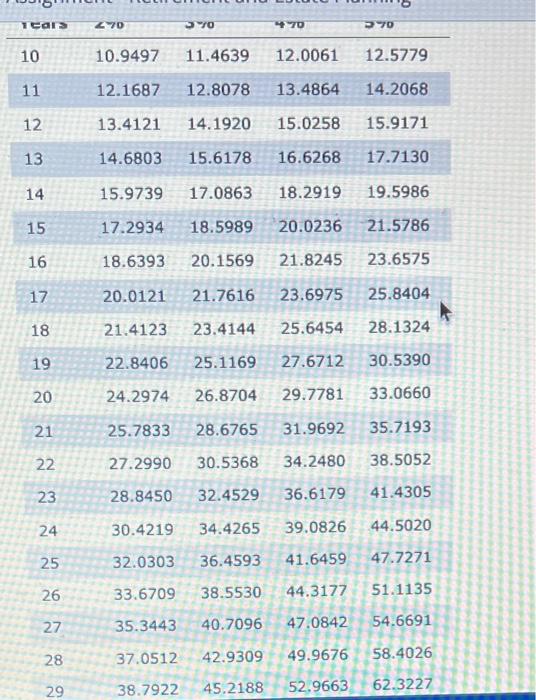

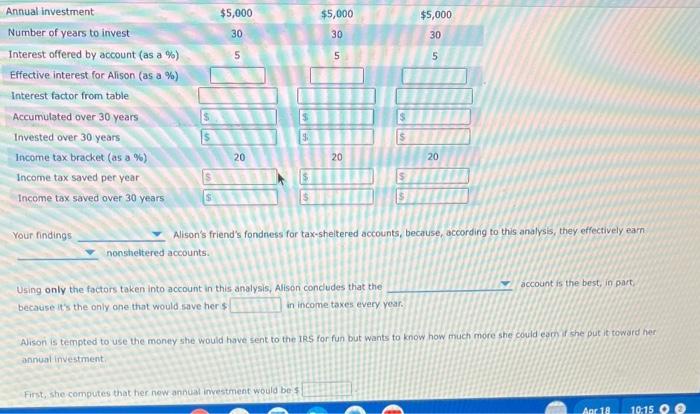

Alison just started leaming about options for saving for her retirement. Her friend is a big fan of tax-sheltered accounts. Why do you suppose that is? Check all that apply. Some withdrawals may be tax-free. Contributions may be tax deductible in the year the contributions are made. Investments are always safer in a tax-sheltered account. Funds can be withdrawn at any time for any reash without penalty or tax payments. Before she commits any money to on account, Alison wants to see bow much her savings would earn using different investment tactics. (For now assume there are no limitations or restrictions on her retiremenk contributions.) she asked you to help and provided the followng information: - Ste pians to invest 5,000 every year for 30 years. - She has found an imestment account that eams 5% per year. - She is in a 20% uncome tax brocket. Your findings Alison's friend's fondruess for tax-sheltered accounts, beciuse, according to this analysis, they effectively eam nonshieltered accounts. Using only the factors taken into account in this analysis, Alisen concudes that the account is the best, in part. because it's the only one that would save her $ in income taxes every year. Alison is tempted to use the money she would have sent to the IRS for fun but wants to know how much more she could eam if she put it toward het annual investment. Alison just started leaming about options for saving for her retirement. Her friend is a big fan of tax-sheltered accounts. Why do you suppose that is? Check all that apply. Some withdrawals may be tax-free. Contributions may be tax deductible in the year the contributions are made. Investments are always safer in a tax-sheltered account. Funds can be withdrawn at any time for any reash without penalty or tax payments. Before she commits any money to on account, Alison wants to see bow much her savings would earn using different investment tactics. (For now assume there are no limitations or restrictions on her retiremenk contributions.) she asked you to help and provided the followng information: - Ste pians to invest 5,000 every year for 30 years. - She has found an imestment account that eams 5% per year. - She is in a 20% uncome tax brocket. Your findings Alison's friend's fondruess for tax-sheltered accounts, beciuse, according to this analysis, they effectively eam nonshieltered accounts. Using only the factors taken into account in this analysis, Alisen concudes that the account is the best, in part. because it's the only one that would save her $ in income taxes every year. Alison is tempted to use the money she would have sent to the IRS for fun but wants to know how much more she could eam if she put it toward het annual investment