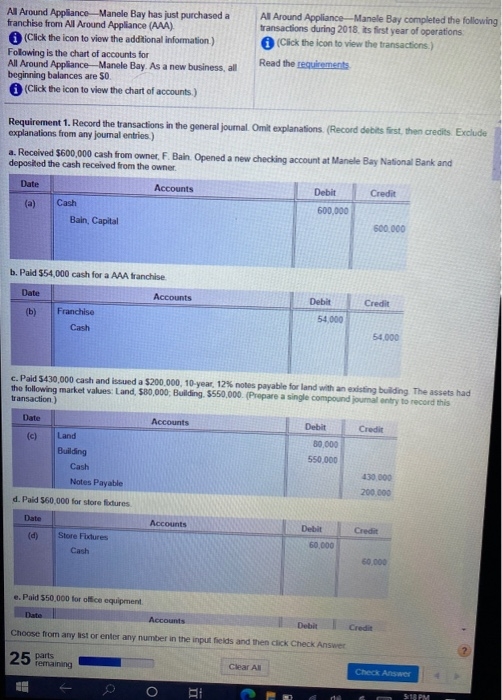

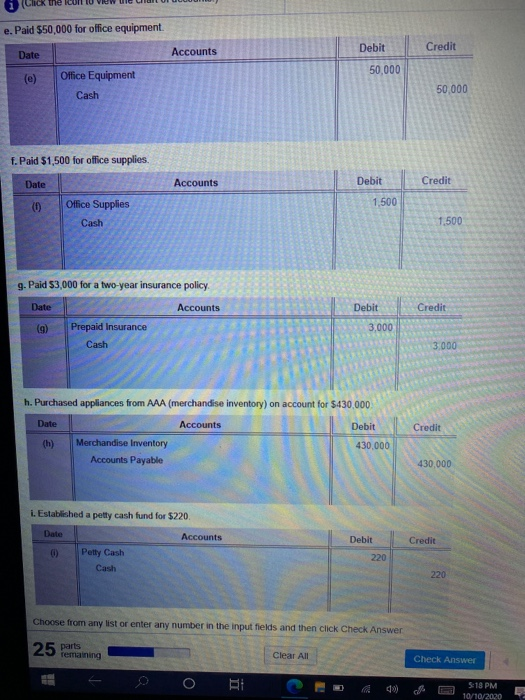

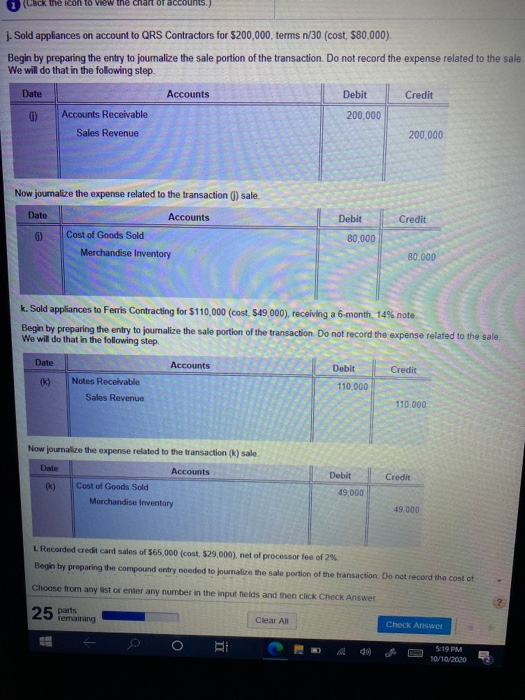

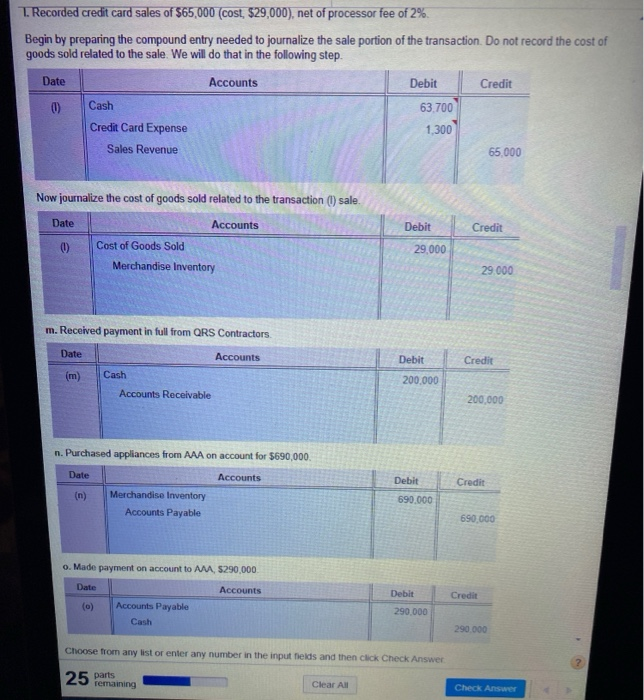

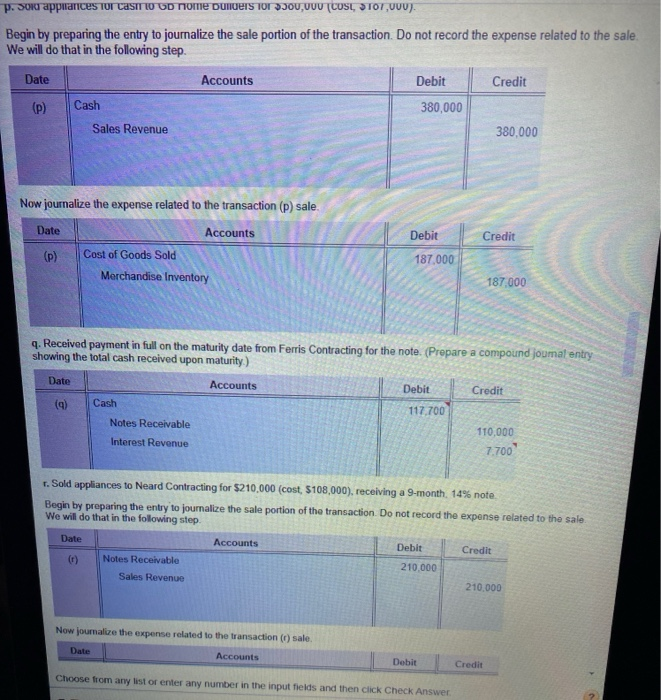

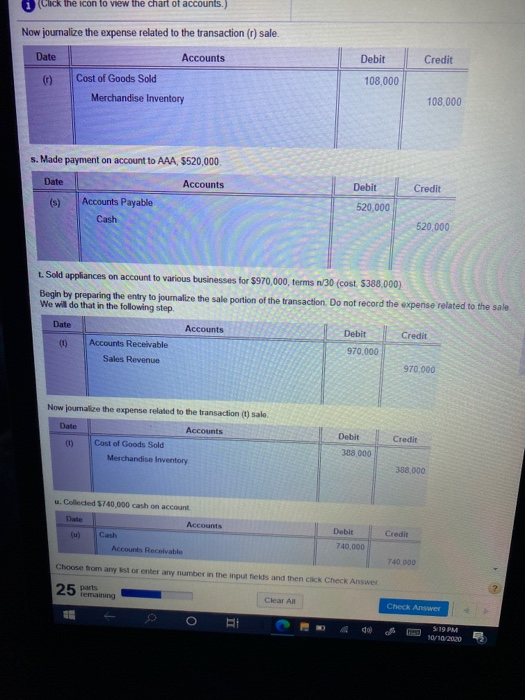

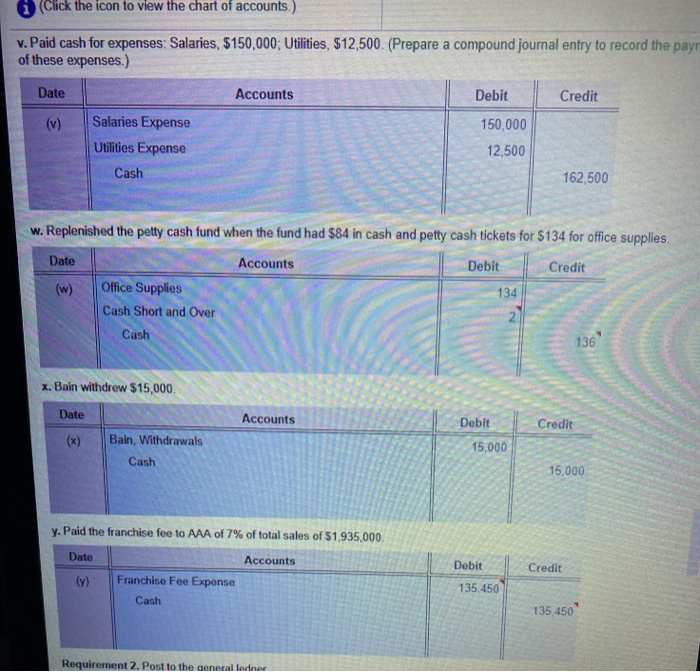

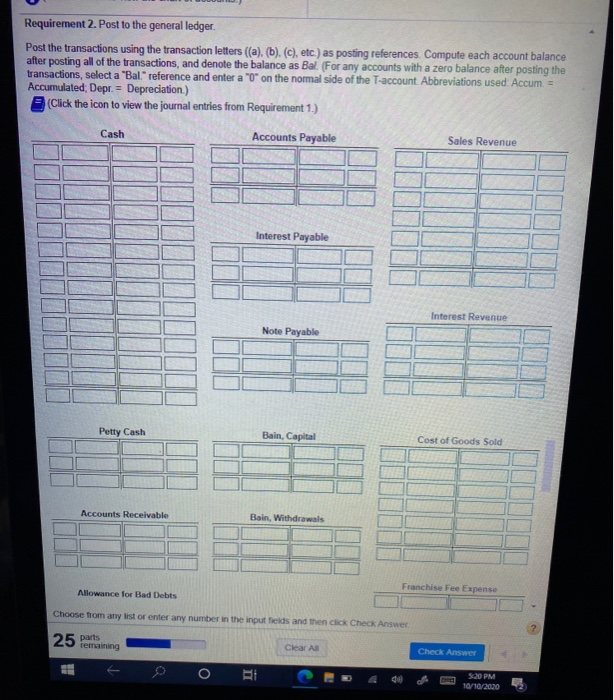

All Around Appliance-Manele Bay has just purchased a franchise from All Around Appliance (AAA) Click the icon to view the additional information) Following is the chart of accounts for All Around Appliance-Manele Bay. As a new business, all beginning balances are $0 Click the icon to view the chart of accounts.) Al Around Appliance-Manele Bay completed the following transactions during 2018 its first year of operations (Click the icon to view the transactions.) Read the requirements Requirement 1. Record the transactions in the general journal Omit explanations (Record debits first, then credits Exclude explanations from any joumal entries) a. Received $600,000 cash from owner, F. Bain. Opened a new checking account at Manele Bay National Bank and deposited the cash received from the owner Date Accounts Debit Credit (a) Cash Bain, Capital 600,000 500.000 b. Pald 54,000 cash for a AAA franchise Date Accounts Debit Credit (b) Franchise Cash 54,000 54.000 c. Pald 5430,000 cash and issued a $200.000, 10-year 12% notes payable for land with an existing building The assets had the following market values: Land, $80,000 Building. 5550,000. (Prepare a single compound jumalontry to record this transaction) Date (c) Accounts Credit Land Building Cash Notes Payable Debit 80.000 550.000 430 000 200.000 d. Paid 560,000 for store fodtures Date Accounts Credit Store Fodures Cash Debit 60.000 60,000 e. Pald 550,000 for office equipment Date Accounts Debit Credit Choose from any list or enter any number in the input fields and then click Check Answer 25 parts remaining Clear All Check AS SPM the IU View e. Paid $50,000 for office equipment. Accounts Debit Date Credit 50,000 Office Equipment Cash 50,000 f. Paid $1,500 for office supplies. Date Accounts Debit Credit (0) 1,500 Office Supplies Cash 1.500 