Answered step by step

Verified Expert Solution

Question

1 Approved Answer

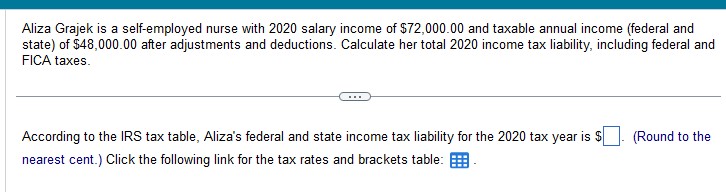

Aliza Grajek is a self-employed nurse with 2020 salary income of $72,000.00 and taxable annual income (federal and state) of $48,000.00 after adjustments and

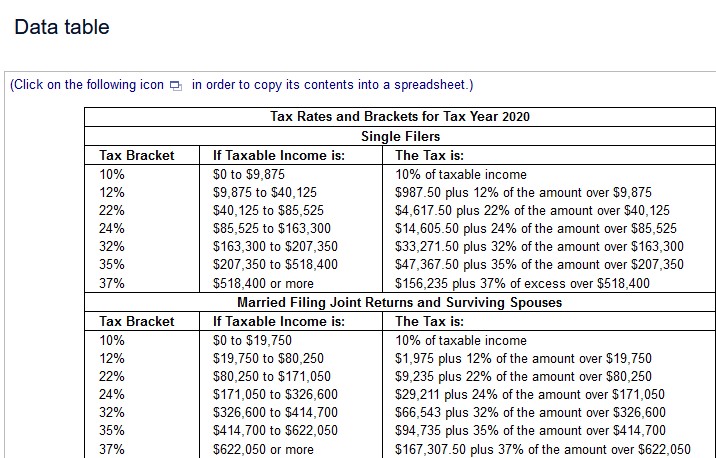

Aliza Grajek is a self-employed nurse with 2020 salary income of $72,000.00 and taxable annual income (federal and state) of $48,000.00 after adjustments and deductions. Calculate her total 2020 income tax liability, including federal and FICA taxes. According to the IRS tax table, Aliza's federal and state income tax liability for the 2020 tax year is $ nearest cent.) Click the following link for the tax rates and brackets table: (Round to the Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Tax Bracket 10% 12% 22% 24% 32% 35% 37% Tax Bracket 10% 12% 22% 24% 32% 35% 37% Tax Rates and Brackets for Tax Year 2020 Single Filers If Taxable Income is: $0 to $9,875 $9,875 to $40,125 $40,125 to $85,525 $85,525 to $163,300 $163,300 to $207,350 $207,350 to $518,400 $518,400 or more The Tax is: 10% of taxable income $987.50 plus 12% of the amount over $9,875 $4,617.50 plus 22% of the amount over $40,125 $14,605.50 plus 24% of the amount over $85,525 $33,271.50 plus 32% of the amount over $163,300 $47,367.50 plus 35% of the amount over $207,350 $156,235 plus 37% of excess over $518,400 Married Filing Joint Returns and Surviving Spouses If Taxable Income is: The Tax is: $0 to $19,750 $19,750 to $80,250 $80,250 to $171,050 $171,050 to $326,600 $326,600 to $414,700 $414,700 to $622,050 $622,050 or more 10% of taxable income $1,975 plus 12% of the amount over $19,750 $9,235 plus 22% of the amount over $80,250 $29,211 plus 24% of the amount over $171,050 $66,543 plus 32% of the amount over $326,600 $94,735 plus 35% of the amount over $414,700 $167,307.50 plus 37% of the amount over $622,050

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Aliza Grajek has a Taxable annual income of 48000 after adjustments and deductions There can be 2 sc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started