Question

All budgets and recommendations are on a pre-tax basis (ignore tax). The recommended price (AUD million) for the business is based on a 'walk-in,

· All budgets and recommendations are on a pre-tax basis (ignore tax).

· The recommended price (AUD million) for the business is based on a 'walk-in, walk-out' basis as of 31 December 2020 (the new owner will incur all cash operating and capital costs and income for 2021). The sale includes all freehold title to land, existing ponds, juvenile and any growing prawn already stocked in ponds, water rights, existing and new regulatory approvals for expansion, a 3 year retail sale agreement and all machinery, plant, aeration, harvesting and processing equipment.

· Included in the sale of the business is all machinery, plant and packaging equipment to continue to operate the farms. Assume the salvage value of any machinery, plant, hatchery, aeration, harvesting and processing equipment is 100% of the original value at the end of 2045. At the time of purchasing the business (2021) assume the current value (real) of "depreciating assets" i.e. machinery, plant, hatchery, aeration, harvesting and processing equipment is $6 million.

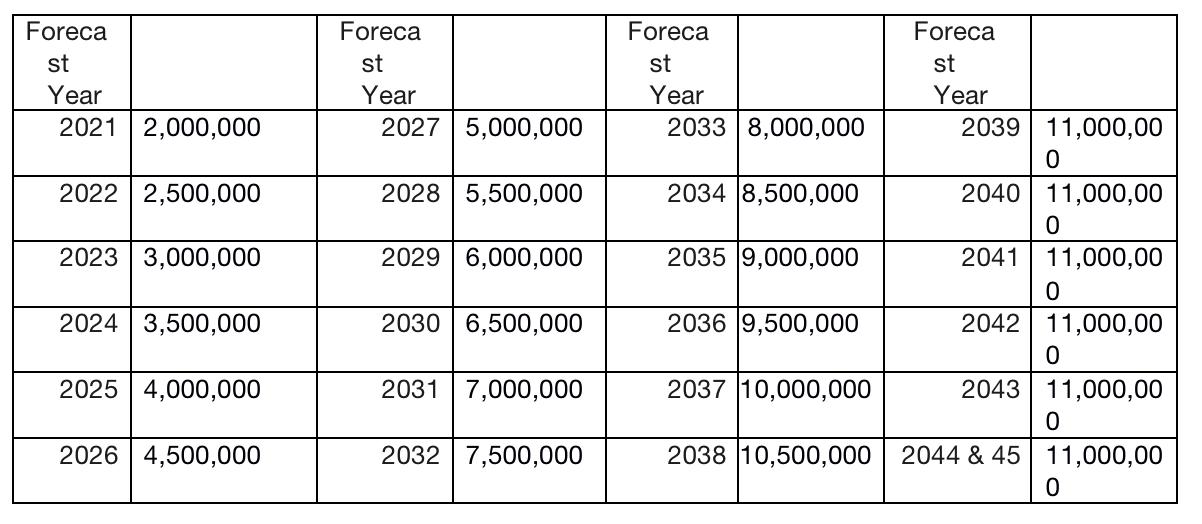

· There is an on-going cash cost for repairs, maintenance and 'stay-in business' replacement capital expenditure to ponds, machinery, plant, hatchery, aeration, harvesting and processing equipment. In 2021 - year one - the cash cost for this category is $2,000,000 and grows incrementally by an additional +$500,000 per annum until the business achieves a 'steady-state' in prawn production. For example, if both Martha River and Zebmoor developments go ahead then on-going cash cost for repairs, maintenance and 'stay-in business' replacement capital expenditure in 2039 is $11,000,000 (real terms).

· Assume zero capital growth or depreciation in real terms for land (except as specified for Zebmoor) and ponds. That is, salvage value = initial investment. For simplicity we will assume 100% salvage value of ponds and land.

· Average prawn prices received by Queensland prawn business are provided in the price spreadsheet. Prawnland has signed a retail agreement with a major supermarket (domestic market) to sell all prawn production for the 2021, 2022 and 2023 years at an average price received for all prawns grown of AUD$17.00 per kilogram real terms (delivered to Brisbane and Sydney). After this period (2024 onwards), Prawnland has no price certainty or guarantee that all prawns grown will be sold domestically, leaving a high degree of uncertainty as to where new production will be sold (either in the domestic or via the export market).

· Current AUD costs (2021) per kilogram prawn production are provided by Prawnland as follows: Variable costs.

I. Nursery/Juvenile Stocking Costs $0.9/kg

II. Casual/Temporary Labour Costs $1.3/kg

III. Electricity Costs $2.5/kg

IV. Processing and Packing Costs $0.4/kg

V. Transport Costs to Market $1.6/kg

VI. Feed costs have been contracted and fixed for 2021 at $1,600/tonne of pellets but after this the prices of prawn feed (pellets) will fluctuate based on the price of key ingredients to make the pellets and AUD exchange rate.

VII. The business is forecasting a farm-wide Feed Conversion Ratio (FCR) of 1.8 for 2021 based on current Black Tiger prawn genetics available in the Australian industry. That is, for every 1.8 tonnes of pellets fed into ponds in 2021, prawn biomass will increase by 1.0 tonne.

· The investor believes costs in real terms will continue to rise for agriculture in Australia and has asked you to factor in a 0.6% p.a. real increase in variable costs.

· Ponds are expected "on average" to yield 8 tonnes of prawn biomass per annum, with new pond development forecast to cost $120,000 per pond hectare in real terms (including all associated water/aeration and effluent infrastructure).

· Cash overheads are given as follows (real terms 2021 dollars). Note the overheads from 2030 incorporate the "Zebmoor" prawn expansion

Question: Evaluate a price (or range of prices) the investor could pay for the business (economic worth of the business). how to use the NPV and MIRR method to solve for the purchase price.

Question: Evaluate a price (or range of prices) the investor could pay for the business (economic worth of the business). how to use the NPV and MIRR method to solve for the purchase price.

Foreca st Year 2021 2,000,000 2022 2,500,000 2023 3,000,000 2024 3,500,000 2025 4,000,000 2026 4,500,000 Foreca st Year 2027 5,000,000 2028 5,500,000 2029 6,000,000 2030 6,500,000 2031 7,000,000 2032 7,500,000 Foreca st Year 2033 8,000,000 2034 8,500,000 2035 9,000,000 2036 9,500,000 2037 10,000,000 2038 10,500,000 Foreca st Year 2039 11,000,00 0 2040 11,000,00 2041 11,000,00 2042 11,000,00 0 0 0 2043 11,000,00 2044 & 45 11,000,00 0 0

Step by Step Solution

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

To evaluate a price range that the investor could pay for the business using the Net Present Value NPV and Modified Internal Rate of Return MIRR metho...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started