g. Paid $3,000 for a two-year insurance policy Date Accounts Debit Credit (9) 3,000 Prepaid Insurance Cash 3.000 h. Purchased appliances from AAA (merchandise inventory) on account for $430,000 Date Accounts Debit Credit 430,000 Merchandise Inventory Accounts Payable 430,000 i. Established a petty cash fund for $220 Date Accounts Debit Credit 0) Petly Cash 220 Cash 220 Choose from any list or enter any number in the input fields and then click Check Answer 25 parts remaining Clear All Check Answer o BE 518 PM 10/10/2020 the icon to view the chart on j. Sold appliances on account to QRS Contractors for $200,000, terms n/30 (cost, $80,000). Begin by preparing the entry to journalize the sale portion of the transaction. Do not record the expense related to the sale We will do that in the following step Date Accounts Debit Credit 200,000 Accounts Receivable Sales Revenue 200.000 Now journalize the expense related to the transaction () sale. Date Debit Credit 0 Accounts Cost of Goods Sold Merchandise Inventory 80,000 80,000 k. Sold appliances to Ferris Contracting for $110,000 (cost, 549.000), receiving a 6-month, 14% note Begin by preparing the entry to journalize the sale portion of the transaction. Do not record the expense related to the sale We will do that in the following step Date Accounts Debit Credit Notes Receivable Sales Revenue 110.000 110.000 Now journalize the expense related to the transaction (k) sale Date Accounts (6) Cost of Goods Sold Merchandise Inventory Debit Credit 49.000 49,000 Recorded credit card sales of $65.000 (cost, $29,000) net of processor fee of 2% Begin by preparing the compound entry needed to journalize the sale portion of the transaction. Do not record the cost of Choose from any list or enter any number in the input helds and then click Check Answer 25 parts remaining Clear All Check Answer 5:19 PM 10/10/2020 Recorded credit card sales of $65,000 (cost, $29,000), net of processor fee of 2% Begin by preparing the compound entry needed to journalize the sale portion of the transaction. Do not record the cost of goods sold related to the sale. We will do that in the following step. Date