Answered step by step

Verified Expert Solution

Question

1 Approved Answer

all apart of one section (1) sorry this was a mistake i have however posted the full quesions with context. kind regards 1: Section 1:

all apart of one section (1)

sorry this was a mistake i have however posted the full quesions with context.

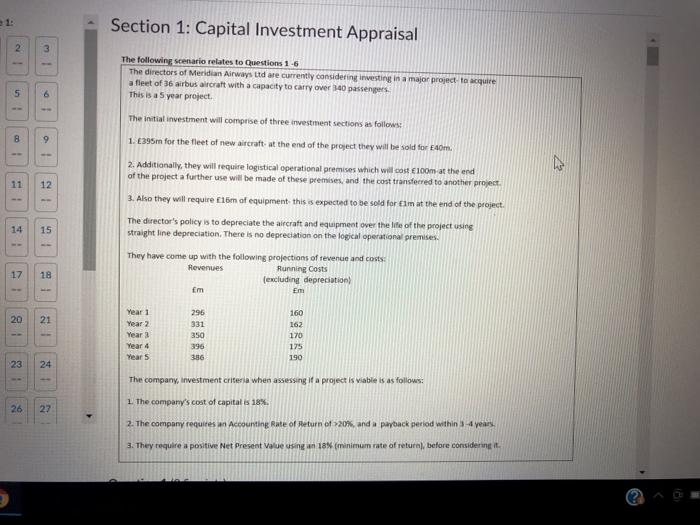

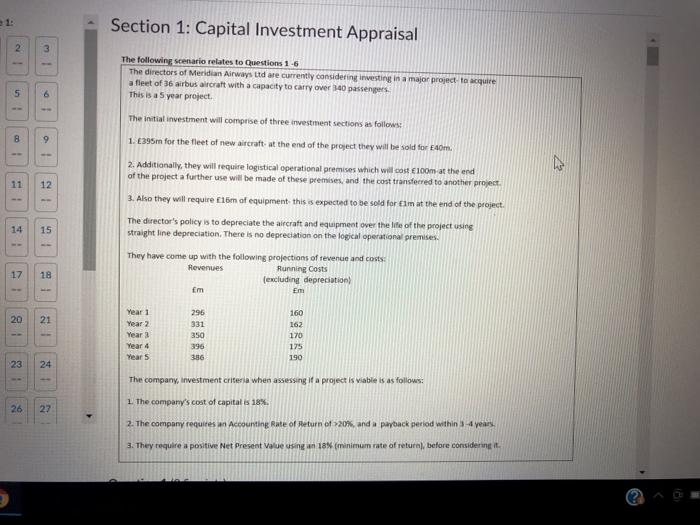

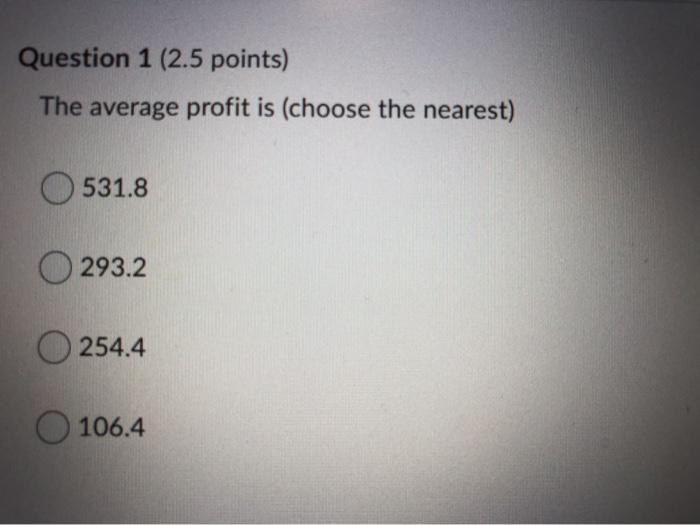

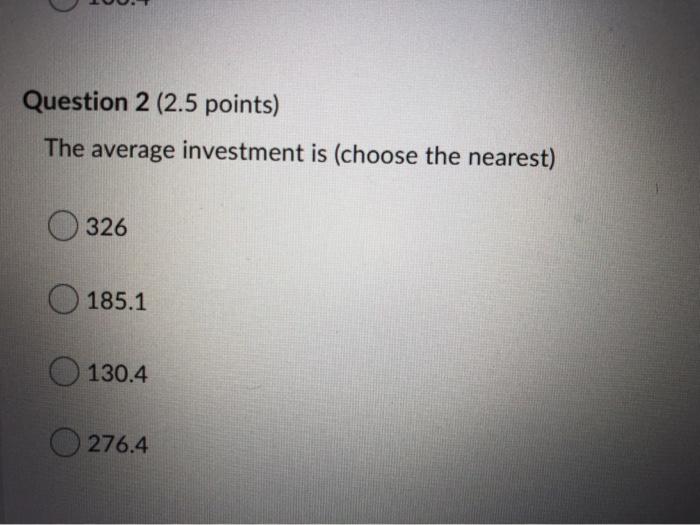

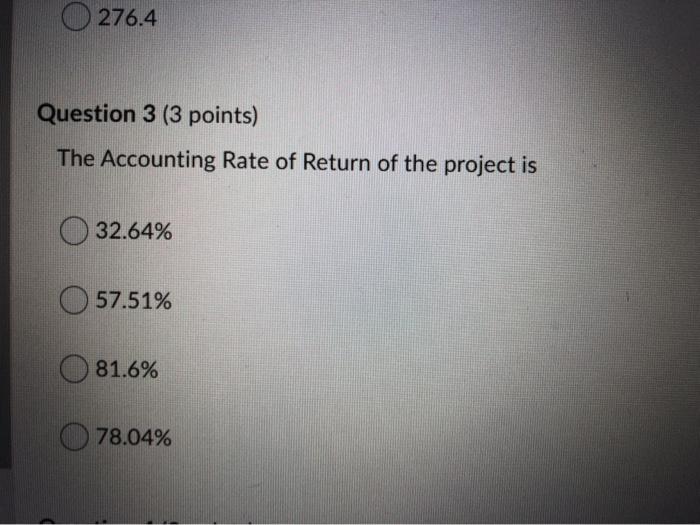

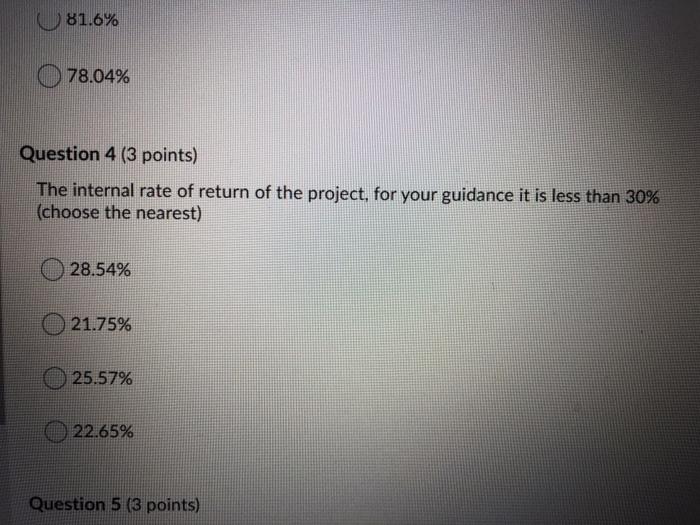

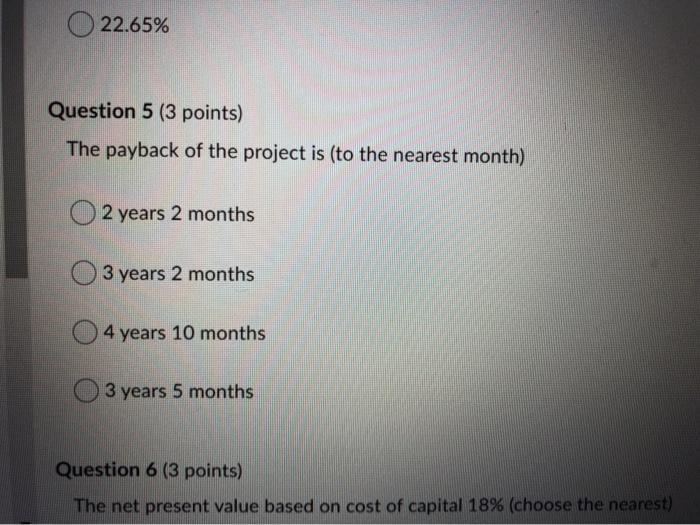

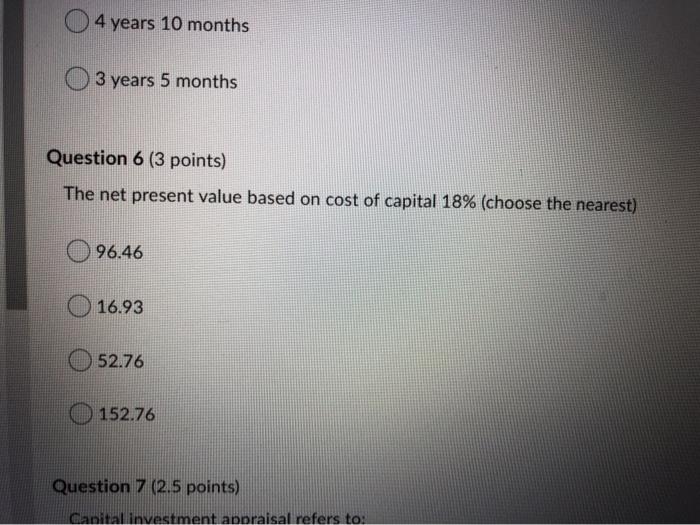

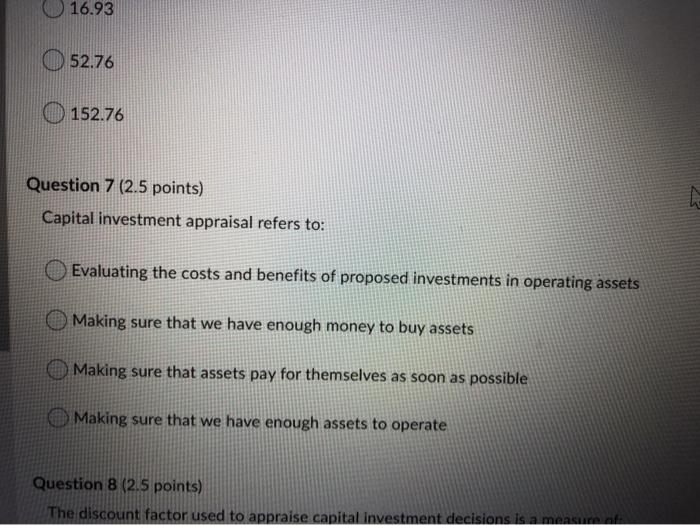

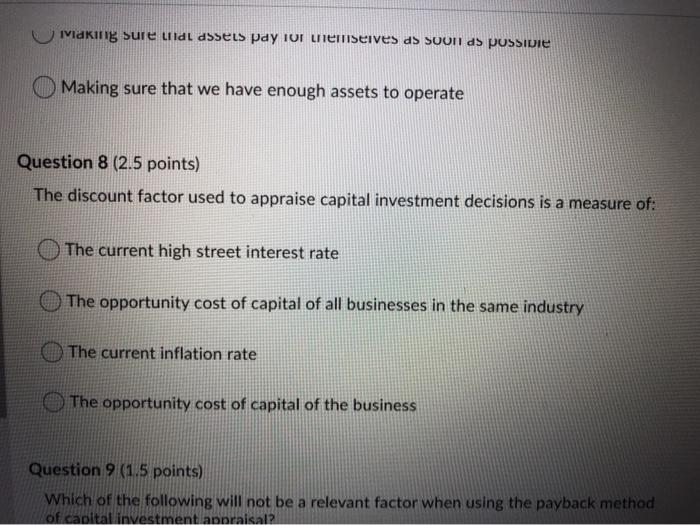

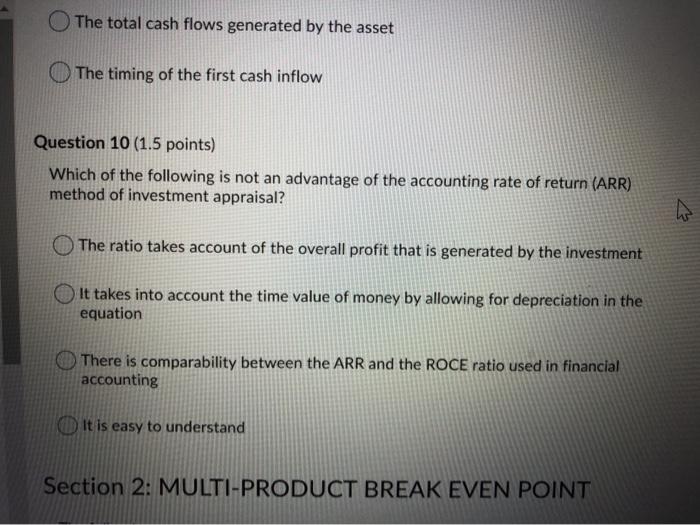

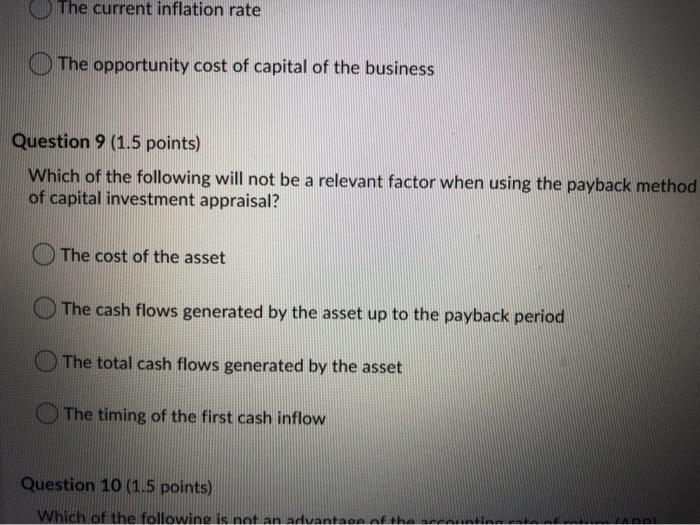

1: Section 1: Capital Investment Appraisal 2 m 5 10 B 9 The following scenario relates to Questions 1-6 The directors of Meridian Airways ttd are currently considering investing in a major project to acquire a fleet of 36 airbus aircraft with a capacity to carry over 140 passengers This is a 5 year project The initial investment will comprise of three investment sections as follows: 1.395 for the fleet of new aircraft at the end of the project they will be sold for com. 2. Additionally, they will require