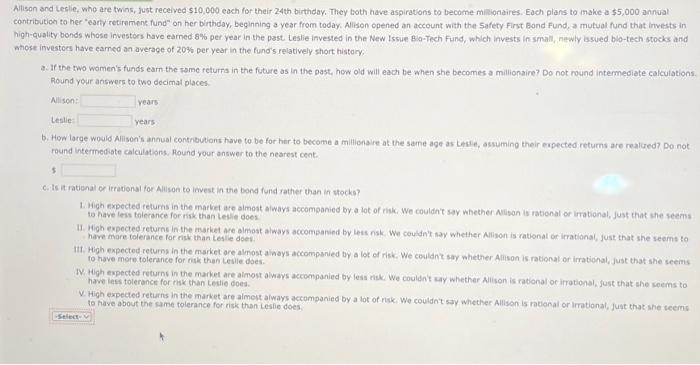

Alisan and Lesle, who are twins, just recelved $10,000 cach for their 24 th birthday. They both have aspirations to become milionaires. Each plans to inake a $5,000 annual contribution to her "earty retirnmens fund" on her birthday, beginning a year from today. Allison opened an account with the Safety First Bond Fund, a mutual fund that invests in high-quality bonds whose investors have earned 8% per year in the past teslie invested in the New Issue Bio-Tech Fund, which invests in small, newly issued blo-tech stocks and whose investors have earned an average of 20% per year in the fund's relatively short history: a. If the two women's funds earn the same returrs in the future as in the past, how old will each be when she becomes a millionaire? Do not round intermeciate calculations. Round your answers to two decimal places. Nilison: vears Leslie years b. How large would Alison's annual controutions have to be for har to become a millionaire at the same age as Leste, assuming their erpected returns are realued? Do not round intermediate calculations, Hound your answer to the nearest cent. 5 c. Is it rational or irrational for Allison to invest in the bond fund rather than in stocks? 1. Wigh expected returns in the market are aimost always accompanied by a lot of riki. We couldn't say whether Nilisan is rational or irrational, just that she seems to have leis tolerance for risk than lesle does 11. Migh expected returns in the market are almost always accompanied by Less nsk. We couldn't say whether Allson is rationat or irrational, Just that she seems to have more tolerance for risk than Lesle dees. III. High expected retums in the market are almost alhays accompanied by a lot of risk. We couldat say whether Alison is rational or irrational, just that she seems. to have more tolerance for risk than Lesile does. IV High expected returns in the market are almost always accompanied by less nik. We couldn' ay whether Alison is rational or irrotional, Just that she seems to have less tolerance for nsk than Ledie does. V. High expected returns in the market are aimest always accompanied by a lot of risk. We couldn't say whether Allison is rational or irrational, Just that she seemis. to have about the same tolerance for risk than leslie does