Accounts Credit Debit 0 63.700 Cash Credit Card Expense Sales Revenue 1.300 65.000 Now journalize the cost of goods sold related to the transaction (1) sale. Date Debit Credit 0 Accounts Cost of Goods Sold Merchandise Inventory 29,000 29.000 m. Received payment in full from QRS Contractors. Date Accounts Debit Credit (m) Cash Accounts Receivable 200.000 200.000 n. Purchased appliances from AAA on account for $690,000 Date Accounts Debit Credit Merchandise Inventory Accounts Payable 690.000 690.000 o. Made payment on account to AMA $290,000 Date Accounts Debit Credit Accounts Payable Cash 290.000 290 000 Choose from any list or enter any number in the input fields and then click Check Answer 25 parts remaining Clear All Check Answer p. Sorr appliances Tor CaST OD nome dunders Tor JOU,000 CUSC STOT,000). Begin by preparing the entry to journalize the sale portion of the transaction. Do not record the expense related to the sale We will do that in the following step. Date Accounts Debit Credit (P) Cash 380,000 Sales Revenue 380,000 Now journalize the expense related to the transaction (p) sale Date Accounts Debit Credit (P) 187.000 Cost of Goods Sold Merchandise Inventory 187.000 q. Received payment in full on the maturity date from Ferris Contracting for the note. (Prepare a compound joumal entry showing the total cash received upon maturity) Date Accounts Debit Credit (9) Cash 117.700 Notes Receivable 110,000 Interest Revenue 7.700 t. Sold appliances to Neard Contracting for $210,000 (cost, $108,000), receiving a 9-month, 14% note Begin by preparing the entry to journalize the sale portion of the transaction. Do not record the expense related to the sale. We will do that in the following step Date Accounts Debit Credit (0) Notes Receivable 210,000 Sales Revenue 210,000 Now journalize the expense related to the transaction() sale. Date Accounts Debit Credit Choose from any list or enter any number in the input fields and then click Check Answer Click the icon to view the chart of accounts.) Now journalize the expense related to the transaction (1) sale. Date Accounts Debit Credit Cost of Goods Sold 108,000 Merchandise