Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1 1 1 1 I Eric Smith, the owner and manager of Eric's, has provided the following information about his business for January-March 20X2.

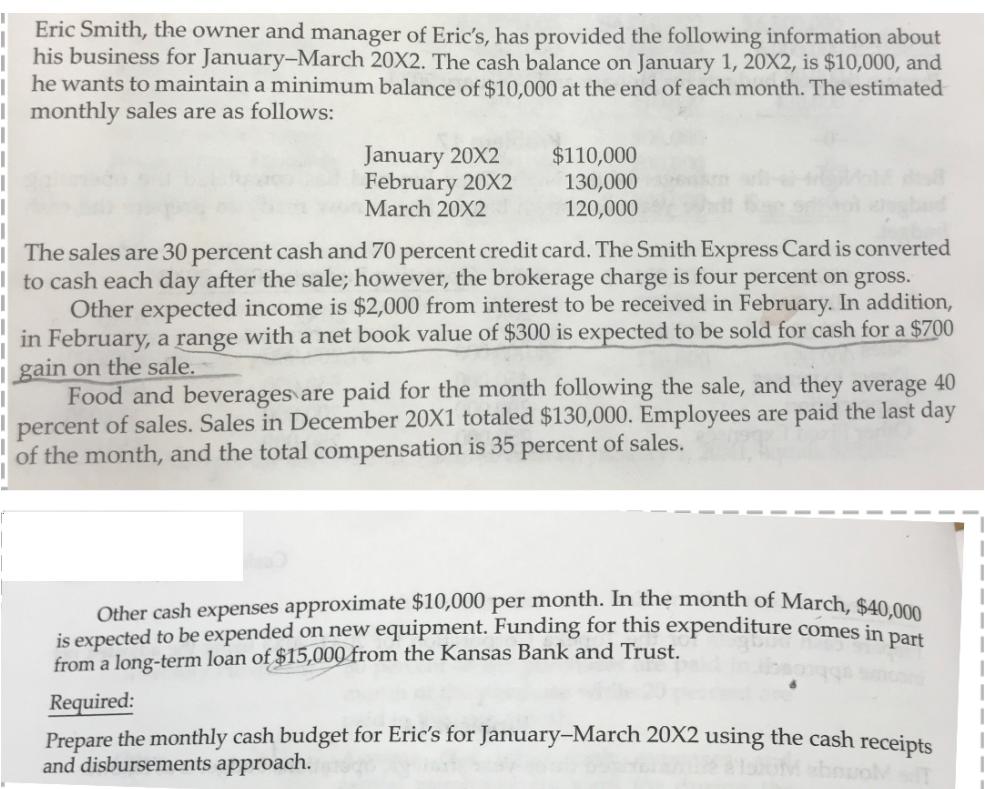

1 1 1 1 I Eric Smith, the owner and manager of Eric's, has provided the following information about his business for January-March 20X2. The cash balance on January 1, 20X2, is $10,000, and he wants to maintain a minimum balance of $10,000 at the end of each month. The estimated monthly sales are as follows: January 20X2 February 20X2 March 20X2 $110,000 130,000 120,000 The sales are 30 percent cash and 70 percent credit card. The Smith Express Card is converted to cash each day after the sale; however, the brokerage charge is four percent on gross. Other expected income is $2,000 from interest to be received in February. In addition, in February, a range with a net book value of $300 is expected to be sold for cash for a $700 gain on the sale. Food and beverages are paid for the month following the sale, and they average 40 percent of sales. Sales in December 20X1 totaled $130,000. Employees are paid the last day of the month, and the total compensation is 35 percent of sales. Other cash expenses approximate $10,000 per month. In the month of March, $40,000 is expected to be expended on new equipment. Funding for this expenditure comes in part from a long-term loan of Required: Prepare the monthly cash budget for Eric's for January-March 20X2 using the cash receipts and disbursements approach.

Step by Step Solution

★★★★★

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION Beginning Cash Balance Add Cash Collection Sales Interes...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started