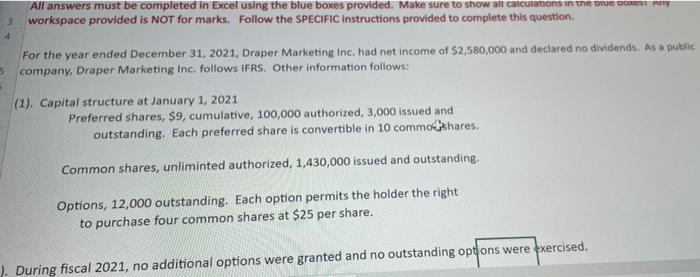

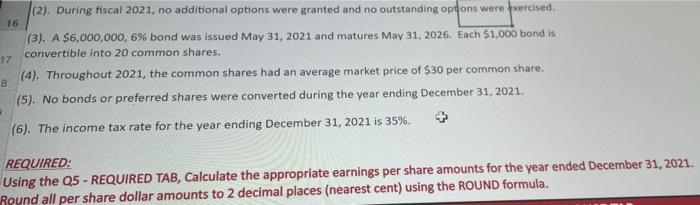

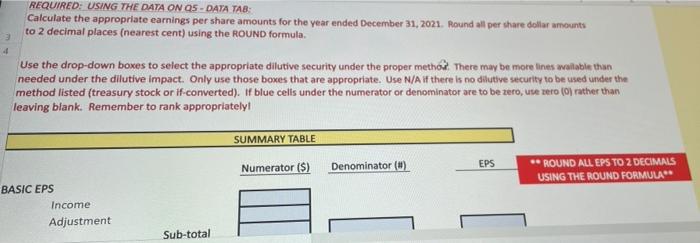

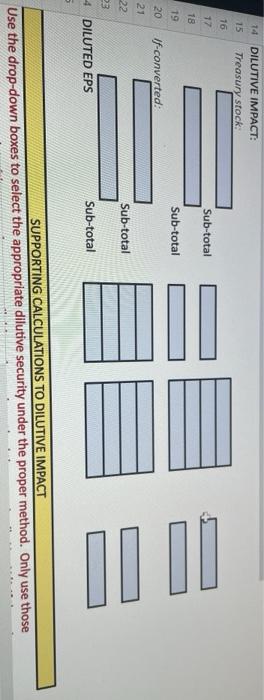

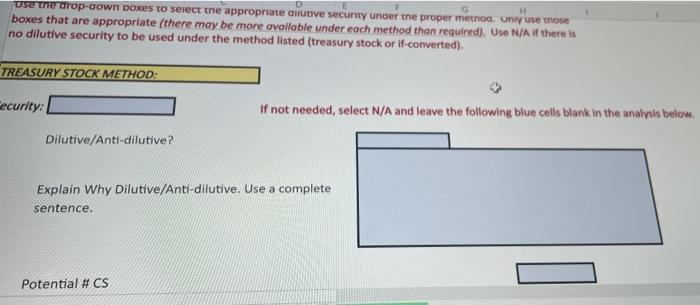

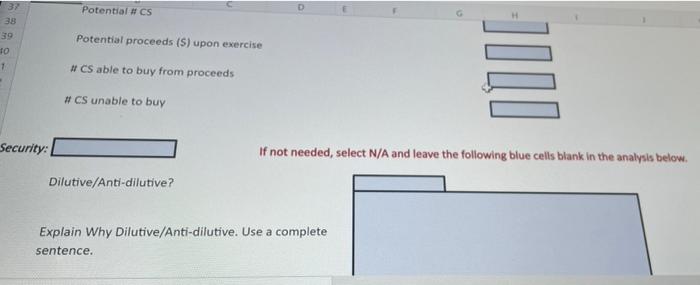

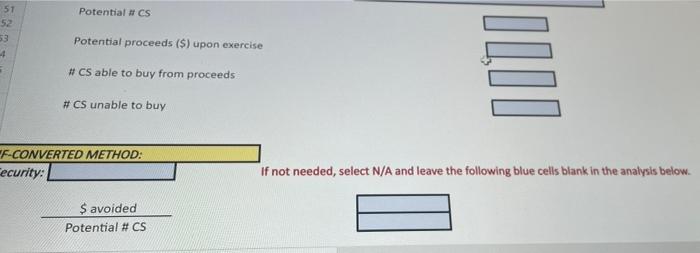

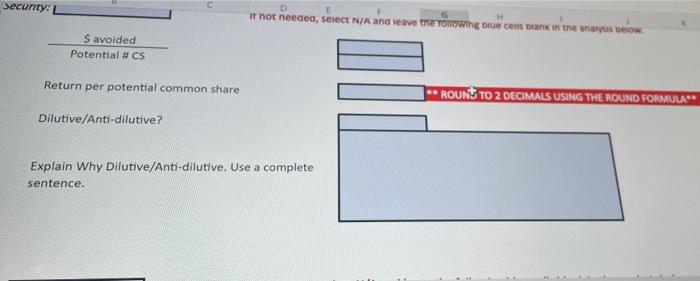

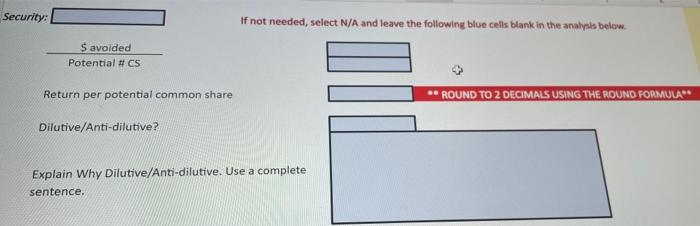

All answers must be completed in Excel using the blue boxes provided. Make sure to show an calculations in the DRY 3 workspace provided is NOT for marks. Follow the SPECIFIC instructions provided to complete this question 4 For the year ended December 31, 2021, Draper Marketing Inc. had net income of $2,580,000 and declared no dividends. As a publie company, Draper Marketing Inc. follows IFRS. Other information follows: 5 (1). Capital structure at January 1, 2021 Preferred shares, $9, cumulative, 100,000 authorized, 3,000 issued and outstanding. Each preferred share is convertible in 10 common shares. Common shares, unliminted authorized, 1,430,000 issued and outstanding. Options, 12,000 outstanding. Each option permits the holder the right to purchase four common shares at $25 per share. 7. During fiscal 2021, no additional options were granted and no outstanding options were exercised. REQUIRED: USING THE DATA ON Q5 - DATA TAB: Calculate the appropriate earnings per share amounts for the year ended December 31, 2021. Round all per share dollar amounts to 2 decimal places (nearest cent) using the ROUND formula. 3 4 Use the drop-down boxes to select the appropriate dilutive security under the proper method. There may be more lines wailable than needed under the dilutive impact. Only use those boxes that are appropriate. Use N/A if there is no dibutive security to be used under the method listed (treasury stock or if-converted). If blue cells under the numerator or denominator are to be zero, u o use zero (6) rather than leaving blank. Remember to rank appropriately! SUMMARY TABLE EPS Numerator (S) Denominator (0) * ROUND ALL EPS TO 2 DECIMALS USING THE ROUND FORMULA* BASIC EPS Income Adjustment Sub-total 14 DILUTIVE IMPACT: Treasury stock 15 Sub-total 16 17 18 19 Sub-total if-converted: 20 21 LUN NO DO Sub-total 22 23 4 DILUTED EPS Sub-total 5 SUPPORTING CALCULATIONS TO DILUTIVE IMPACT Use the drop-down boxes to select the appropriate dilutive security under the proper method. Only use those Use the drop-down boxes to select the appropriate cutive security under the proper method Only use those boxes that are appropriate (there may be more available under each method