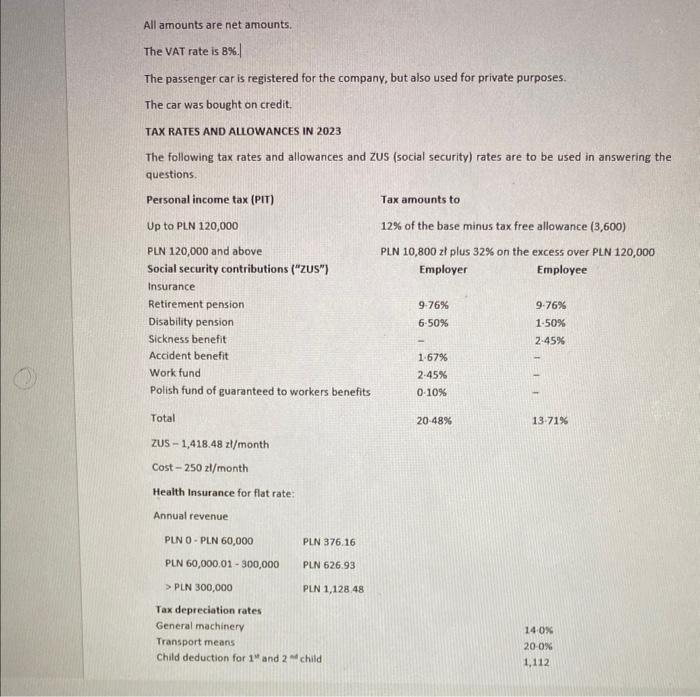

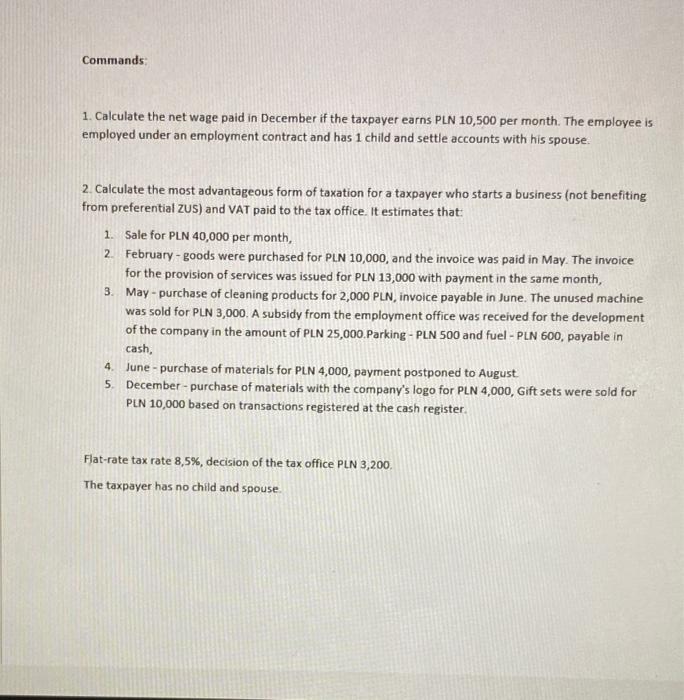

All amounts are net amounts. The VAT rate is B%. The passenger car is registered for the company, but also used for private purposes. The car was bought on credit. TAX RATES AND ALIOWANCES IN 2023 The following tax rates and allowances and ZUS (social security) rates are to be used in answering the questions. 1. Calculate the net wage paid in December if the taxpayer earns PLN 10,500 per month. The employee is employed under an employment contract and has 1 child and settle accounts with his spouse. 2. Calculate the most advantageous form of taxation for a taxpayer who starts a business (not benefiting from preferential zUS) and VAT paid to the tax office. It estimates that: 1. Sale for PLN 40,000 per month, 2. February - goods were purchased for PLN 10,000 , and the invoice was paid in May. The invoice for the provision of services was issued for PLN 13,000 with payment in the same month, 3. May - purchase of cleaning products for 2,000PLN, invoice payable in June. The unused machine was sold for PLN 3,000. A subsidy from the employment office was received for the development of the company in the amount of PLN 25,000.Parking - PLN 500 and fuel - PLN 600, payable in cash, 4. June - purchase of materials for PLN 4,000, payment postponed to August: 5. December - purchase of materials with the company's logo for PLN 4,000 , Gift sets were sold for PLN 10,000 based on transactions registered at the cash register. All amounts are net amounts. The VAT rate is B%. The passenger car is registered for the company, but also used for private purposes. The car was bought on credit. TAX RATES AND ALIOWANCES IN 2023 The following tax rates and allowances and ZUS (social security) rates are to be used in answering the questions. 1. Calculate the net wage paid in December if the taxpayer earns PLN 10,500 per month. The employee is employed under an employment contract and has 1 child and settle accounts with his spouse. 2. Calculate the most advantageous form of taxation for a taxpayer who starts a business (not benefiting from preferential zUS) and VAT paid to the tax office. It estimates that: 1. Sale for PLN 40,000 per month, 2. February - goods were purchased for PLN 10,000 , and the invoice was paid in May. The invoice for the provision of services was issued for PLN 13,000 with payment in the same month, 3. May - purchase of cleaning products for 2,000PLN, invoice payable in June. The unused machine was sold for PLN 3,000. A subsidy from the employment office was received for the development of the company in the amount of PLN 25,000.Parking - PLN 500 and fuel - PLN 600, payable in cash, 4. June - purchase of materials for PLN 4,000, payment postponed to August: 5. December - purchase of materials with the company's logo for PLN 4,000 , Gift sets were sold for PLN 10,000 based on transactions registered at the cash register