00 $ 1,762.56 $ 50.02 $ (12.57) S (3.46) S 40.90 2 $ 1,900.00 $ 1,860.48 $ 85.72 $ (46.20) $ (12.70) $ 52.22 3 $ 2,000.00 4 $ 2,100.00 $ 2,056.32 $ 43.72 $ (0.04) $ (0.02) $ 43.70 5 $ 2,200.00 6 $ 2,300.00 7 $ 2,400.00 8 $ 2,500.00 9 $ 2,600.00 10 $ 2,700.00 111 $ 2.600.00 LS 2.545.92 IS S 54.08 S 27.04S 27.04 Instructions Cost of Capital Capital Budgeting 96 97 98 99 100 101 102 103 104 105 106 De Clipboard 21 Font Alignment M88 X B E F G H 102 103 104 105 106 107 $ 54.08 $ 27.04 $ 27.04 108 D 7 $ 2,400.00 8 $ 2,500.00 9 $ 2,600.00 10 $ 2,700.00 11 $ 2,600.00 $ 2,545.92 $ 12 $ 2,500.00 13 $ 2,400.00 14 $ 2,200.00 15 $ 2,000.00 16 $ 1,800.00 17 $ 1,500.00 18 $ 1,200.00 19 $ 800.00 20 $ 400.00 21 109 110 111 112 113 114 115 116 117 118 SNPV IRR 119 120 121 122 Projects Workbook 2202. Maple Excel Page Layout Formulas Data Review View Help Sigri Tell me what you want to do Home Insert 5 cur Copy Format Painter board BIU. A. General Whapes Merge Center - F WE Auteum - $. Font Insert Delete Format Alignment Conditional Formatas Cel Formatting Table Styles Styles Sort Find F Number Cells Eating B G Information from McCormick Your task is to make an estimate of McCormick & Company's Weighted Average cost of capital (WACC) to use as the discount rate for evaluating capital projects, such as the one in the next tab. The CFO plans to borrow a portion of the required $350 million initial investment for this project using 20 year bonds. For most of the past 10 years, the company has used as the discount rate. This was based on a study of the company's WACC in early 2010. Interest rates have risen since the last study when the McCormick & Co rate average interest rate was 3%. We will use 4 today. Also, there has been a change in the weights between debt and equity in the overall capital structure since 2010 The most significant change was the acquisition of RB Foods. It is the main reason for this study. Here is what our MOBA reported about that acquisition On August 17, 2017, we completed the acquisition of Reckitt Benckiser's Food Division ("R8 Foods from Reckitt Benckiser Group ple. The purchase price was approximately $4.2 bilion, net of acquired cash. The acquisition was funded through our issuance of approximately 6.35 million shares of common stock non voting see note 13 of the financial statements and through new borrowings compared of senior unsecured notes and pre-payable term loans (see note 6 of the financial statements. The acquired market leading brands of Foods include French's, Ron's Red Hot and Cottlemen's which are a natural strategic fit with our robust global branded flower portfolio We believe that these additions move us to a leading position in the offractive U.S. condiments category and prowide significant international growth opportunities for our consumer and industrial segments The RB Foods acquisition resulted in acquisitions contributing more than one-third of our sales growth in 2017 and is expected to result in acquisitions contributing more than one-third of our sales growth in 2018 As part of your work, you will be asked for a recommendation for the cost of equity. There are three widely accepted methods used to calculate the cost of equity. They are the Capital Asset Pricing Model (CAPM), the Discounted Cash Flow approach (DCF) and the debt rate plus a risk premium of to recommended by one board member. This last is often used by very wealthy investors as check on the other two methods. Your recommendation for the cost of equity will be necessary so you can undertake the calculation estimating the WACC Questions instructions Cost of Capital Capital Budgeting Deng A 4 Insert E Page Layout Formula Data Review View Help Tell me what you want to do Calibri 2 Wrap Text Gel Cut Copy - Format Painter Doard $.% Conditional Formats Cell Formatting Table Styles Insert Delete Format Sort & Find Font Alignment Number > H M B G Questions: 1. You have been asked to calculate the cost of equity using the Capital Asset Pricing Model (CAPM). The estimates the Beta as 0.90. Management wants to use the 30 year bond rate as the risk free rate, arguing that investors should make long term investments that rate is today. The expected return on the stock market as a whole has been estimated to be 7%, 10% and 125 by various studies. The CFO asks that you use an expected return of 9% for the average stock. The market risk Premium (RP) will be minus 30% Calculate the cost of equity (Rs) using the CAPM. The formula is Rs TRF RP.) D. Rs is the required return on equity or the cost of Equity, is the risk free rute, Pis the required stock market return in excess of the risk free rate, and (Beta) is the stocks relative risk. is also described as the estimate of the amount of risk that an individual stock contributes to a well balance portfolio 2. The Discounted Cash Flow model is referred to as the Direct Dividend Model in the MBA 620 course materials. The formula reduces to Rs = (0,/P.) where Rs is the required return on equity or the Cost of Equity, D, is the expected future dividend, P, is the price of the stock today and g is the expected growth in dividends. The CFO notes that the expected future dividend is $2.38 and the expected growth rate is 7%. For this calculation, please use the March 17, 2020 dosing price of $138.70 per share. Calculate the cost of equity (is) using the DF approach 3. Cristina