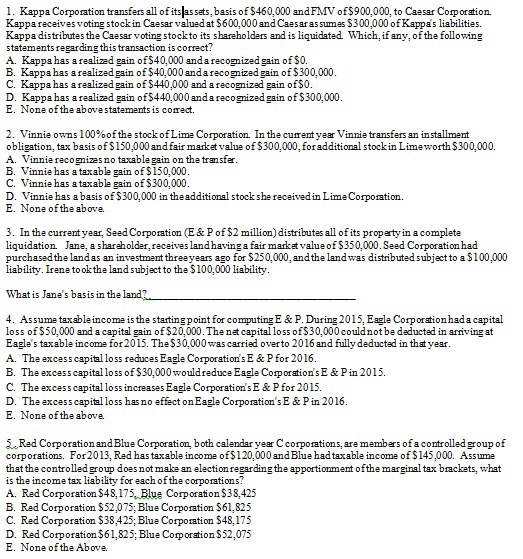

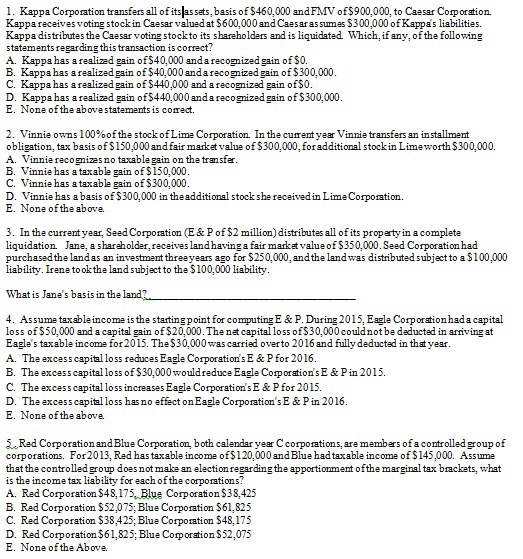

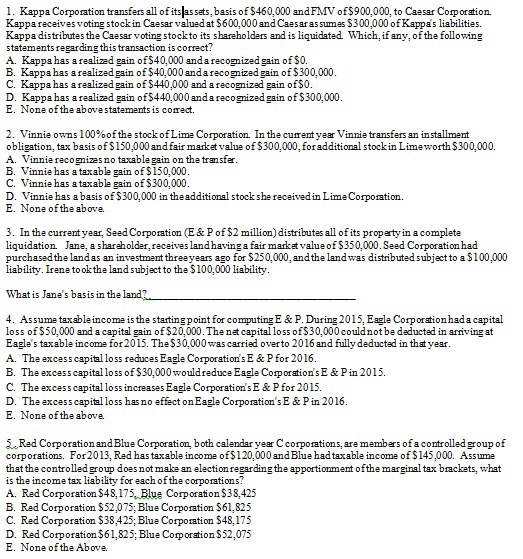

All 5 multiple choice please

Kappa Corporation transfers all of its assets, basis of $460,000 and FMV of $900,000, to Caesar Corporation. Kappa receives voting stock in Caesar valued at $ 600,000 and Caesar assumes $300,000 of Kappa's liabilities. Kappa distributes the Caesar voting stock to its shareholders and is liquidated. Which, if any, of the following statements regarding this transaction is correct? Kappa has a realized gain of $40,000 and a recognized gain of $0. Kappa has a realized gain of $40,000anda recognized gain of $300,000. Kappa has a realized gain of $440,000 and a recognized gain of $0. Kappa has a realized gain of $440,000anda recognized gain of $300,000. None of the above statements is correct. Vinnie owns 100%of the stock of Lime Corporation. In the current year Vinnie transfers an installment obligation, tax basis of $ 150,000 and fair market value of $300,000.for additional stock in Lime worth $300,000. Vinnie recognizes no taxable gain on the transfer. Vinnie has a taxable gain of $150,000. Vinnie has a taxable gain of $300,000. Vinnie has a basis of $300,000 in the additional stock she received in Lime Corporation. None of the above. In the current year. Seed Corporation (E& P of $2 million) distributes all of its property in a complete liquidation. Jane, a shareholder, receives land having a fair market value of $350,000. Seed Corporation had purchased the land as an investment three years ago for $250,000. and the land was distributed subject to a $100,000 liability. Irene took the land subject to the $100,000 liability. What is Jane's basis in the land? _________ Assume taxable income is the starting point for computing E & P. During 2015, Eagle Corporation had a capital loss of $50,000 and a capital gain of $20,000. The net capital loss of $30,000 could not be deducted in arriving at Eagle's taxable income for 2015. The $30,000 was carried over to 2016 and fully deducted in that year. The excess capital loss reduces Eagle Corporation's E & P for 2016. The excess capital loss of $30,000 would reduce Eagle Corporation's E & P in 2015. The excess capital loss increases Eagle Corporation's E & P for 2015. The excess capital loss has no effect on Eagle Corporation's E & P in 2016. None of the above. Red Corporation and Blue Corporation, both calendar year C corporations, are members of a controlled group of corporations. For 2013, Red has taxable income of $ 120,000 and Blue had taxable income of $145,000. Assume that the controlled group does not make an election regarding the apportionment of the marginal tax brackets, what is the income tax liability for each of the corporations? Red Corporation $48, 175, Blue Corporations $38, 425 Red Corporation $52, 075; Blue Corporation $61, 825 Red Corporation $38, .425; Blue Corporation $48, 175 Red Corporations $61, 825: Blue Corporations $52, 075 None of the Above