Answered step by step

Verified Expert Solution

Question

1 Approved Answer

All answers submitted please! You work for Apple Aorting away on $9 3 milion worth of prototypes you have finally produced your answer to Google

All answers submitted please!

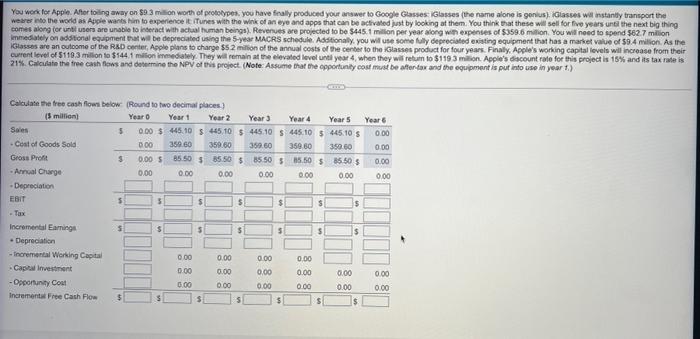

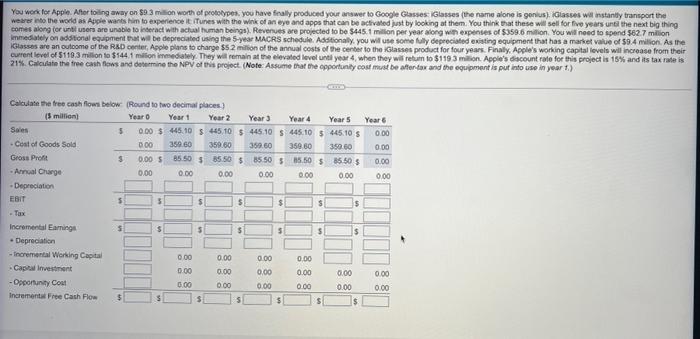

You work for Apple Aorting away on $9 3 milion worth of prototypes you have finally produced your answer to Google Glasses Glasses (the name alone is genius). Glasses will instantly transport the were into the world as Apple wants him to experience it iTunes with the wink of an eye and apps that can be activated just by looking at them. You think that these will sell for five years until the next big thing comes along for unters are unable to interact with actual human beings). Revenues are projected to be $445.1 million per year song with expenses of $359.6 milion. You will need to spend 562.7 milion immediately on additional equipment will be deprecated using the year MACRS schedule. Additionally, you will use some My depreciated existing equipment that has a market value of 59.4 million. As the Glasses are an outcome of the R&D center Apple plans to charge $52 million of the annual costs of the center to the Glasses product for four years. Finally, Apple's working capital levels will increase from their current level of 51103 million to $144.1 milion immediately. They will remain at the elevated level unt yearwhen they will return to $119 3 milion. Apple's discount rate for this project is 15% and its tax rate is 21%. Calculate the free cash flows and determine the NPV ofis project. (Note: Assume that the opportunity cost must be after cow and the equipment is put into use in year 1) Calculate the free cash flows below Round to two decimal places) (5 million Year D Year 1 Year 2 Year Year 4 Year 5 Year 6 Sales 5 0.00 $ 445.10 $ 445.10 $ 445.10 $ 445.10 $ 445.10 $ 0.00 Cost of Goods Sold 0.00 359.60 359.60 359.50 359 60 350.00 0.00 Gross Profit 5 0.00 S 85 505 85.50 $ 8550 385.50 $ 85505 0.00 Annual Charge 0.00 0.00 0.00 0.00 0.00 0.00 0.00 -Depreciation EBIT 5 5 $ $ $ $ 5 s $ 5 $ 5 $ $ 0.00 Incremental Earnings - Depreciation - Incremental Working Capital - Captainvestment - Opportunity Cou Incremental Free Cash Flow 0.00 0.00 0.00 0.00 0.00 0,00 0.00 0.00 0.00 0.00 6.00 0.00 0.00 0.00 0.00 $ 5 You work for Apple Aorting away on $9 3 milion worth of prototypes you have finally produced your answer to Google Glasses Glasses (the name alone is genius). Glasses will instantly transport the were into the world as Apple wants him to experience it iTunes with the wink of an eye and apps that can be activated just by looking at them. You think that these will sell for five years until the next big thing comes along for unters are unable to interact with actual human beings). Revenues are projected to be $445.1 million per year song with expenses of $359.6 milion. You will need to spend 562.7 milion immediately on additional equipment will be deprecated using the year MACRS schedule. Additionally, you will use some My depreciated existing equipment that has a market value of 59.4 million. As the Glasses are an outcome of the R&D center Apple plans to charge $52 million of the annual costs of the center to the Glasses product for four years. Finally, Apple's working capital levels will increase from their current level of 51103 million to $144.1 milion immediately. They will remain at the elevated level unt yearwhen they will return to $119 3 milion. Apple's discount rate for this project is 15% and its tax rate is 21%. Calculate the free cash flows and determine the NPV ofis project. (Note: Assume that the opportunity cost must be after cow and the equipment is put into use in year 1) Calculate the free cash flows below Round to two decimal places) (5 million Year D Year 1 Year 2 Year Year 4 Year 5 Year 6 Sales 5 0.00 $ 445.10 $ 445.10 $ 445.10 $ 445.10 $ 445.10 $ 0.00 Cost of Goods Sold 0.00 359.60 359.60 359.50 359 60 350.00 0.00 Gross Profit 5 0.00 S 85 505 85.50 $ 8550 385.50 $ 85505 0.00 Annual Charge 0.00 0.00 0.00 0.00 0.00 0.00 0.00 -Depreciation EBIT 5 5 $ $ $ $ 5 s $ 5 $ 5 $ $ 0.00 Incremental Earnings - Depreciation - Incremental Working Capital - Captainvestment - Opportunity Cou Incremental Free Cash Flow 0.00 0.00 0.00 0.00 0.00 0,00 0.00 0.00 0.00 0.00 6.00 0.00 0.00 0.00 0.00 $ 5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started