than required). Use N/A If there is no dilutive security to be used under the method listed (treasury stock or if-converted). TREASURY STOCK METHOD: Recurity: If not needed, select N/A and leave the following blue cells blank in the analysis below. Dilutive/Anti-dilutive? Explain Why Dilutive/Anti-dilutive. Use a complete sentence. Potential # CS Potential CS 37 38 39 TO 1 Potential proceeds (S) upon exercise # CS able to buy from proceeds IDIE # CS unable to buy Security: If not needed, select N/A and leave the following blue cells blank in the analysis below. Dilutive/Anti-dilutive? Explain Why Dilutive/Anti-dilutive. Use a complete sentence. Potential CS 51 52 53 + Potential proceeds ($) upon exercise # CS able to buy from proceeds INTO # CS unable to buy F-CONVERTED METHOD: Cecurity: If not needed, select N/A and leave the following blue cells blank in the analysis below. $ avoided Potential # CS Security: Ir not neede, select N/A ana leave the followme nie cen Dank in the any pow. Savolded Potential # CS Return per potential common share -- ROUN TO 2 DECIMALS USING THE ROUND FORMULA"* Dilutive/Anti-dilutive? Explain Why Dilutive/Anti-dilutive. Use a complete sentence. Security: if not needed, select N/A and leave the following blue cells blank in the analysis below. S avoided Potential # CS Return per potential common share ROUND TO 2 DECIMALS USING THE ROUND FORMULA Dilutive/Anti-dilutive? Explain Why Dilutive/Anti-dilutive. Use a complete sentence. All answers must be completed in Excel using the blue boxes provided. Make sure to show an calculations in the DRY 3 workspace provided is NOT for marks. Follow the SPECIFIC instructions provided to complete this question 4 For the year ended December 31, 2021, Draper Marketing Inc. had net income of $2,580,000 and declared no dividends. As a publie company, Draper Marketing Inc. follows IFRS. Other information follows: 5 (1). Capital structure at January 1, 2021 Preferred shares, $9, cumulative, 100,000 authorized, 3,000 issued and outstanding. Each preferred share is convertible in 10 common shares. Common shares, unliminted authorized, 1,430,000 issued and outstanding. Options, 12,000 outstanding. Each option permits the holder the right to purchase four common shares at $25 per share. 7. During fiscal 2021, no additional options were granted and no outstanding options were exercised. REQUIRED: USING THE DATA ON Q5 - DATA TAB: Calculate the appropriate earnings per share amounts for the year ended December 31, 2021. Round all per share dollar amounts to 2 decimal places (nearest cent) using the ROUND formula. 