Inventory 108,000 s. Made payment on account to AAA, 5520,000 Date Accounts Debit Credit (s) Accounts Payable Cash 520.000 520,000 t. Sold appliances on account to various businesses for $970,000, terms n/30 (cost. 5388,000) Begin by preparing the entry to journalize the sale portion of the transaction. Do not record the expense related to the sale We will do that in the following step Date Accounts Debit Credit (0) Accounts Receivable 970.000 Sales Revenue 970,000 Now jumalize the expense related to the transaction (t) sale Date Accounts Cost of Goods Sold Merchandise Inventory Credit Debit 388 000 388,000 u. Collected $740,000 cash on account Date (u) Accounts Cash Accounts Receivable Credit Debit 740.000 740.000 Choose from any list or enterary number in the input fields and then cack Check Answer 25 parts Clear All Check Answer S19 PM 10/10/2020 (Click the icon to view the chart of accounts.) v. Paid cash for expenses: Salaries, $150,000: Utilities, $12,500. (Prepare a compound journal entry to record the payr of these expenses.) Date Accounts Debit Credit (v) Salaries Expense 150,000 Utilities Expense 12,500 Cash 162,500 w. Replenished the petty ca fund when the fund had $84 in cash and petty cash tickets for $134 for office supplies. Date Accounts Debit Credit (w) 134 Office Supplies Cash Short and Over Cash 136 x. Bain withdrew $15,000 Date Accounts Debit Credit (x) Bain, Withdrawals 15,000 Cash 15,000 y. Paid the franchise fee to AAA of 7% of total sales of $1,935,000, Date Accounts (y) Franchise Fee Exponse Cash Debit Credit 135.450 135.450 Requirement 2. Post to the general ledna Requirement 2. Post to the general ledger Post the transactions using the transaction letters (a), (b). (c), etc.) as posting references Compute each account balance after posting all of the transactions, and denote the balance as Bal (For any accounts with a zero balance after posting the transactions, select a "Bal" reference and enter a "0" on the normal side of the T-account. Abbreviations used. Accum= Accumulated, Depr. = Depreciation) (Click the icon to view the journal entries from Requirement 1.) Cash Accounts Payable Sales