Question

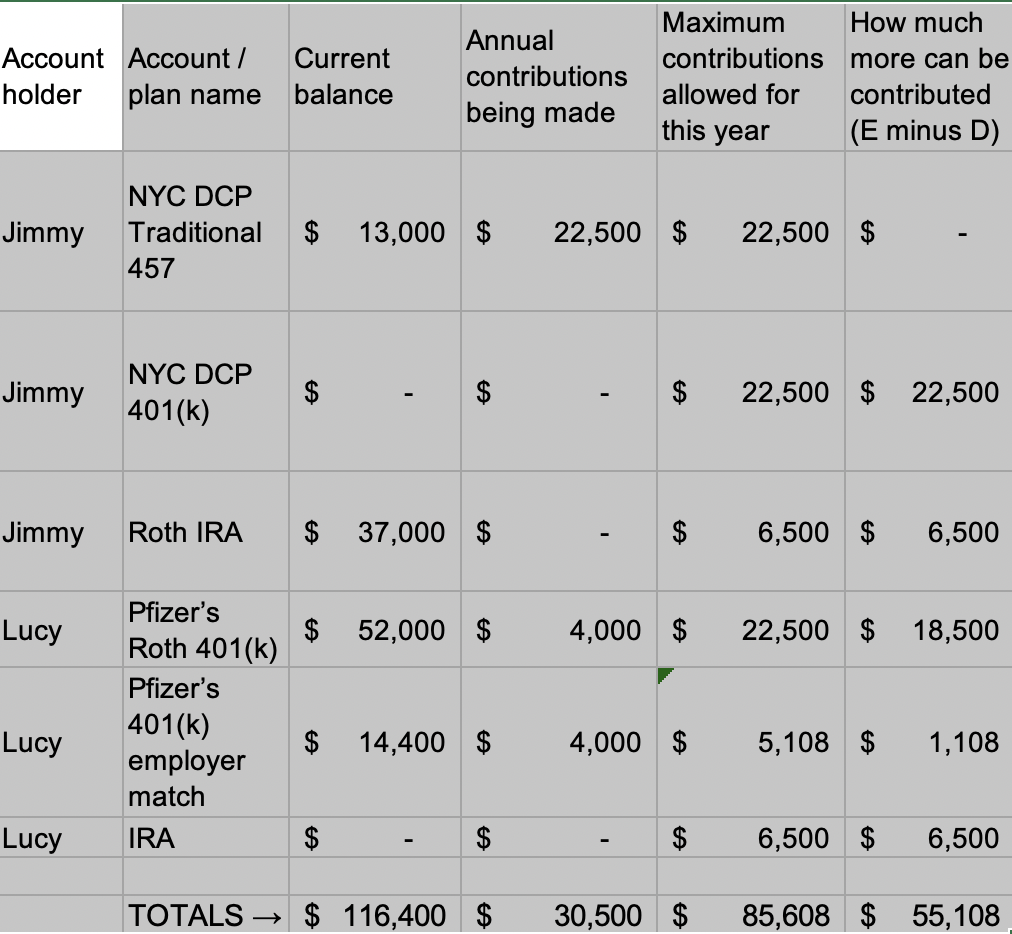

All account contributions are made annually. In retirement, they will need distributions from their investment accounts to come into their bank account monthly. They want

All account contributions are made annually.

In retirement, they will need distributions from their investment accounts to come into their bank account monthly.

They want to count on 4% inflation-adjusted investment return before retirement, and on 3% inflation-adjusted return in retirement. The Ali plan to retire and start receiving their Social Security benefits at the same time, when Jimmy is 67 and Lucy is 62 years old. Their monthly Social Security retirement benefits at those ages in today's dollars are estimated to be $3,200 for Jimmy and $2,000 for Lucy. They think their expenses in retirement in today's dollars will be 70% of their total cash outflows now. Other than Social Security, they will rely on their retirement savings in order to meet their retirement expenses. They want to assume they will die in the same year, when Jimmy is 95 and Lucy is 90 years old.

Investment withdrawals necessary to meet retirement expenses = Total expenses in retirement - Social Security retirement benefits

1. How much are their total monthly expenses in retirement?

2. Determine what the payments will be in the distribution phase. These will be the withdrawals Jimmy and Lucy will need to take monthly from their accounts, in order to meet their retirement expenses. How much is that monthly amount? Note: this question is asking about the withdrawals they will need, not about the expenses they will be incurring monthly.

