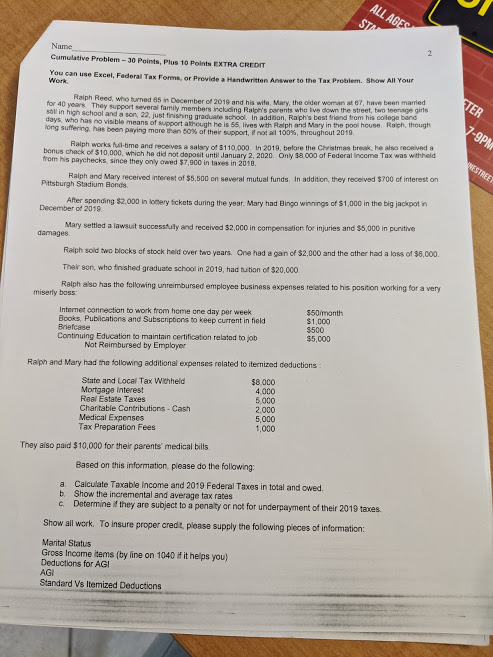

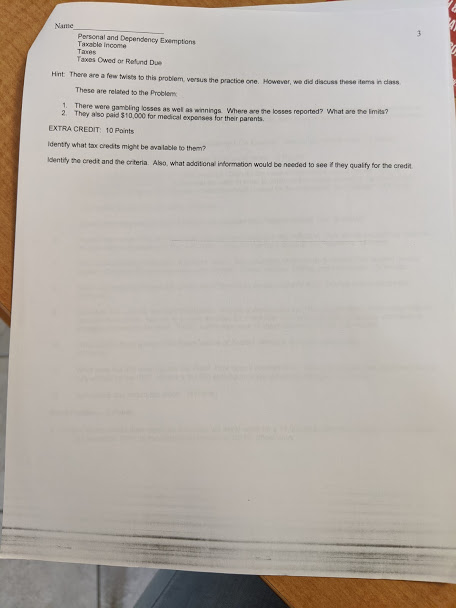

ALL AGES ST Cumulative Problem - 30 Pins Plus 10 Point EXTRA CREDIT You can use Excel, Federal Tax Forme or provide a Handwritten Answer to the Tax Problem. Show All Your Ralph Reed, who turned 65 in December of 2019 and his wife, Mary, the older woman at 67, have been married for 40 years. They support several family members including Ralph's parents who es including Rash's nits while down the street, tw o girls soll in high school and a son 22, just finishing graduate school in addition, Rach's best friend from his college band days, who has no visible means of support although he is lives with Ralph and Mary in the pool house. Raich, though long suffering has been paying more than 50% of their port, not all 100%, throughout 2010 Ralph works Multime and receives a salary of $110.000 in 2010 before the Christmas tre e received a bonus check of $10,000, which he did not deposit until January 2, 2020. Only $8.000 of Federal income Tax was withheld from his paychecks. since they only owed $7,500 in taxes in 2018 Ralph and Mary received interest of $5,500 on several mutual funds. In addition, they received $700 of interest on Pittsburgh Stadium Bonde After spending $2,000 in fery tickets during the year, Mary had Bingo winings of $1,000 in the big jackpot in December of 2019 STRE Mary settled a lawsuit successfully and received 52.000 in compensation for injuries and 55.000 in punitive damages Ralph sold two blocks of stock held over two years. One had aan of $2.000 and the other had a loss of $8,000 Their son, who finished graduate school in 2019, had tuition of $20,000 Ralph also has the following unreimbursed employee business expenses related to his position working for a very miserty boss Internet connection to work from home one day per week $month Books Publications and Subscrpoons to keep current in field $1.000 Briefcase 5500 Continuing Education to maintain certification related to job Not Reimbursed by Employer $5.000 Ralph and Mary had the following additional expenses related to ternized deductions State and Local Tax Withheld 58.000 Mortgage interest 400O Real Estate Taxes 5.000 Charitable Contributions - Cash 2000 Medical Expenses 5.000 Tax Preparation Fees 1,000 They also paid $10,000 for their parents' medical bills. Based on this information, please do the following: a Calculate Taxable income and 2019 Federal Taxes in total and owed. b Show the incremental and average tax rates c. Determine if they are subject to a penalty or not for underpayment of their 2019 taxes Show all work. To insure proper credit, please supply the following pieces of information: Marital Status Gross Income items (by line on 1040 if it helps you) Deductions for AGI Standard Vs Itemized Deductions Personal and Dependency Emptions Taxable income Taxes Owed or Refund Due Hint There are a few twists to this problem, versus the practice one. However, we de sote practice one. However, we did discuss the These are related to the Problem m e in das 1. There were gambling losses as well as winnings Where are the bases reported? What are the limits? 