Answered step by step

Verified Expert Solution

Question

1 Approved Answer

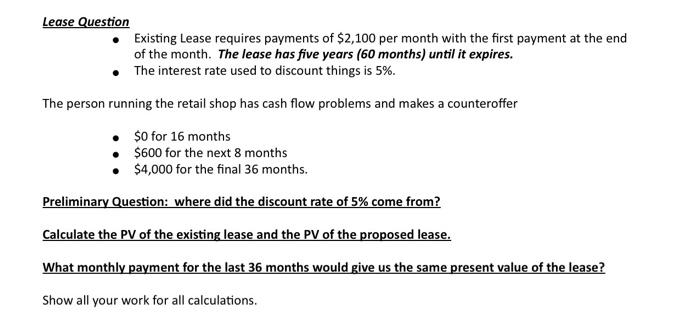

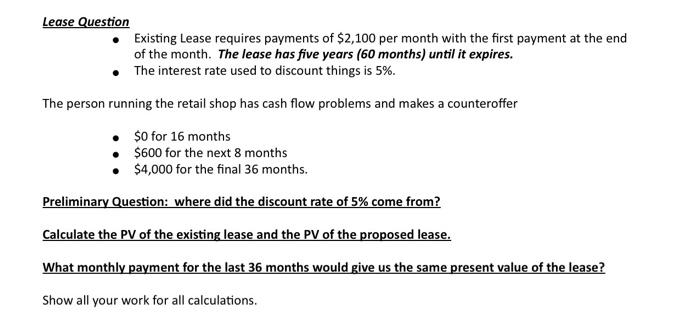

all 3 questions Lease Question - Existing Lease requires payments of $2,100 per month with the first payment at the end of the month. The

all 3 questions

Lease Question - Existing Lease requires payments of $2,100 per month with the first payment at the end of the month. The lease has five years ( 60 months) until it expires. - The interest rate used to discount things is 5%. The person running the retail shop has cash flow problems and makes a counteroffer - \$0 for 16 months - $600 for the next 8 months - \$4,000 for the final 36 months. Preliminary Question: where did the discount rate of 5% come from? Calculate the PV of the existing lease and the PV of the proposed lease. What monthly payment for the last 36 months would give us the same present value of the lease? Show all your work for all calculations. Lease Question - Existing Lease requires payments of $2,100 per month with the first payment at the end of the month. The lease has five years ( 60 months) until it expires. - The interest rate used to discount things is 5%. The person running the retail shop has cash flow problems and makes a counteroffer - \$0 for 16 months - $600 for the next 8 months - \$4,000 for the final 36 months. Preliminary Question: where did the discount rate of 5% come from? Calculate the PV of the existing lease and the PV of the proposed lease. What monthly payment for the last 36 months would give us the same present value of the lease? Show all your work for all calculations

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started