logistical operational premises which will cost E100m at the end of the project a further use will be made of these premises and the cost transferred to another project 3. Also they will require 16 of equipment this is expected to be sold for Elm at the end of the project. The director's policy is to depreciate the aircraft and equipment over the life of the project using straight line depreciation. There is no depreciation on the logical operational premises. They have come up with the following projections of revenue and costs Revenues Running Costs (excluding depreciation) Em Em 12 14 15 17 18 20 21 Year 1 Year 2 Year 2 Year 4 Year 5 296 331 350 396 386 160 162 170 175 190 23 24 The company, Investment criteria when assessing if a project is viable is as follows: 1. The company's cost of capital is 18% 26 27 2. The company requires an Accounting Rate of Return of >20%, and a payback period within 3-4 years 3. They require a positive Net Present Value using an 18% (minimum rate of return), before considering it. Question 1 (2.5 points) The average profit is (choose the nearest) 531.8 293.2 254.4 106.4 Question 2 (2.5 points) The average investment is (choose the nearest) 326 185.1 130.4 276.4 276.4 Question 3 (3 points) The Accounting Rate of Return of the project is 32.64% 57.51% 81.6% 78.04% 81.6% 78.04% Question 4 (3 points) The internal rate of return of the project, for your guidance it is less than 30% (choose the nearest) 28.54% 21.75% 25.57% 22.65% Question 5 (3 points) 22.65% Question 5 (3 points) The payback of the project is (to the nearest month) 2 years 2 months 3 years 2 months 4 years 10 months 3 years 5 months Question 6 (3 points) The net present value based on cost of capital 18% (choose the nearest) 4 years 10 months 3 years 5 months Question 6 (3 points) The net present value based on cost of capital 18% (choose the nearest) 96.46 16.93 52.76 152.76 Question 7 (2.5 points) Canital investment appraisal refers to: 16.93 52.76 152.76 Question 7 (2.5 points) 23 Capital investment appraisal refers to: Evaluating the costs and benefits of proposed investments in operating assets Making sure that we have enough money to buy assets Making sure that assets pay for themselves as soon as possible Making sure that we have enough assets to operate Question 8 (2.5 points) The discount factor used to appraise capital investment decisions is a measuren making sure ulat assets pay for themseives as soon as possible Making sure that we have enough assets to operate Question 8 (2.5 points) The discount factor used to appraise capital investment decisions is a measure of: The current high street interest rate The opportunity cost of capital of all businesses in the same industry The current inflation rate The opportunity cost of capital of the business Question 9 (1.5 points) Which of the following will not be a relevant factor when using the payback method of capital investment appraisal? The total cash flows generated by the asset The timing of the first cash inflow Question 10 (1.5 points) Which of the following is not an advantage of the accounting rate of return (ARR) method of investment appraisal? w The ratio takes account of the overall profit that is generated by the investment It takes into account the time value of money by allowing for depreciation in the equation There is comparability between the ARR and the ROCE ratio used in financial accounting It is easy to understand Section 2: MULTI-PRODUCT BREAK EVEN POINT The current inflation rate The opportunity cost of capital of the business Question 9 (1.5 points) Which of the following will not be a relevant factor when using the payback method of capital investment appraisal? The cost of the asset The cash flows generated by the asset up to the payback period The total cash flows generated by the asset The timing of the first cash inflow Question 10 (1.5 points) Which of the following is not an advantage of th kind regards

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started