2. They also paid $10,000 for medical expenses for their parents EXTRA CREDIT 10 Points identify what tax credits might be avalable to them? Identify the credt and the arteria. Also, what additional information would be needed to see they qualify for the credit ALL AGES ST Cumulative Problem - 30 Pins Plus 10 Point EXTRA CREDIT You can use Excel, Federal Tax Forme or provide a Handwritten Answer to the Tax Problem. Show All Your Ralph Reed, who turned 65 in December of 2019 and his wife, Mary, the older woman at 67, have been married for 40 years. They support several family members including Ralph's parents who es including Rash's nits while down the street, tw o girls soll in high school and a son 22, just finishing graduate school in addition, Rach's best friend from his college band days, who has no visible means of support although he is lives with Ralph and Mary in the pool house. Raich, though long suffering has been paying more than 50% of their port, not all 100%, throughout 2010 Ralph works Multime and receives a salary of $110.000 in 2010 before the Christmas tre e received a bonus check of $10,000, which he did not deposit until January 2, 2020. Only $8.000 of Federal income Tax was withheld from his paychecks. since they only owed $7,500 in taxes in 2018 Ralph and Mary received interest of $5,500 on several mutual funds. In addition, they received $700 of interest on Pittsburgh Stadium Bonde After spending $2,000 in fery tickets during the year, Mary had Bingo winings of $1,000 in the big jackpot in December of 2019 STRE Mary settled a lawsuit successfully and received 52.000 in compensation for injuries and 55.000 in punitive damages Ralph sold two blocks of stock held over two years. One had aan of $2.000 and the other had a loss of $8,000 Their son, who finished graduate school in 2019, had tuition of $20,000 Ralph also has the following unreimbursed employee business expenses related to his position working for a very miserty boss Internet connection to work from home one day per week $month Books Publications and Subscrpoons to keep current in field $1.000 Briefcase 5500 Continuing Education to maintain certification related to job Not Reimbursed by Employer $5.000 Ralph and Mary had the following additional expenses related to ternized deductions State and Local Tax Withheld 58.000 Mortgage interest 400O Real Estate Taxes 5.000 Charitable Contributions - Cash 2000 Medical Expenses 5.000 Tax Preparation Fees 1,000 They also paid $10,000 for their parents' medical bills. Based on this information, please do the following: a Calculate Taxable income and 2019 Federal Taxes in total and owed. b Show the incremental and average tax rates c. Determine if they are subject to a penalty or not for underpayment of their 2019 taxes Show all work. To insure proper credit, please supply the following pieces of information: Marital Status Gross Income items (by line on 1040 if it helps you) Deductions for AGI Standard Vs Itemized Deductions Personal and Dependency Emptions Taxable income Taxes Owed or Refund Due Hint There are a few twists to this problem, versus the practice one. However, we de sote practice one. However, we did discuss the These are related to the Problem m e in das 1. There were gambling losses as well as winnings Where are the bases reported? What are the limits? 2. They also paid $10,000 for medical expenses for their parents EXTRA CREDIT 10 Points identify what tax credits might be avalable to them? Identify the credt and the arteria. Also, what additional information would be needed to see they qualify for the credit