Flores is an advisor to a board member who works at a private equity firm. She has told the CFO that sophisticated investors use a quick estimate of the cost of equity. She says that the cost of equity must logically be higher than the company's debt rate. The estimate is that 3% to 5% should be added to the company's long term interest rates. McCormick & Company estimates its current borrowing cost at 4%. Make your own estimate of the relative risk of McCormick & Company. Then, calculate the cost of equity (Rs) using this own debt plus 3% to 5% formula 4. Calculate the weighted Average cost of Capital (WACC) for McCormick and Company using the formula WACC (W XR, *(1-T)*(W, * Rs) Note that Rss the cost of equity Rd the cost of debt Tthe tax rate W Value of debt / (Value of debt plus value of equity) W, -Value of equity / (Value of debt plus value of equity) Note that the weight of debt plus the weight of equity must total to 100%, as there are only two components in the capital structure. ** In order to estimate the weights of debt and equity in the total capital structure, the CFO suggests using the book value of debt and the market value of equity. To determine the book value of debt, use Instructions Cost of Capital Capital Budgeting Dal Settings 427 PM F Home Insert Page Layout Formulas Projects Workbook 2202 Maple - Excel Tell me what you want to do Data Sign in View Help Calibri Share . General Cut Copy Format Painter card . Auti. BIU. 2 Wrap Test Merge Center O A $. Conditional Formatos C Formatting Table Styles Invert De Format Fort Gear Agent Number Find a Flere teng D E G H 1 M F 4. Calculate the Weighted Average cost of Capital (WACC) for McCormick and Company using the formula WACC = (W x H (1-1)) + (W x ) Note that Rs the cost of equity Rd the cost of debt To the tax rate W. - Value of debt / (Value of debt plus value of equity W. Value of equity / Value of debt plus value of equity) **Note that the weight of debt plus the weight of equity must total to 100%, as there are only two components in the capital structure." In order to estimate the weights of debt and equity in the total capital structure, the CFO suggests using the book value of debt and the market value of equity. To determine the book value of debt, use data from the year end November 2019 McCormick 10K. Look on the Balance sheet and add the following - Short term borrowings, Current portion of long term debt, and long term debt. To determine the market value of equity, use the following data: On March 17, 2020 the market value of equity (or "Market Cap for McCormick ( MC)-as found on Yahoo finance - was $18.42 billion. Use 4% for the cost of debt. Use 27.5% as the tax rate - an estimate of the combination of federal and state income tax rates. Make your own best estimate of the cost of equity based on your work in questions 1, 2, and 3. Answer Questions Below 1. RPP Risk Free Rate Market Premium Beta Beta Market Premium Instructions Cost of Capital Capital Budgeting Settings AD 4 4:25 PM WO Home book 22. Maple - Excel Insert Page Layout Formulas Data Review Sign in View Help Tell me what you want to do Calibri cut Copy - Format Painter AN 26 Wrap Test General Autose BIU.B Meige & Center $ - % *888 Insert Delete Format pboard Font Conditional Formats Cell Formatting Table Styles Styles Alignment Number f B D G 1 Answer Questions Below: 1 Risk Free Rate Market Premium Beta 6% IS F (RP) xp 3% Betax Market Premium 0.9 5.40% 3.006 Risk Free rate 8.40% CAPM cost of Equity D1 12 D. Po 01/P $2.38 $138.70 PO $2.38 $138.70 1.72% 7% expected future dividend Price of the stock today growth in dividends 8 7% DCF Cost of Equity 8.725 1, (0./P.)+8 3 Bond Rate Premium Cost of Equity 4% 3% 4% 59 7% 8% 9% Cost of equity 3-5% Borrowing cost 4% 496 Instructions Cost of Capital Capital Budgeting Display Settings File Home Bets Workbook 22.Maple - Excel Insert Page Layout Formulas Review View Help Tell me what you want to do Calibri Xcut Pa Copy Format Painter VAN 2 Wrap Text General III V BIU- S. A. Merge & Center - $. %. 8.98 EET Insert Delete For Clipboard Font Alignment Conditional Formatas Cell Formatting Table Styles Styles Number 31 B D E F G Bond Rate Premium Cost of Equity 3% 4% 5% 4% 4% 7% 8% 9% Cost of equity 3-5% Borrowing cost 4% Calculate weights Short-term borrowings Current portion of long-term debt Long-term debt Total Debt $ 600.7 $ 97.7 $3,625.80 $4,324.20 Market Cap Equity $18,420 Total Capital $22,744 Weights 19% 81% Debt Interest rate Tax Rate After tax cost of debt 4% 27.50% 2.90% 8.72% cost of equity WACC Debt term 0.5514% Equity term 7.059% 7,61% instructions Cost of Capital Capital Budgeting Display Settings Project 5 Workbook 2202. Maple - Excel Insert Page Layout Formulas Data Review View Help Tell me what you want to do Calibri General M Copy Format Painter BIU- B-A- 9. 2 Wrap Text Merge & Center Alignment $ . % *822 Insert Delete Format board Font Conditional Format as Cell Formatting Table Styles Styles Number C D E H B Calculate weights Short-term borrowings Current portion of long-term debt Long-term debt Total Debt $ 600.7 $ 97.7 $3,625.80 $4,324.20 Market Cap Equity $18,420 Total Capital $22,7441 Weights 19% 81% Debt Interest rate Tax Rate After tax cost of debt 4% 27.50% 2.90% 8.72% Cost of equity WACC Debt term 0.5514% Equity term 7.059% 7.61% instructions Cost of Capital Capital Budgeting Display Settings O