Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Alison decides to create a new sole proprietorship, Wonder Wilderness Company, or WWC for short. Wonder Wilderness Company is a service-based company that rents

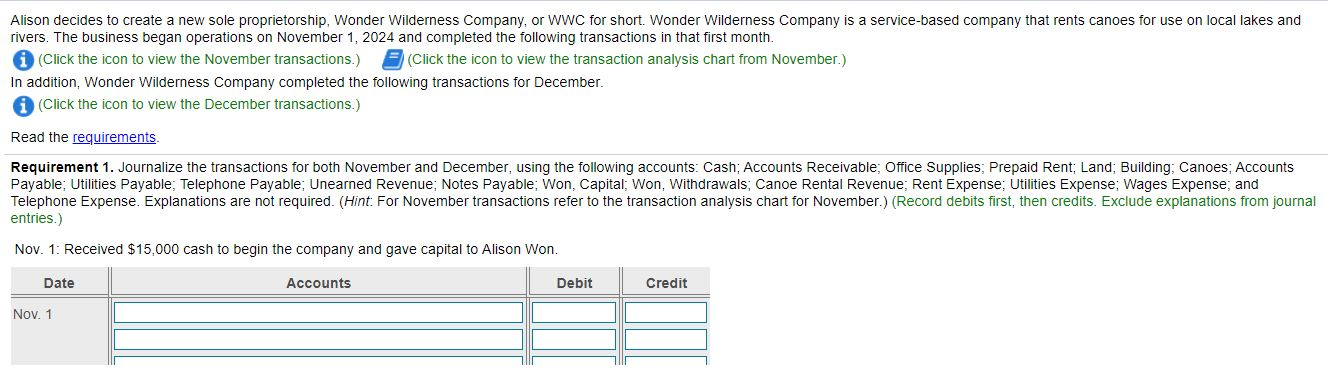

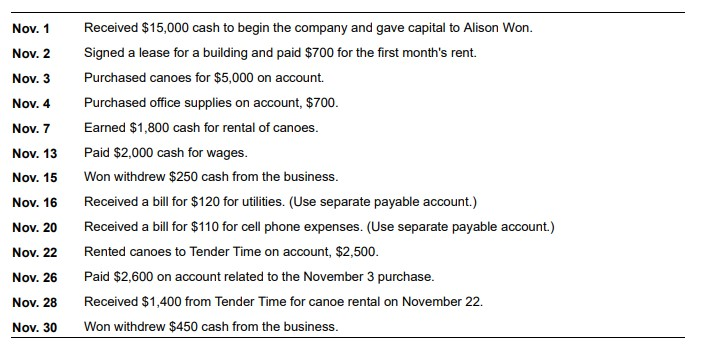

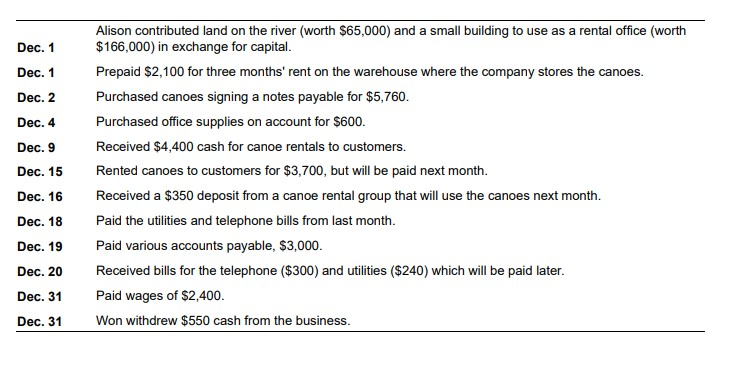

Alison decides to create a new sole proprietorship, Wonder Wilderness Company, or WWC for short. Wonder Wilderness Company is a service-based company that rents canoes for use on local lakes and rivers. The business began operations on November 1, 2024 and completed the following transactions in that first month. i (Click the icon to view the November transactions.) (Click the icon to view the transaction analysis chart from November.) In addition, Wonder Wilderness Company completed the following transactions for December. i (Click the icon to view the December transactions.) Read the requirements. Requirement 1. Journalize the transactions for both November and December, using the following accounts: Cash; Accounts Receivable; Office Supplies; Prepaid Rent; Land; Building; Canoes; Accounts Payable; Utilities Payable; Telephone Payable; Unearned Revenue; Notes Payable; Won, Capital; Won, Withdrawals; Canoe Rental Revenue; Rent Expense; Utilities Expense; Wages Expense; and Telephone Expense. Explanations are not required. (Hint: For November transactions refer to the transaction analysis chart for November.) (Record debits first, then credits. Exclude explanations from journal entries.) Nov. 1: Received $15,000 cash to begin the company and gave capital to Alison Won. Date Accounts Debit Credit Nov. 1 Nov. 1 Nov. 2 Nov. 3 Nov. 4 Nov. 7 Nov. 13 Nov. 15 Nov. 16 Nov. 20 Nov. 22 Nov. 26 Nov. 28 Nov. 30 Received $15,000 cash to begin the company and gave capital to Alison Won. Signed a lease for a building and paid $700 for the first month's rent. Purchased canoes for $5,000 on account. Purchased office supplies on account, $700. Earned $1,800 cash for rental of canoes. Paid $2,000 cash for wages. Won withdrew $250 cash from the business. Received a bill for $120 for utilities. (Use separate payable account.) Received a bill for $110 for cell phone expenses. (Use separate payable account.) Rented canoes to Tender Time on account, $2,500. Paid $2,600 on account related to the November 3 purchase. Received $1,400 from Tender Time for canoe rental on November 22. Won withdrew $450 cash from the business. Dec. 1 Dec. 1 Dec. 2 Dec. 4 Dec. 9 Dec. 15 Dec. 16 Dec. 18 Dec. 19 Dec. 20 Dec. 31 Dec. 31 Alison contributed land on the river (worth $65,000) and a small building to use as a rental office (worth $166,000) in exchange for capital. Prepaid $2,100 for three months' rent on the warehouse where the company stores the canoes. Purchased canoes signing a notes payable for $5,760. Purchased office supplies on account for $600. Received $4,400 cash for canoe rentals to customers. Rented canoes to customers for $3,700, but will be paid next month. Received a $350 deposit from a canoe rental group that will use the canoes next month. Paid the utilities and telephone bills from last month. Paid various accounts payable, $3,000. Received bills for the telephone ($300) and utilities ($240) which will be paid later. Paid wages of $2,400. Won withdrew $550 cash from the business.

Step by Step Solution

★★★★★

3.45 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Wonder Wilderness Company Journal Enteries Date Particulars 1112024 Cash 2112024 Rent Expense Cash R...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started