Revenue Interest Payable Interest Revenue Note Payable Petty Cash Bain, Capital Cost of Goods Sold Accounts Receivable Bain, Withdrawals Franchise Fee Expense Allowance for Bad Debts Choose from any list or enter any number in the input fields and then click Check Answer 25 parts remaining Clear As Check Answer o 5:20 PM 10/10/2020 All Around Appliance Manele Bay has just purchased a franchise from All Around Appliance (AAA) (Click the icon to view the additional information.) Following is the chart of accounts for All Around Appliance Manele Bay. As a new business, all beginning balances are 50 (Click the icon to view the chart of accounts.) All Around Appliance-Manele Bay completed the following transactions during 2018, its first year of operations Click the icon to view the transactions.) Read the requirements Franchise Fee Expense Allowance for Bad Debts Salaries Expense Merchandise Inventory Utilities Expense Office Supplies Insurance Expense Prepaid Insurance Supplies Expense Interest Receivable Bad Debes Expense Notes Receivable Bank Expense Choose from any list of enter any number in the input Delds and then chok Check 25 remaining CAB Check Answer O RI 5:20 PM 90/10/2020 we franchise from All Around Appliance (AAA). i (Click the icon to view the additional information.) Following is the chart of accounts for All Around Appliance - Manele Bay. As a new business, all beginning balances are 50 (Click the icon to view the chart of accounts) transactions during 2018, its first year of operations: (Click the icon to view the transactions.) Read the requirements Notes Receivable Bank Expense Land Credit Card Expense Building Depr. Expense Building Accum. Depr.-Building Depr. Expense-Store Fixtures Store Fixtures Depr. Expense-Office Equipment Accur. Depr.- Store Fixtures Amortization Expense-Franchise Office Equipment Interest Expense Choose from any list or enter any number in the input fields and then click Check Answer 25 parts remaining C Office Equipment Interest Expense Accurn. Depr.-Office Equipment Cash Short and Over Franchise Choose from any list or enter any number in the input fields and then click Check