Answered step by step

Verified Expert Solution

Question

1 Approved Answer

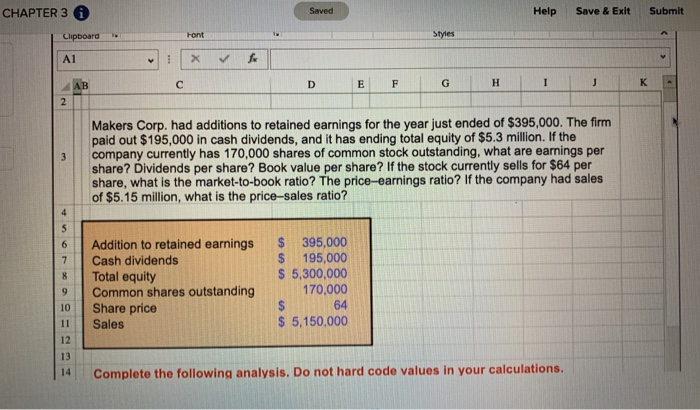

All answers must be entererd as formulas Saved Help Save & Exit Submit CHAPTER 3 Styles Hont Clipboard fr X A1 K G I E

All answers must be entererd as formulas

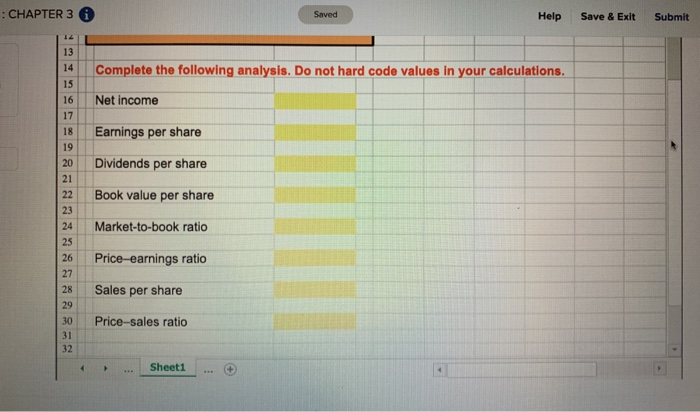

Saved Help Save & Exit Submit CHAPTER 3 Styles Hont Clipboard fr X A1 K G I E C AB 2 Makers Corp. had additions to retained earnings for the year just ended of $395,000. The firm paid out $195,000 in cash dividends, and it has ending total equity of $5.3 million. If the company currently has 170,000 shares of common stock outstanding, what are earnings per share? Dividends per share? Book value per share? If the stock currently sells for $64 per share, what is the market-to-book ratio? The price-earnings ratio? If the company had sales of $5.15 million, what is the price-sales ratio? 4 5 395,000 $ Addition to retained earnings Cash dividends Total equity Common shares outstanding Share price 6 195,000 $ 5,300,000 170,000 $ $ 5,150,000 7 8 64 10 Sales 11 12 13 Complete the following analysis. Do not hard code values in your calculations. 14 CHAPTER 3 Saved Help Save & Exit Submit 14 13 Complete the following analysis. Do not hard code values in your calculations. 14 15 Net income 16 17 Earnings per share 18 19 Dividends per share 20 21 Book value per share 22 23 Market-to-book ratio 24 25 Price-earnings ratio 26 27 Sales per share 28 29 Price-sales ratio 30 31 32 Sheet1 4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started