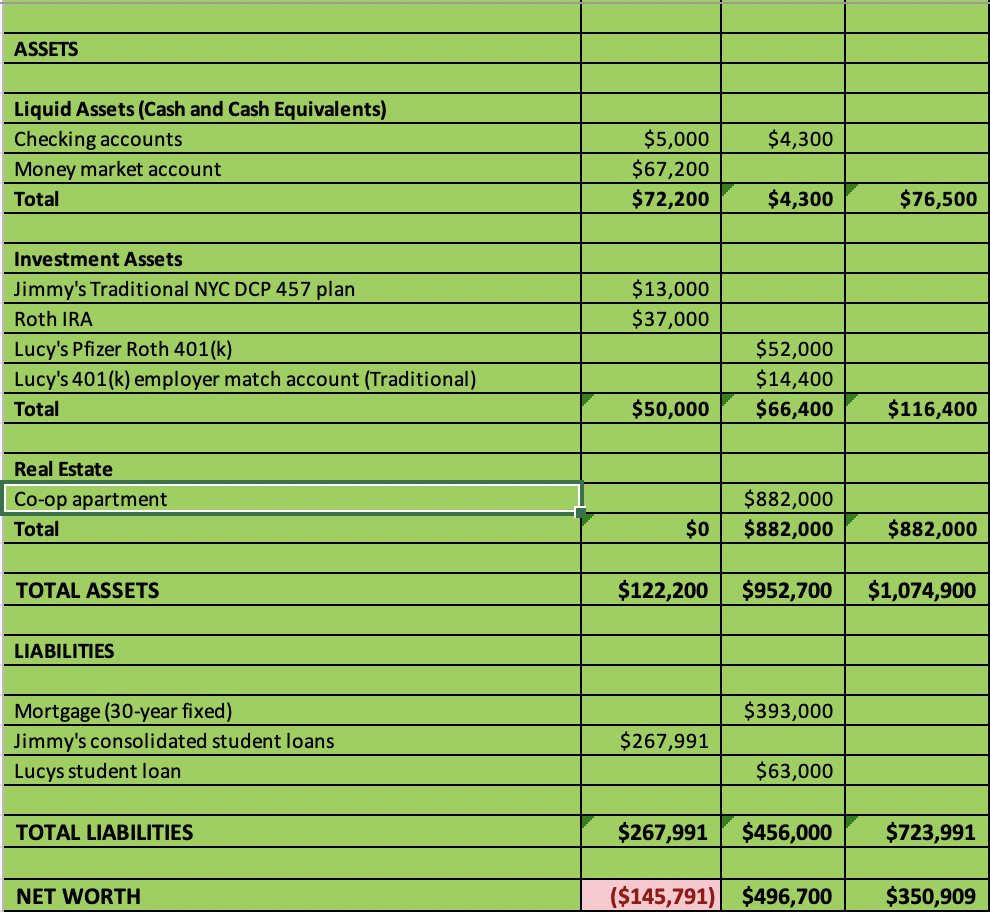

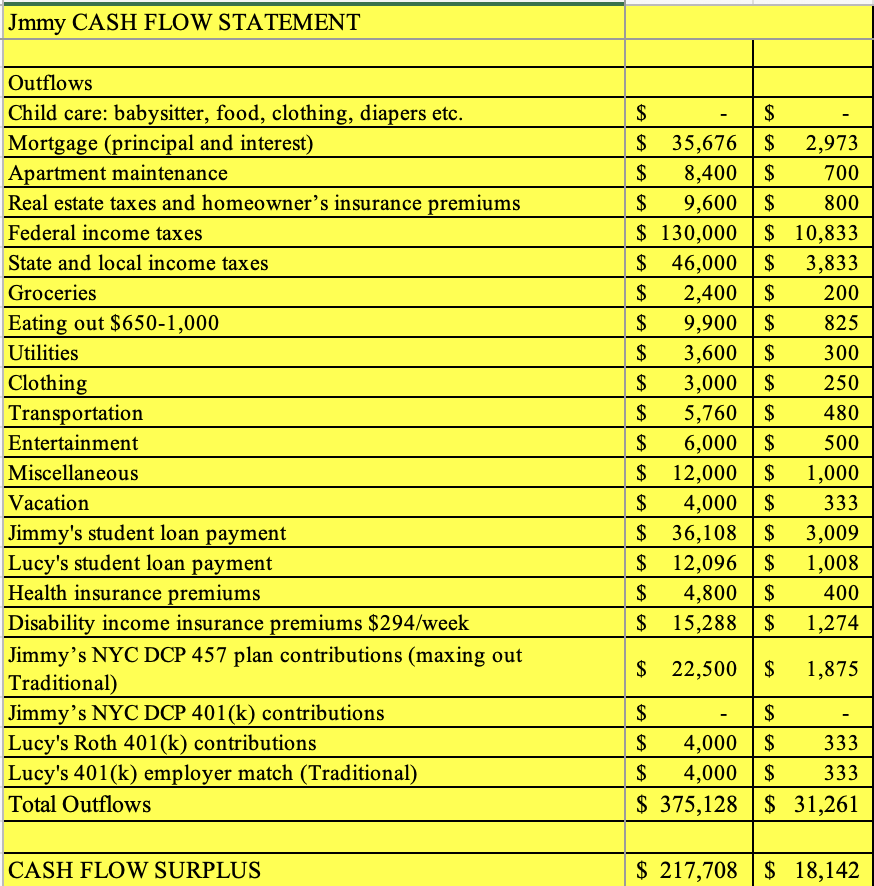

Jmmy CASH FLOW STATEMENT Jmmy CASH FLOW STATEMENT

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started