Answered step by step

Verified Expert Solution

Question

1 Approved Answer

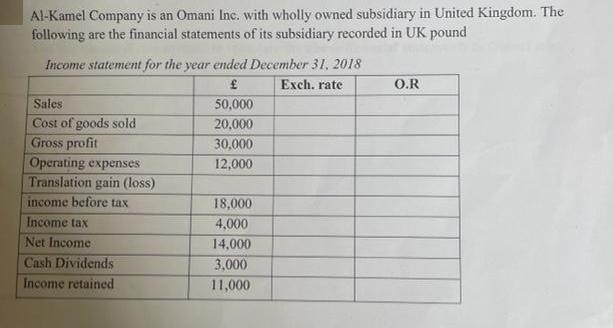

Al-Kamel Company is an Omani Inc. with wholly owned subsidiary in United Kingdom. The following are the financial statements of its subsidiary recorded in

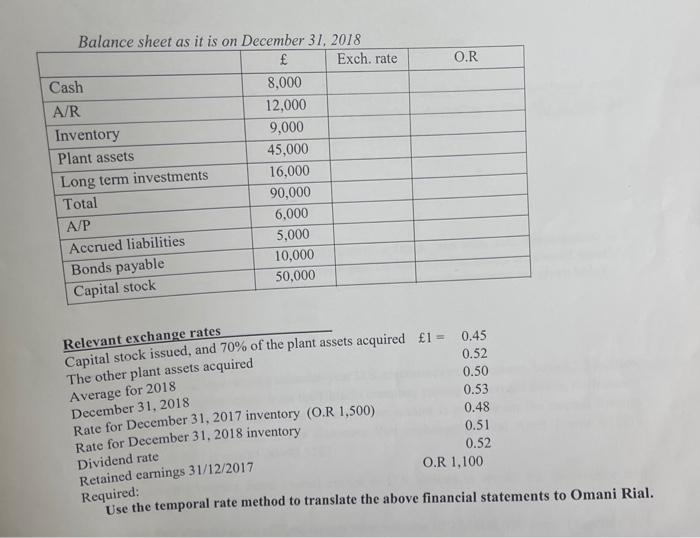

Al-Kamel Company is an Omani Inc. with wholly owned subsidiary in United Kingdom. The following are the financial statements of its subsidiary recorded in UK pound Income statement for the year ended December 31, 2018 Exch. rate 50,000 20,000 30,000 12,000 Sales Cost of goods sold Gross profit Operating expenses Translation gain (loss) income before tax Income tax Net Income Cash Dividends Income retained 18,000 4,000 14,000 3,000 11,000 O.R Balance sheet as it is on December 31, 2018 8,000 12,000 9,000 Cash A/R Inventory Plant assets Long term investments Total A/P Accrued liabilities Bonds payable Capital stock 45,000 16,000 90,000 6,000 5,000 10,000 50,000 Exch. rate Dividend rate Retained earnings 31/12/2017 Relevant exchange rates Capital stock issued, and 70% of the plant assets acquired 1 = 0,45 The other plant assets acquired 0.52 0.50 0.53 0.48 0.51 0.52 Average for 2018 December 31, 2018 Rate for December 31, 2017 inventory (O.R 1,500) Rate for December 31, 2018 inventory O.R O.R 1,100 Required; Use the temporal rate method to translate the above financial statements to Omani Rial.

Step by Step Solution

★★★★★

3.42 Rating (174 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started