Answered step by step

Verified Expert Solution

Question

1 Approved Answer

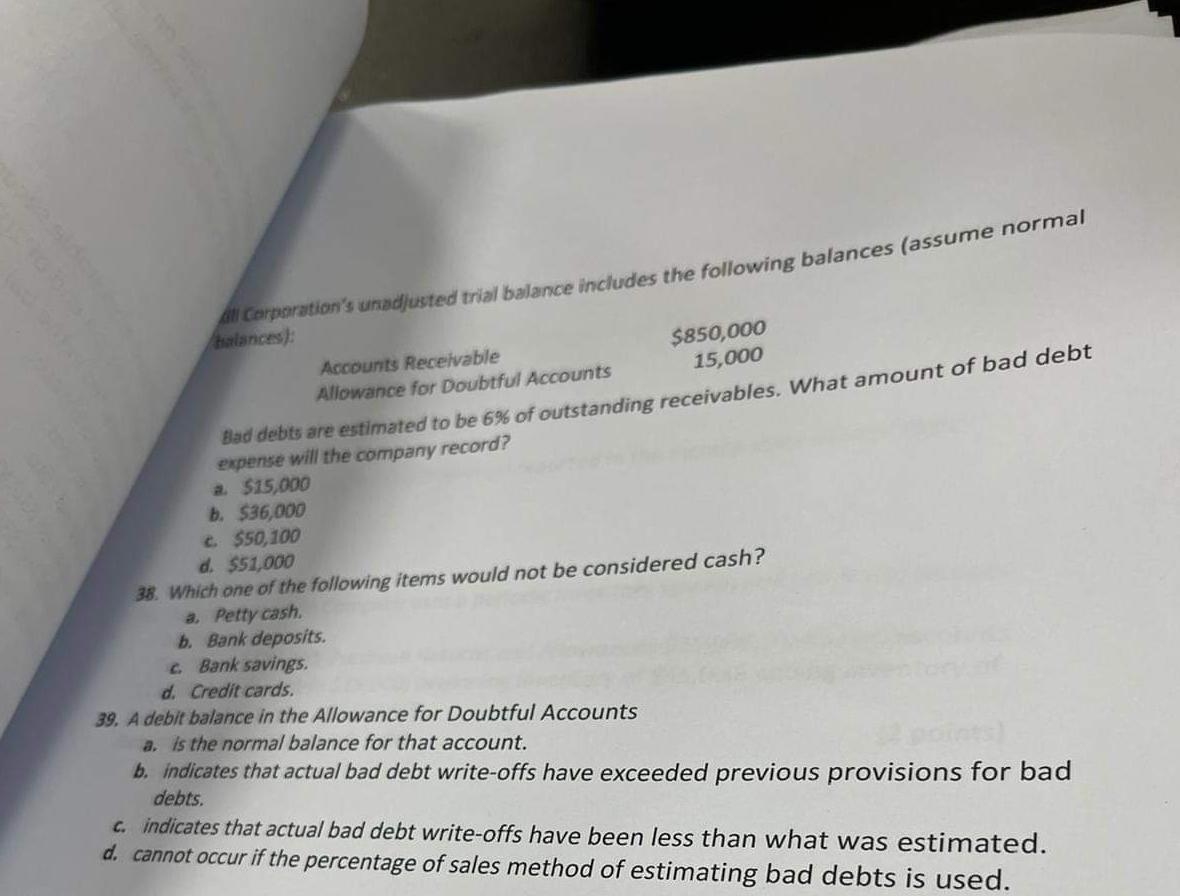

All Corporation's unadjusted trial balance includes the following balances (assume normal balances): Accounts Receivable Allowance for Doubtful Accounts a. $15,000 b. $36,000 Bad debts

All Corporation's unadjusted trial balance includes the following balances (assume normal balances): Accounts Receivable Allowance for Doubtful Accounts a. $15,000 b. $36,000 Bad debts are estimated to be 6% of outstanding receivables. What amount of bad debt expense will the company record? $850,000 15,000 c. $50,100 d. $51,000 38. Which one of the following items would not be considered cash? a. Petty cash. b. Bank deposits. c. Bank savings. d. Credit cards. 39. A debit balance in the Allowance for Doubtful Accounts a. is the normal balance for that account. b. indicates that actual bad debt write-offs have exceeded previous provisions for bad debts. c. indicates that actual bad debt write-offs have been less than what was estimated. d. cannot occur if the percentage of sales method of estimating bad debts is used.

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To determine the amount of bad debt expense that the company will record we need to calculate 6 of t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started