3 4 Use the drop-down boxes to select the appropriate dilutive security under the proper method. There may be more lines wailable than needed under the dilutive impact. Only use those boxes that are appropriate. Use N/A if there is no dibutive security to be used under the method listed (treasury stock or if-converted). If blue cells under the numerator or denominator are to be zero, u o use zero (6) rather than leaving blank. Remember to rank appropriately! SUMMARY TABLE EPS Numerator (S) Denominator (0) * ROUND ALL EPS TO 2 DECIMALS USING THE ROUND FORMULA* BASIC EPS Income Adjustment Sub-total 14 DILUTIVE IMPACT: Treasury stock 15 Sub-total 16 17 18 19 Sub-total if-converted: 20 21 LUN NO DO Sub-total 22 23 4 DILUTED EPS Sub-total 5 SUPPORTING CALCULATIONS TO DILUTIVE IMPACT Use the drop-down boxes to select the appropriate dilutive security under the proper method. Only use those Use the drop-down boxes to select the appropriate cutive security under the proper method Only use those boxes that are appropriate (there may be more available under each method than required). Use N/A If there is no dilutive security to be used under the method listed (treasury stock or if-converted). TREASURY STOCK METHOD: Recurity: If not needed, select N/A and leave the following blue cells blank in the analysis below. Dilutive/Anti-dilutive? Explain Why Dilutive/Anti-dilutive. Use a complete sentence. Potential # CS Potential CS 37 38 39 TO 1 Potential proceeds (S) upon exercise # CS able to buy from proceeds IDIE # CS unable to buy Security: If not needed, select N/A and leave the following blue cells blank in the analysis below. Dilutive/Anti-dilutive? Explain Why Dilutive/Anti-dilutive. Use a complete sentence. Potential CS 51 52 53 + Potential proceeds ($) upon exercise # CS able to buy from proceeds INTO # CS unable to buy F-CONVERTED METHOD: Cecurity: If not needed, select N/A and leave the following blue cells blank in the analysis below. $ avoided Potential # CS Security: Ir not neede, select N/A ana leave the followme nie cen Dank in the any pow. Savolded Potential # CS Return per potential common share -- ROUN TO 2 DECIMALS USING THE ROUND FORMULA"* Dilutive/Anti-dilutive? Explain Why Dilutive/Anti-dilutive. Use a complete sentence. Security: if not needed, select N/A and leave the following blue cells blank in the analysis below. S avoided Potential # CS Return per potential common share ROUND TO 2 DECIMALS USING THE ROUND FORMULA Dilutive/Anti-dilutive? Explain Why Dilutive/Anti-dilutive. Use a complete sentence