Question

All Acme Investors is considering the purchase of the undeveloped Baker Tract of land. It is currently zoned for agricultural use. If purchased, however, Acme

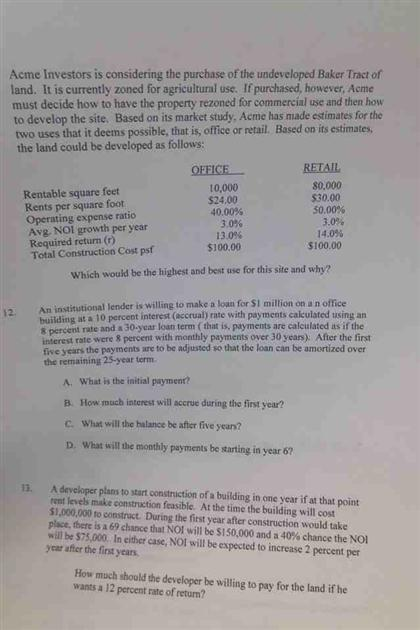

All  Acme Investors is considering the purchase of the undeveloped Baker Tract of land. It is currently zoned for agricultural use. If purchased, however, Acme must decide how to have the property rezoned for commercial use and then how to develop the site. Based on its market study. Acme has made estimates for the two uses that it deems possible, that is, office or retail. Based on its estimates, the land could be developed as follows: which would be the highest and best use for this site and why? An institutional lender is willing to make a loan for $ 1 million on a n office building at a 10 percent interest (accrual) rate with payments calculated using an 8 percent rate and a 30-year loan term (that is, payments are calculated as if the interest rate were 8 percent with monthly payments over 30 years). After the first five years the payments are to be adjusted so that the loan can be amortized over the remaining 25-year term. What is the initial payment? How much interest will accrue during the first year? What will the balance be after five years? What will the monthly payments be starting in year 6? A developer plans to start construction of a building in one year if at that point rent levels make construction feasible. At the time building will cost $1,000,000 to construct. During the first year after construction would take place, there is a 69 chance the NOI will be $150,000 and a 40% chance the NOI will be $75,000. In either case, NOI will be expected to increase 2 percent per year after the first years. How much should the developer be willing to pay for the land if he wants a 12 percent rate of return? Acme Investors is considering the purchase of the undeveloped Baker Tract of land. It is currently zoned for agricultural use. If purchased, however, Acme must decide how to have the property rezoned for commercial use and then how to develop the site. Based on its market study. Acme has made estimates for the two uses that it deems possible, that is, office or retail. Based on its estimates, the land could be developed as follows: which would be the highest and best use for this site and why? An institutional lender is willing to make a loan for $ 1 million on a n office building at a 10 percent interest (accrual) rate with payments calculated using an 8 percent rate and a 30-year loan term (that is, payments are calculated as if the interest rate were 8 percent with monthly payments over 30 years). After the first five years the payments are to be adjusted so that the loan can be amortized over the remaining 25-year term. What is the initial payment? How much interest will accrue during the first year? What will the balance be after five years? What will the monthly payments be starting in year 6? A developer plans to start construction of a building in one year if at that point rent levels make construction feasible. At the time building will cost $1,000,000 to construct. During the first year after construction would take place, there is a 69 chance the NOI will be $150,000 and a 40% chance the NOI will be $75,000. In either case, NOI will be expected to increase 2 percent per year after the first years. How much should the developer be willing to pay for the land if he wants a 12 percent rate of return

Acme Investors is considering the purchase of the undeveloped Baker Tract of land. It is currently zoned for agricultural use. If purchased, however, Acme must decide how to have the property rezoned for commercial use and then how to develop the site. Based on its market study. Acme has made estimates for the two uses that it deems possible, that is, office or retail. Based on its estimates, the land could be developed as follows: which would be the highest and best use for this site and why? An institutional lender is willing to make a loan for $ 1 million on a n office building at a 10 percent interest (accrual) rate with payments calculated using an 8 percent rate and a 30-year loan term (that is, payments are calculated as if the interest rate were 8 percent with monthly payments over 30 years). After the first five years the payments are to be adjusted so that the loan can be amortized over the remaining 25-year term. What is the initial payment? How much interest will accrue during the first year? What will the balance be after five years? What will the monthly payments be starting in year 6? A developer plans to start construction of a building in one year if at that point rent levels make construction feasible. At the time building will cost $1,000,000 to construct. During the first year after construction would take place, there is a 69 chance the NOI will be $150,000 and a 40% chance the NOI will be $75,000. In either case, NOI will be expected to increase 2 percent per year after the first years. How much should the developer be willing to pay for the land if he wants a 12 percent rate of return? Acme Investors is considering the purchase of the undeveloped Baker Tract of land. It is currently zoned for agricultural use. If purchased, however, Acme must decide how to have the property rezoned for commercial use and then how to develop the site. Based on its market study. Acme has made estimates for the two uses that it deems possible, that is, office or retail. Based on its estimates, the land could be developed as follows: which would be the highest and best use for this site and why? An institutional lender is willing to make a loan for $ 1 million on a n office building at a 10 percent interest (accrual) rate with payments calculated using an 8 percent rate and a 30-year loan term (that is, payments are calculated as if the interest rate were 8 percent with monthly payments over 30 years). After the first five years the payments are to be adjusted so that the loan can be amortized over the remaining 25-year term. What is the initial payment? How much interest will accrue during the first year? What will the balance be after five years? What will the monthly payments be starting in year 6? A developer plans to start construction of a building in one year if at that point rent levels make construction feasible. At the time building will cost $1,000,000 to construct. During the first year after construction would take place, there is a 69 chance the NOI will be $150,000 and a 40% chance the NOI will be $75,000. In either case, NOI will be expected to increase 2 percent per year after the first years. How much should the developer be willing to pay for the land if he wants a 12 percent rate of return

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started